The SEC’s Proposed “Transition Plan” Requirement is One More Reason to Think about your Firm’s Ownership

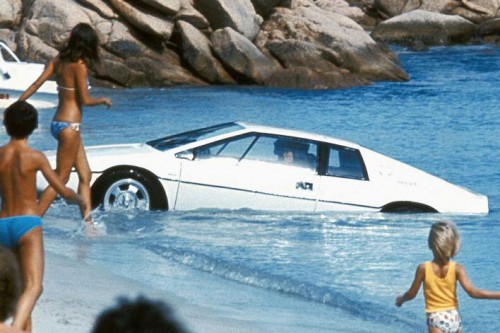

Wet Nellie – a highly modified 1977 Lotus Esprit – from The Spy Who Loved Me Photo Credit: Road & Track

James Bond’s engineering mastermind, Q, makes his living out of planning for the unexpected. Over the years, the star of the franchise has been saved from nearly certain demise by a remarkable variety of devices – but none of them more preposterous than the one that saved Roger Moore’s character in The Spy Who Loved Me, in which Bond escapes a typical car chase in his Lotus Esprit by driving into the Mediterranean, only to have the car immediately transform into a submarine. The whole scene could have been a metaphor for Lotus Motors itself, which was very much underwater – financially – at the time.

Lotus’s founder, Colin Chapman, was a genius at designing sports cars, but had a harder time making the business consistently successful. By the late 1970s, Lotus was gasping for air. Desperate for cash, Lotus got involved with John DeLorean to design his eponymous car, the DMC-12, and promptly got embroiled in the DeLorean scandal. The pressure built on Lotus and on Chapman, who died of a heart attack in 1982 at the age of 54. The untimely death of Chapman, coupled with poor sales and the ongoing investigation, almost bankrupted Lotus. Q may have planned ahead for the unexpected for James Bond, but Chapman unfortunately didn’t do a similar amount of planning for Lotus. As a consequence, the Bond franchise has been, all in all, more successful.

Picking up on this, the SEC seems concerned about RIAs doing some planning for the unexpected, and hence they’ve unleashed 206(4)-7. By now you’ve probably read the SEC’s proposed rules on Adviser Business Continuity and Transition Plans. While there are two weeks left on the comment period, I’ve been a little surprised at how few comments have been posted, so far at least. Maybe that means the RIA community has decided this is inevitable, and they’re already looking forward to how to comply with the rules once they’re finalized.

Most of the proposed rule simply codifies a reasonable standard for practice management at an RIA. Certain of the proposal’s requirements, such as IT management and being able to conduct business and communicate with staff and clients in the event of a natural disaster, are likely to be met with turn-key solutions from vendors. Mercer Capital has had some firsthand experience with these kinds of issues: we had to move to temporary quarters for a year after a fire in our office building fifteen years ago, and we provided an alternative location for a New Orleans-based valuation firm for a short time after Hurricane Katrina. It’s amazing what you can do with remote hosted data, laptops, and cell phones when you have to.

Of more interest is how the requirement for a “transition plan” in the event of the death or incapacitation of an advisory firm owner will be implemented. The primary elements the SEC wants to see on business transition planning are:

- Policies and procedures that would safeguard, transfer and/or distribute client assets during transition

- Plans for transitioning the corporate governance of the adviser

- Identification of any material financial resources available to the adviser

- Policies and procedures that would generate client-specific information needed to transition client accounts to a new adviser

- Assessing the applicable laws and contractual obligations governing an RIA and its clients that would be relevant given the adviser’s transition

Again, much of this is check-the-box kind of stuff that will become fairly routine over time. The one sticky wicket, as we see it, is the requirement to have a plan to transition the corporate governance of the RIA. In other words, if a key owner becomes incapacitated, dies, or for whatever reason cannot fulfill his or her position on the organization chart, who will? Since corporate governance at an RIA is usually accompanied by ownership, what the SEC is really asking is “who is going to own and manage the advisory firm in the event that a key owner/manager cannot?”

Most of the commentary on this topic has been directed at small RIAs with one owner, which essentially operate as sole proprietorships. For small firms, the options are many, but follow a similar theme: sell the firm immediately at a pre-arranged valuation to another RIA that is in a position to take over.

The narrative included with the SEC’s proposal is careful not to define the parameters of any particular RIA’s transition plan too specifically. Every situation is going to be different, but eventually, the regulation is going to have to get fairly granular with regard to expectations of transition plans. Thinking ahead to that time, we would suggest the following might be a descriptive (as opposed to prescriptive) guide to what issues are going to be prominent for RIAs, depending on size.

As has been suggested by several commentators on the proposed regulation, solo practitioners and smaller RIAs probably have no recourse for a transition plan that provides for corporate governance (and, thus, control ownership) than some version of a living will for their practice that sells it, immediately, to either a peer RIA or a consolidator like Focus Financial (who filed for an IPO over the weekend). One thing to keep in mind, at that size, is counterparty risk; will the contracted acquirer/operator of the RIA be in a position – financially and operationally – to purchase and run the selling firm if something happens to its owner, and will the acquirer be able to do it on a moment’s notice such that client service is not interrupted? Will the SEC require some kind of “fire-drill” to check if the transition plan works? And who will be held accountable (estate of the Seller, contracted buyer, or both) if the transition plan fails when it’s triggered? Transitions don’t always go smoothly even in a regular acquisition setting, when everyone has time to plan for them and when the seller is available to assist with the transition process.

As the size of the firm increases, so typically does the number of owners. One awkward size might be the next one, a medium sized RIA with up to $1.0 billion under management, a few owners and a dozen or more employees. At that scale, it’s not uncommon for the founding partner to hold a majority stake or at least a substantial minority stake. An RIA of this size usually generates more value, per dollar of AUM, than a smaller firm. More value means, of course, a higher purchase price. So while it may be easier to manage the client service issue internally, not every RIA in this size range will be in a position to finance the purchase of the deceased or disabled partner.

The largest RIAs have the internal resources to protect their clients in the event of an untimely death. At these sizes, the most significant issues are whether or not the ownership agreements providing for repurchase of a deceased or disabled partner are thorough and current, and whether or not the ownership group has some agreement as to the value of the business. We are involved in numerous matters each year where one or more of these factors is not present, and as a consequence there is a material disagreement as to the value of a buyout. We are also involved with many clients who substantially mitigate this risk by reviewing their buy-sell agreements regularly and have annual valuations prepared so the owners know what to expect in the event of the unexpected. Obviously, we recommend the latter.

Regardless of how much planning you do, your RIA is unlikely to emerge from an unexpected calamity without a scratch, but at least you won’t be all wet.

RIA Valuation Insights

RIA Valuation Insights