Small/Mid-Sized Asset Managers Can Stay Relevant

Asset Management Industry Outlook

Over the last decade, investors have generally earned a higher net return by investing in passive vehicles rather than actively managed funds. Heather Brilliant, CFA (CEO of Diamond Hill), says the growth of passive investing has allowed “investors to access beta at a much lower price.”

However, the strong performance of large cap indices like the S&P 500 between the 2008-2009 recession and February of this year has also contributed to outflows from actively managed products. In March of last year, when the stock market fell due to COVID-19, many of our clients thought this would lead to a reversal in the trend. Active managers could once again shine.

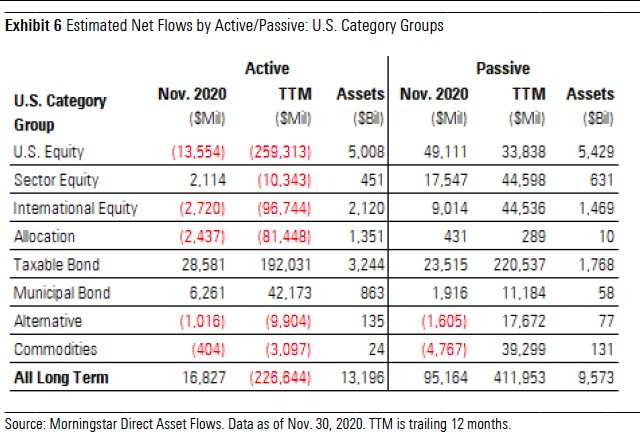

When the market quickly recovered and performance was largely driven by a handful of sizeable tech companies, however, active managers continued to struggle to deliver alpha (net of fees). U.S. trailing twelve month fund flows as of November 2020 were negative for all classes of actively managed equity investments and positive for all passive products. Passive market share is now greater for U.S. equity investing than active, a first.

While large asset managers (i.e. BlackRock), are protected by sheer scale, how do small/mid-sized asset managers stay relevant in this environment?

As we noted last week, the multiples observed for publicly traded asset managers are often lower than multiples observed in acquisitions of wealth management franchises. Asset managers are still facing numerous headwinds, as outlined below, and this higher risk profile and lower opportunity for growth is the cause for lower multiples.

Industry Headwind |

How to Stay Relevant |

| Underperformance Drives Outflows

An asset manager’s clients are more likely to jump ship after short term underperformance than clients of wealth managers. A 2016 State Street Study found that 89% of clients will look elsewhere after just 2 years of underperformance. But outperformance can also drive asset attrition from rebalancing. |

Educate your Clients

Investors who truly understand the risk/ return profile of their investment portfolio are more likely to tolerate short term underperformance. Most asset managers have a style that will work better in some markets than others.

|

| Asset Management Industry Barbell

Many asset managers are too small to achieve scale yet too big for the investment team to create highly researched and distinguished funds. Some of these firms are capitulating to consolidation, but there are other options. |

Commit to Capacity Limits

The CEO of Diamond Hill Capital Management, Heather Brilliant, CFA, took the stance in a recent podcast that active management is not a scale game. While many consider this to be a shortcoming of the industry, acknowledging that your firm cannot work for everyone, but can deliver great returns for fewer investors, is key. Her advice lines up with the recent growth of the OCIO industry, which commits more time and energy to individual clients’ needs.

|

| Fee Pressure

As we have written numerous times before, fee pressure in the asset management space has increased over the last decade, as low-to-no-cost products have proliferated and actively managed products have underperformed. |

Differentiate Products and Trim Expenses

There are two ways to increase the bottom line: 1) increase revenue and 2) reduce expenses. Asset managers can combat fee pressure by differentiating their products by taking a new approach to branding or by considering specialized investment classes such as sustainable investing. But, without buttressing your fees, the only way to save your margin is to clean up the “back of the house.” Investment management techniques and products have developed tremendously and there is a growing focus to match this development in the back office. |

A Plug for Mercer Capital’s Upcoming RIA Practice Management Insights Conference

We’ve decided to put together a virtual conference for RIAs that is focused entirely on operational issues – from staffing to branding to technology to culture – issues that are as easy to ignore as they are vital to success. The RIA Practice Management Insights conference will be a two half-day, virtual conference held on March 3 and 4.

The topic list is unlike that of any other investment management firm forum. We’ve attended and spoken at plenty of great conferences that cover investment products and M&A, so we’re not going to plow that ground ourselves. Instead, we have gathered an impressive list of thought leaders who have built careers out of professionalizing the “back of the house” to support the best investment management products and services.

Please join us to get their wisdom on how your firm can evolve to become a more sustainable, profitable, valuable enterprise.

Have you registered for the RIA Practice Management Insights conference yet?

RIA Valuation Insights

RIA Valuation Insights