Strong Gains in the Wealth Management Industry Propel RIA Aggregators to New Highs

Oh What a Difference a Year Makes…

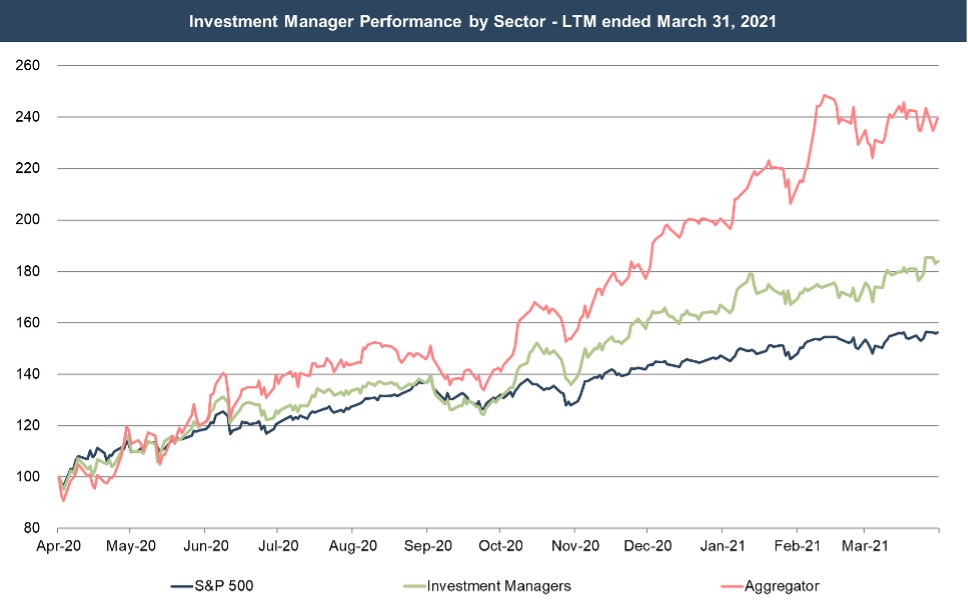

Nearly all sectors of the stock market are up over the last year, but that’s especially true for the RIA industry. Even if most wealth management firms don’t employ any debt in their capital structure, their performance is very much levered to the stock market due to its direct effect on AUM balances, and the operating leverage inherent in the wealth management model. RIA aggregators are even more levered to market conditions, since they typically borrow money to purchase wealth management firms. It shouldn’t be too surprising that our aggregator index is up 140% over the last year.

After a rough Q1 in 2020, wealth management firms have fared particularly well over the last year, with favorable market conditions and rising demand for financial advisory services. During times of excessive volatility and market turmoil, individual investors rely on their advisors to stay the course and rebalance portfolios in accordance with their investment objectives. Wealth management firms have capitalized on this reliance as the number of advisors charging financial planning fees on top of asset-based fees or commissions increased 72% in 2020.

Despite steady gains over the last year, wealth management firms still face challenges pertaining to fee pressure, succession planning and connecting with millennials who are more interested in robo-advisors and fintech products than being counseled by their parents’ advisor. Additionally, the switch from in-person meetings to digital communication is viewed by many as another obstacle. According to a recent Schwab study, 35% of advisors viewed clients’ ability to connect virtually as one of the biggest challenges to their business in 2020. On the flip side, 37% of advisors view leveraging technology infrastructure to be able to seamlessly work remotely as one of the biggest opportunities to their business.

Source: Schwab Advisor Services’ 2020 Independent Advisor Outlook Study

Another near-term opportunity is the pending reversal of some or all of the Tax Cuts and Jobs Act of 2017, and the implications it has for estate planning in 2021. Biden’s current proposal cuts the Unified Tax Credit (the exemption on gift and estate taxes) in half from $23.2 million to $11.6 million for married couples and from $11.6 million to $5.8 million per individual. As a consequence, many high net worth families will have significant gift and estate planning needs from their advisors to avoid a substantial increase in their embedded estate tax liability next year.

On balance, 2021 should prove to be another challenging but favorable year for wealth management firms that focus on their clients’ needs and take advantage of rising demand for financial planning services. Industry headwinds remain, but we’re confident that the industry will prosper, diversify, and expand.

RIA Valuation Insights

RIA Valuation Insights