The Four Types of RIAs

And What It Means for Practice Management

There are 15,000 or so RIAs in the US. No two are identical, of course, but broadly speaking, firms that seek to serve the same types of clients tend to end up with similar-looking business models, whether intentionally or through some form of convergent evolution. A firm’s structure—its org chart, compensation model, advisory team model, internal processes, marketing, technology, and so on—tends to reflect the types of clients the firm seeks to serve and, relatedly, the value proposition it offers to those clients. The result is that firms tend to cluster around a handful of distinct models, and identifying what those models are and how they differ can be a useful exercise both in analyzing a particular firm and in thinking about practice management issues.

Back in 2021, Ashish Nanda and Das Narayandas—both economists and professors specializing in professional services and client management strategies—published an article in the Harvard Business Review titled What Professional Services Firms Must Do To Thrive. In that article, the authors introduced a framework for thinking about professional services firms based on the type of service they provide to clients. While the framework is generally from the perspective of professional services, we’ve found it to be a particularly useful tool for thinking about asset and wealth management firms.

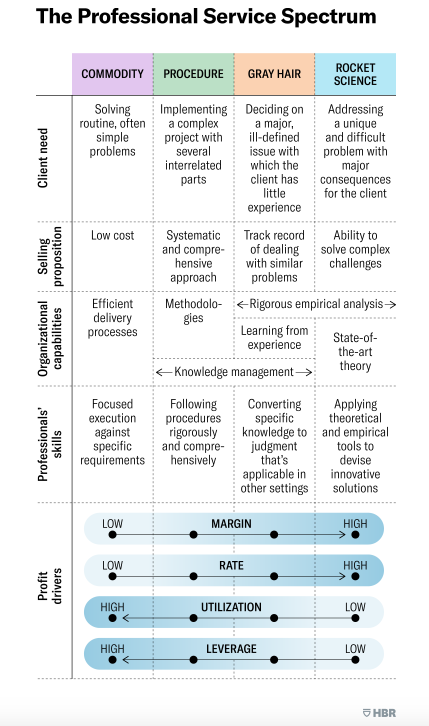

The framework categorizes firms into four buckets based on where they fall along a spectrum of the complexity of services provided. At one end of the spectrum are Commodity Practices—firms that offer undifferentiated services that solve simple problems. Next are Procedural Practices—those firms that offer clients the ability to tackle larger problems that are complicated primarily by larger scope and multiple moving parts. Next are Gray Hair Practices—firms that bring experience and institutional knowledge to solve even more complex problems. At the other end are Rocket Science Practices—firms that solve unique, difficult, and high-stakes problems for sophisticated clients.

Firms are defined along this spectrum not by their own self-perceptions but by the selling proposition that brings clients to the firm. If clients select a particular firm because it’s the lowest-cost provider, that’s likely a commodity practice. At the other end of the spectrum, if clients choose a particular firm because they think it’s best suited to solve a particularly difficult and novel problem, that firm is likely best classified as a rocket science practice.

What does this look like for RIAs? To illustrate, it’s helpful to look at the profiles of firms that fall in each category. Many firms may have elements that place them into multiple categories, but generally, firms lean most heavily into a single or perhaps two categories at most. For wealth management firms, we think most practices straddle the Procedural and Gray Hair categories.

- Commodity RIAs. Includes firms that use scale and automation to deliver low-cost, standardized investment services. Firms with algorithm-driven portfolio management strategies and mass-market advisory firms would likely fall into this category.

- Procedural RIAs. Includes firms with services that involve complex but well-defined processes. For RIAs, this could be offering comprehensive financial planning that follows structured steps. The administratively heavy nature of independent trust companies would also generally place them in this category.

- Gray Hair RIAs. This category includes RIAs that provide more sophisticated advice to more sophisticated clients than procedural practices, relying heavily on the experience and expertise of their advisors. Firms that predominantly serve ultra-high-net-worth clients, families with multi-generational wealth, or those that offer complex estate planning strategies generally fall into this category.

- Rocket Science RIAs. Asset managers that utilize complex or novel investment strategies would fall into this category—think those that have developed proprietary, quantitative trading strategies or those that utilize complex, derivative-based hedging strategies or certain alternative investment strategies.

This framework has implications for the profit drivers of a business and the resources required to succeed. The farther a firm is towards the commodity end of the spectrum, the more important efficiency and systems for delivery become because these are necessary to deliver while remaining profitable. For RIAs, this typically means that such firms have org charts that are wider at the bottom, lower compensation levels on average, and low margins that are offset by scale and the ability to more easily leverage and grow the business.

The farther a firm is toward the Rocket Science end of the spectrum, the more important knowledge management, experience, and analytical expertise become to the firm’s success. For RIAs, this typically manifests in a higher ratio of senior staff to junior staff, higher average compensation levels, higher margins, and less leverage. Such practices are inherently more difficult to scale because they rely more on individual expertise than company-wide systems to deliver their value proposition.

Depending on where your practice falls on the spectrum, the type of talent you hire will be different, the way you structure client service teams will be different, the internal systems and processes you develop will be different, the way you market services will be different, and the way you invest in technology will be different.

Successful Practices Are Clear About Where They Fall on the Spectrum

While “commodity” and “rocket science” may elicit different knee-jerk responses in the professional services world, it’s important to note that one type of practice is not categorically better than any other. Success can be found through each of the routes above, and we’ve seen examples from each. But it’s essential to have a clear vision of the type of practice you’re seeking to run. Thinking about the type of practice you’re running is a valuable exercise for identifying the areas you want to lean into and the areas you want to avoid, as it has implications for the resources required for success.

About Mercer Capital

We are a valuation firm that is organized according to industry specialization. Our Investment Management Team provides valuation, transaction, litigation, and consulting services to a client base consisting of asset managers, RIAs, trust companies, broker-dealers, PE firms, and alternative managers.

RIA Valuation Insights

RIA Valuation Insights