RIP to the Father of Index Investing

John Bogle’s Legacy Endures with the Prominence of Passive Investing

John C. Bogle (May 8, 1929 – January 16, 2019), founder and retired CEO of the Vanguard Group | Image via Wikipedia

Perhaps John Bogle’s greatest legacy is not founding Vanguard (nearly $5 trillion in total AUM), but his common sense (and yet often contrarian) approach to long-term investing. “In investing you get what you don’t pay for. Costs matter. So intelligent investors will use low-cost index funds to build a diversified portfolio of stocks and bonds, and they will stay the course. And they won’t be foolish enough to think that they can consistently outsmart the market,” Bogle told the New York Times in 2012.

“Don’t look for the needle in the haystack. Just buy the haystack.” – John Bogle on the merits of passive investing over active management

Unfortunately, most investors haven’t stayed the course. For the twenty years ending December 2015, the S&P 500 index averaged 9.85% a year while the average equity fund investor earned a return of only 5.19%. High costs and market timing are largely to blame, which is why passive investing has dominated active management over this period.

Ironically, the king of active management is a huge fan of Bogle’s. You may recall Warren Buffett’s bet with Protégé Partners that an index fund would outperform their selection of hedge funds over a ten-year period. Buffett’s investment vehicle was Vanguard’s S&P 500 Admiral Fund (VFIAX), which outperformed Protégé’s fund of funds for nine of the ten years. Buffett’s advice on investing is right out of Bogle’s playbook, “Stick with big, ‘easy’ decisions and eschew activity.” Easier said than done, unfortunately.

Most active managers probably feel differently. According to the Associated Press, investors paid 40% less in fees for each dollar invested in mutual funds during 2017 than they did at the start of the millennium. That’s great for investors, but not so good for mutual fund providers and active managers.

“Stick with big, ‘easy’ decisions and eschew activity.” – Warren Buffett

Still, there might be a silver lining to all this for some active managers. It’s hard to envision a world without stock pickers and market timers. After all, what would happen to asset prices if nobody paid attention to them? For the active managers that have survived the so-called flowmageddon to passive products, there’s ample opportunity to pick up market share and less competition for undervalued assets. Best-in-class asset managers could very well come out ahead over the long run.

The problem is best-in-class asset managers are scarce. Over 90% of active managers underperformed the S&P 500 over the last market cycle. Such underperformance has led to all sorts of problems for the industry, including asset outflows and fee pressure that pushed most of these businesses into bear market territory last quarter.

Active managers can’t blame Bogle for their recent woes. He merely shed light on an obvious deficiency in their value proposition (alpha in excess of fees), and investors have responded accordingly. What’s especially problematic is the recent trend seems to be accelerating. An estimated $369 billion flowed out of long-term U.S. active mutual funds in 2018, versus net inflows of $72 billion in 2017. By comparison, outflows were a little more than $200 billion in 2008.

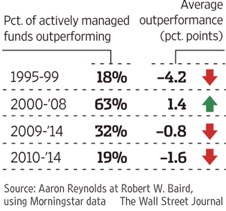

So if you’re a contrarian like Bogle, is now the time to get back into active management? It could be. Most active managers haven’t beaten the market since 2008, so they’re long overdue, especially if you consider their outperformance during bear markets:

In addition, high dividend ETFs often underperform their active counterparts since many of them are programmed to buy the highest yielding securities, regardless of fundamentals. Interestingly enough, actively managed Vanguard Dividend Growth has outperformed the Vanguard Dividend Appreciation ETF since 2007 even after fee considerations.

Still, we think Bogle would advise most investors to keep it simple and stick with passive investing. He has undoubtedly saved millions of investors around the world from the higher fees and (often) subpar performance of active management. So, next time you imbibe, pour one out for John Bogle and, perhaps, the active management industry as well.

RIA Valuation Insights

RIA Valuation Insights