Should RIAs Care About Broker Protocol?

As noted last week, much has been written about some of the major wirehouse firms abandoning protocol these last few months. This week we explore what the implications are for RIAs and how it could impact their value in the marketplace.

There was a time when broker protocol made a lot of sense to the wirehouse firms. In an effort to avoid countless hours and company funds on litigation, the major brokerage firms at the time, Smith Barney (now part of Morgan Stanley), Merrill Lynch, and UBS signed the Broker Protocol Agreement in August 2004 to avoid the threat of lawsuits for financial advisors switching firms or setting up their own shop. At the time, the logic was that talent poaching was happening anyway, and the only parties benefiting from fighting the poaching were litigators. Several attorneys we’ve spoken with about the potential demise of protocol echoed this sentiment.

For years it appeared that broker protocol worked pretty well; today over 1,600 RIAs and broker-dealers voluntarily participate in the de facto cease fire over talent between the brokerage houses. All was quiet on this issue until late October when Morgan Stanley announced it was abandoning protocol, emphasizing its commitment to training and retaining brokers rather than poaching them from rival firms. One month later UBS followed suit, similarly citing the firm’s focus on retaining existing advisors over recruiting them from other shops. From a numbers perspective, these moves aren’t surprising as larger wirehouses have been net losers for several years as protocol made it easier for FAs to switch firms or start their own. Interestingly enough though, Bank of America Merrill Lynch recently announced that it would be sticking to protocol in favor of advisor flexibility in serving client needs.

Merrill’s decision seems counterintuitive until you consider that it uses certain exclusions to the agreement to selectively poach other advisors while punishing those trying to leave; therefore, it is less incentivized to break protocol. ML allows advisors who generate their own business to be covered by the protocol while those that use firm referrals to do so are exempt. Similarly, JP Morgan’s commission-based brokers are under protocol while those who receive a salary and bonus to service clients are not. Smaller independent firms and RIAs have also gamed the system by joining protocol to recruit advisors before exiting the agreement to make it harder for them to leave.

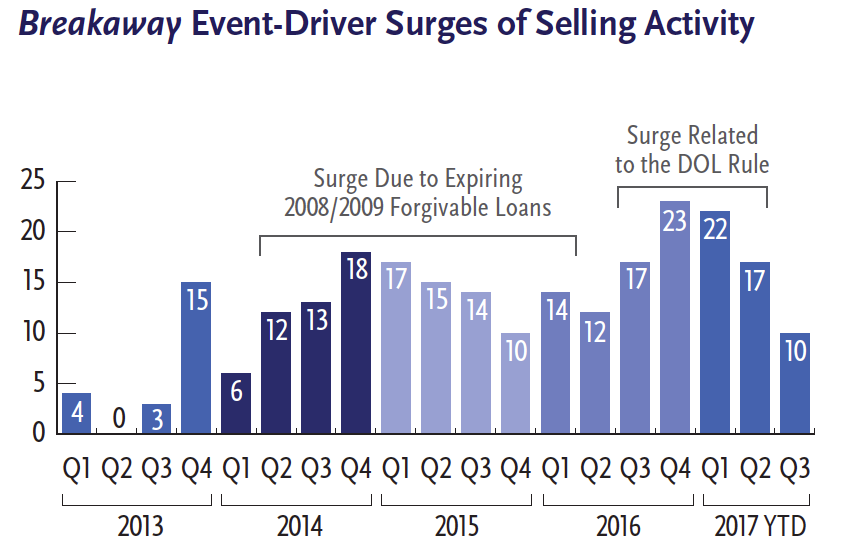

Moves by UBS and Morgan Stanley to abandon recruitment will make it much more risky and costly for RIAs to recruit their advisors. It also limits the market for whom these advisors can sell their book to if many of the prospective buyers are on a different platform, which could compress valuations for advisory firms built under broker-dealers. In fact, we’ve already seen a bit of a dampening effect on M&A activity as the last quarter tallied the lowest level of RIA dealmaking and advisor breakaways in three years – just 29 such transactions compared to 40 in Q2, according to a new report by DeVoe & Company. Devoe also attributes the decline to the prior surge created by the expiration of many forgivable loans to wirehouse advisors during the financial crisis and the potential passage of the fiduciary rule in late 2016 or early 2017:

Source: Devoe & Company, wealthmanagement.com

Source: Devoe & Company, wealthmanagement.com

On balance, RIAs and financial advisors looking to add brokers or sell in the foreseeable future should care about broker protocol. Sector transaction activity has already taken a hit, and we may be on the brink of another wave of firms abandoning protocol. Experienced advisor recruitment will also become more challenging as firms continue to exit the agreement. If, on the other hand, the remaining wirehouses stand firm, we could see a stabilization in M&A and possible mean reversion for broker recruitment. Wells Fargo’s pending decision on broker protocol could have a major impact on the industry as a whole, so we’ll be watching that announcement very closely.

The epitaph for wirehouse brokerage operations has been written repeatedly over the past twenty-five years or more, but Morgan Stanley’s move to exit protocol has opened a whole new chapter in the saga, suggesting that RIAs are indeed making more than a dent in brokerage firm revenues. We suspect this will remain a major topic in 2018 and will keep you posted on what we think the impact will be to investment management firms.

In the interim, feel free to reach out to us if you’d like to talk further.

Mercer Capital’s RIA Valuation Insights Blog

The RIA Valuation Insights Blog presents a weekly update on issues important to the Asset Management Industry. Follow us on Twitter @RIA_Mercer.

RIA Valuation Insights

RIA Valuation Insights