Strong Quarter Propels Alt Managers to New Highs

The second quarter was especially kind to the alt manager sector, which benefited from favorable market conditions and growing interest from institutional investors. Heightened volatility creates more opportunities for hedge funds to generate alpha (when their positions aren’t concentrated in meme stocks), and market peaks often spur interest in alternative asset classes, like private equity and real estate. These trends initially took root last fall before gaining considerable momentum in the second quarter.

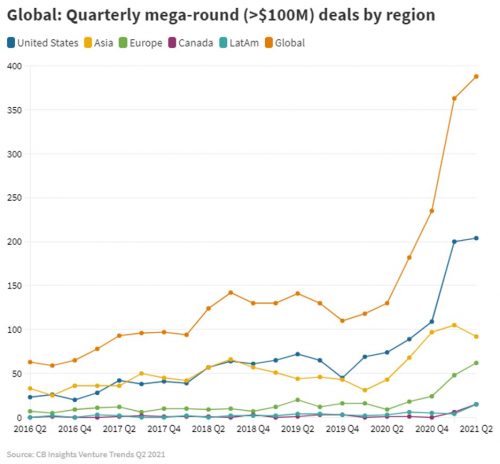

Much of this momentum is attributable to the VC space as investors turn to private equity and start-up tech firms for higher returns than more traditional asset classes. According to CB Insights, a record 249 firms achieved the $1 billion “unicorn” valuation status in the first half of 2021, almost doubling the total tally from last year.

Growing interest in the sector also stems from the fact that alt managers are often better positioned during a prospective downturn than their traditional asset management counterparts. Alt assets aren’t directly correlated to market conditions and are often held in illiquid investment vehicles, which means their investors are locked up for years at a time with no withdrawal rights.

While sticky assets can provide a cushion for alt managers in a downturn, the longer-term performance of many of these managers depends on their ability to raise new funds and put that money to work. Raising institutional capital is often a long and involved process in the best of circumstances. For many managers, the economic interruption of last year’s global shutdown presented challenges to their fundraising process that often involves extensive in-person due diligence. And if new funds are raised, there is the question of how fast managers can put that money to work without sacrificing proper due diligence.

M&A declined significantly in the second and third quarter of last year, leaving deal teams at many PE firms on the sidelines before rebounding sharply over the last nine months or so.

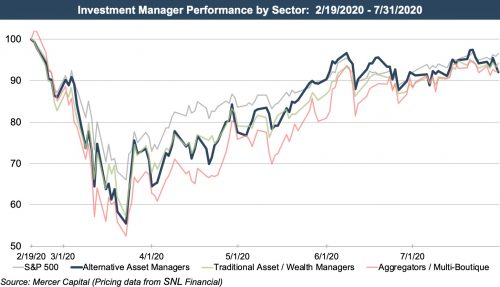

It’s also important to keep in mind that these alt managers and their assets are still vulnerable to bear markets. Public alt managers were particularly affected during the selloff last March, reflecting the decline in portfolio asset values and reduced expectations for realizing performance fees. From February 19, 2020 (the prior market peak), our index of alt managers declined nearly 45% in just over a month. Since then, an outsized recovery has pushed the index back to all-time highs.

Such a sharp gain in alt manager stock prices means the market is increasingly optimistic about the sector’s prospects. Performance fees and carried interest payments are likely to increase with rising asset prices. Strong investment performance also tends to entice inflows from institutional investors, which will buoy AUM balances and management fees for most of these firms. The market is therefore anticipating higher revenues for the industry, which should be accompanied by even greater gains in profitability given the sector’s relatively high level of operating leverage (fixed costs).

Many alt manager funds also have high levels of financial leverage (debt) that can augment returns when things go well. The trouble is that both forms of leverage can exacerbate earnings when revenue dips or investments underperform. These attributes are what make the alt management industry so volatile and are part of the reason why the sector lost nearly half its value last March before doubling over the next year.

On balance, we believe the recent run-up is justified, but it’s important to remember what can happen when alt asset prices go the other way. Expect volatility to remain as investors weigh the impact of a recovering economy and rising inflation on alt asset returns.

RIA Valuation Insights

RIA Valuation Insights