Outlook for Asset Management Firms Amid COVID-19

Falling Asset Prices Threaten Profitability as Spotlight Turns to Relative Performance

The recent sell-off in equities have put pressure on the financial performance of most asset managers, given that revenues and cash flows are highly correlated with the market. At the same time, it is also a critical time for these businesses to deliver on their value proposition of alpha net of fees. Active managers have generally underperformed their benchmarks over the past 10 years, which has driven outflows into low-fee passive products. The extreme financial market volatility and dispersion over the last two months has created major price dislocation and the potential to generate outperformance. The current environment may well be the time for active managers to prove themselves by protecting clients’ assets relative to index performance and justifying their fees.

Underperformance Has Driven Outflows

For active managers, the eleven-year bull run that preceded the current downturn was accompanied by relative underperformance, falling fees, and asset outflows. Over the last decade, indexing to the market largely beat out stock picking and asset allocation based on security-specific research or macroeconomic factors. The strong performance of large cap indices like the S&P 500 between the 2008-2009 recession and February of this year has been largely driven by a handful of sizeable tech companies, and active managers struggled to deliver alpha in that environment. Not only did the indices beat the active managers, but the fees on the passive products tracking these indices have also fallen to virtually zero. Not surprisingly, investors have chased after the strong relative performance and low fees of passive index tracking products. In August last year, passively managed assets exceeded active for the first time.

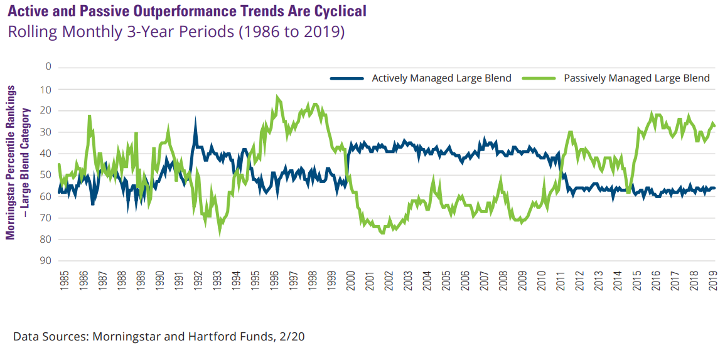

Many asset managers have explained underperformance over the last decade in the context of a runaway bull market while suggesting that the merits of active management would be proven in the next downturn. So, now that a bear market and significant volatility are here, will active managers outperform? Intuitively, it makes some sense, as market shocks and liquidity needs in a downturn can cause disconnects between asset prices and fundamentals that active managers seek to exploit. There is some evidence to suggest that active/passive relative performance is cyclical. As the chart below shows, the 10-year bull market through 2019 was accompanied by passively managed funds outperforming. With the bull market over, the era of passive outperformance may be as well.

However, initial data from Morningstar indicates that only about 42% of active funds beat their indices between February 20, 2020 and March 16, 2020, compared to 44% during the preceding rally (December 24, 2018 – February 19, 2020). While active funds collectively have not fared well, some asset classes have fared better than others. Some alternatives, commodities, and sector equity funds have outperformed by wide margins during the bear market. Funds with long-short exposure or large cash holdings relative to the benchmark have also had high success rates.

Outflows from Active Funds Accelerate

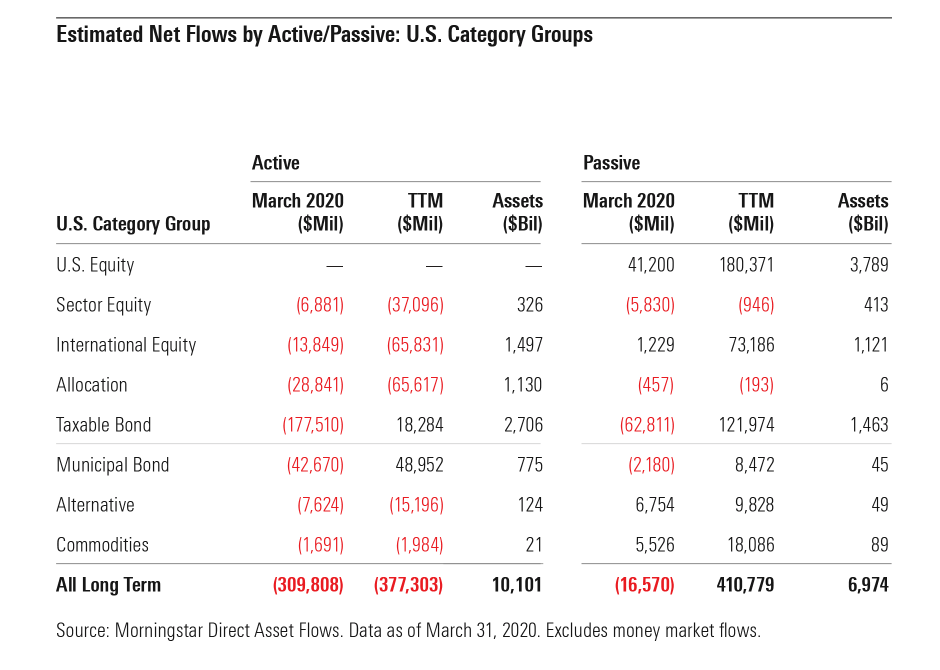

Outflows from active funds have accelerated as the global pandemic has caused investors to rapidly shift into cash. As shown in the table below, March saw record outflows from long-term funds and record inflows into money market funds. The outflows in long-term funds were concentrated in actively managed funds. Passively managed U.S. equity funds saw $41 billion in net inflows in March, while all categories of actively managed funds saw outflows in March.

Stock Price Performance for Publicly Traded Asset Managers

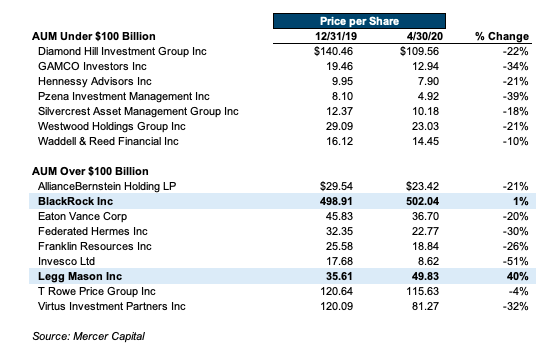

The combination of accelerating outflows and falling asset prices represents a major headwind for active asset managers, and the price movement in publicly traded asset managers has reflected this. As shown in the table below, the stock prices for most of these companies are down 20-30% so far this year.

Only Legg Mason and BlackRock are above where they were at year-end, and the performance of Legg Mason is not related to its fundamentals, but rather a fortuitously timed transaction. Franklin Resources agreed to buy Legg Mason for $50.00 cash per share on February 18, 2020, one day before the S&P reached its peak. Since then, Legg’s shares have been anchored close to $50.00, while Franklin Resources’ price has fallen significantly as it is stuck on the other side of a trade that now looks very good for Legg Mason shareholders.

BlackRock, on the other hand, has performed well due to its positioning as the largest player in passive products. About 75% of BlackRock’s $7.4 trillion in assets under management are passively managed, and its growth has been driven not just by market movement but by strong inflows into its iShares ETF franchise and other passive products. The strong relative performance of BlackRock’s shares in this environment suggests that the market views BlackRock and its massive passive franchise as better positioned to perform than its smaller, more actively managed counterparts.

Outlook for Future Financial Performance

Moody’s recently downgraded its outlook on global asset managers to “negative” from “stable,” citing economic headwinds and market declines resulting from the coronavirus pandemic. With asset prices down across virtually across the board, asset management revenues and profitability will take a significant hit in the second quarter and perhaps beyond depending on the market trajectory. The financial performance of asset management firms over the next several years will largely be tied to the shape of the market recovery. As of early May, the run-rate financial performance for asset managers has improved significantly as asset prices have recovered from March lows.

The longer-term outlook for active managers depends more on the ability of these managers to deliver alpha net of fees in the current environment and stem the asset outflows that have drained AUM over the last decade. While the initial data indicates that active management relative performance has not improved during the bear market, there is opportunity over the next several months as markets calm and prices reconnect with fundamentals. The coming months will be a critical time for asset managers to prove themselves.

RIA Valuation Insights

RIA Valuation Insights