The Evolution of Rule-Based Valuation Metrics and Why They Still Don’t Work

One of our first blog posts addressed the fallacies of rule-based valuation measures in RIA transactions. Our position hasn’t changed, but these so-called rules of thumb have certainly evolved over time.

In a recent podcast with Michael Kitces, industry transaction specialist Elizabeth Nesvold of Raymond James explains the history and rationale behind these changes. For this week’s post, we’ll discuss this evolution and why such measures are usually more misleading than meaningful.

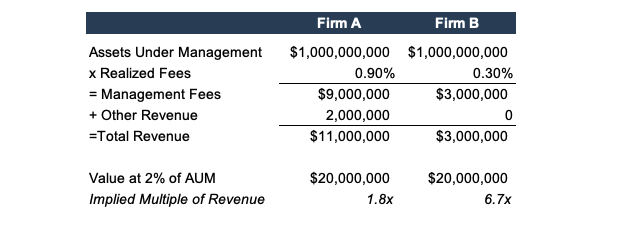

Ten to twenty years ago, it was just assumed that all RIAs were worth 1-2% of AUM. At that time, many RIAs were able to charge 1% of AUM for their services, so a valuation of 1-2% of AUM equated to a 1-2x multiple of revenue, which was also thought to be a reasonable estimate of value. Over the last decade, AUM-based valuations have broken down with fee compression and the proliferation of non-asset-based sources of revenue. The example below illustrates how AUM multiples break down for firms with different fee structures and revenue sources.

Firm A charges higher fees and has other sources of income. Its revenue yield (total revenue as a percentage of AUM) is therefore much higher at 1.1% (versus 0.3% for firm B), so a 2% of AUM valuation translates into a 1.8x revenue multiple, which is within a range often observed for investment management firms. Firm B, on the other hand, charges lower fees and has no alternate source of revenue, so a 2% of AUM valuation would be nearly 7x revenue, well above a reasonable valuation estimate for most RIAs. Mathematically, the AUM multiple is the product of the revenue multiple and the revenue yield (e.g. 2% = 1.1% of 1.8x for Firm A), so this measure varies directly with realized fees.

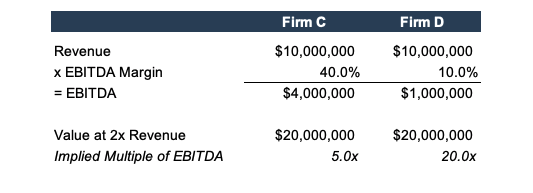

As fee schedules changed, many RIA owners began valuing their businesses with revenue multiples. This approach isn’t much better as it ignores how efficiently the business is managing its costs. Firms with similar levels of revenue can have drastically different EBITDA margins, so blindly applying the same revenue multiple to all of them can lead to nonsensical valuations.

Applying a 2x revenue multiple to a low margin RIA like Firm D would likely overvalue the subject company since it would imply an unrealistically high multiple of earnings or cash flow. Just like AUM multiples vary with realized fees, revenue multiples are directly proportional to profit margins since these cap factors are the product of EBITDA multiples and profit margins (2x revenue multiple= 40% EBITDA margin times a 5x EBITDA multiple for firm C).

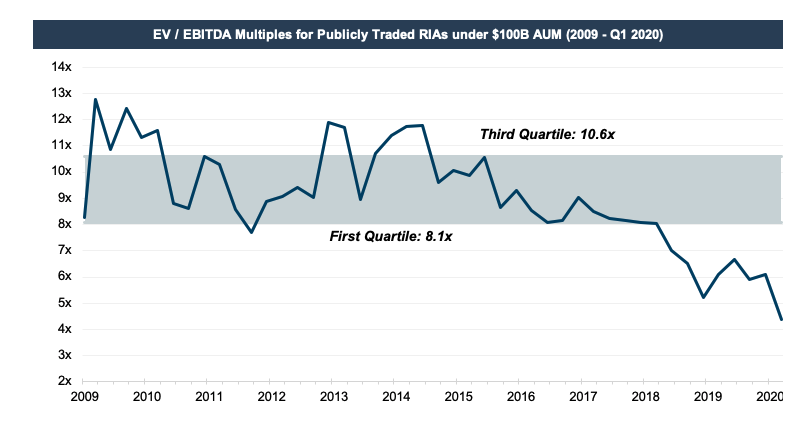

Because of these shortcomings, many industry analysts now use earnings multiples to value RIAs. We consider cash flow metrics superior to AUM and revenue measures since earnings multiples take into account realized fees and profit margins. Earnings multiples are directly related to growth prospects and inversely related to risk, so valuing all RIAs with the same profitability multiple can be problematic as well. Investment management firms can have radically different risk profiles due to varying customer concentrations, manager dependencies, and regulatory pressures. Growth prospects also vary with scalability, capacity limitations, and new business development. Applying a one-size-fits-all earnings multiple to businesses with varying risk profiles and growth prospects will lead to inaccurate valuations.

The appropriate multiple also changes over time. This is true for all industries but is especially true for RIAs, whose business is tied to market conditions, which have been highly volatile in recent years. The EBITDA multiple for publicly traded RIAs with under $100 billion in AUM has been cut in half in the last two years, so if your firm was worth 8x in 2018, all else equal, that’s probably no longer the case, as depicted in the graph below.

Even though the multiple has changed, the methodologies for valuing investment management firms remain the same.

Most RIA appraisals include a discounted cash flow (DCF) analysis and a market methodology involving publicly traded investment managers or industry transactions if there are sufficiently similar companies with reported financial metrics. Rules of thumb are overly simplistic and often lead to nonsensical appraisals.

The reality is that there is no magic formula for valuing RIAs, so try not to fall into that trap. Any reasonable appraisal of your business will include a careful study of trends in asset flows, realized fees, profit margins, client retention, investment performance, stock transactions, shareholder agreements, and budgeted financial performance, among other things. It’s a lot to keep up with, but we’re happy to walk you through it.

RIA Valuation Insights

RIA Valuation Insights