Valuations of Asset Managers Are Slow to Recover

Is the Decline in Active Management a Result of Increased Competition or Mediocre Performance?

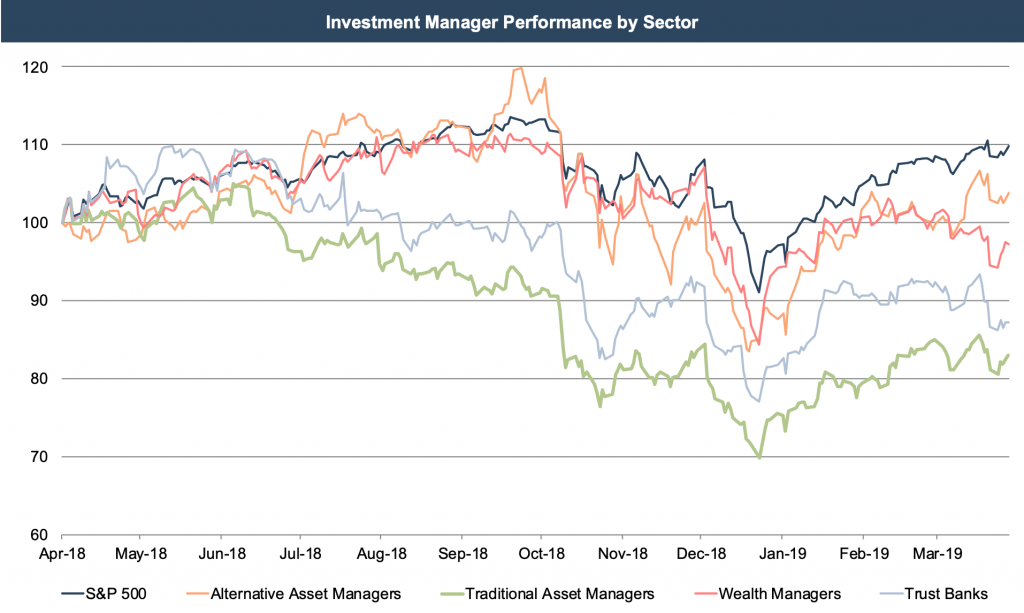

Over the last year, the stock price declines of publicly traded asset managers were generally more significant than other investment managers and the broader stock market.

As mentioned in our latest whitepaper, How to Value a Wealth Management Firm, wealth managers are more resistant to market volatility as shown by their superior performance to asset managers over the last year. Their resilience stems from the fact that client assets are correlated with the market, but client relationships are not.

Asset management firms are more susceptible to market volatility, however, because during periods of volatility or market declines, asset management firms risk losing assets from both downward market movements and client outflows. Downward market movement clearly has a direct negative impact on AUM, but it can also lead to outflows and lower revenue as clients de-risk or reallocate to lower fee fixed income products.

While market declines are a threat to the profitability and valuations of any asset management firm, active managers face the additional threat of relative underperformance driving outflows, even in periods of rising markets. Low fee passive strategies have become increasingly popular due in part to both the perceived underperformance of active managers and an increasing focus on fees. But to what extent have active fund outflows been driven by mediocre performance versus competition from passive strategies, and what is the impact on asset management firm valuations?

Fund Outflows

In general, asset managers are experiencing an industry-wide shift away from actively managed investment products. Over the last 15 years, more than half of all U.S. equity funds have merged or liquidated. According to MorningStar, 2018 was the “worst year for long-term fund flows since 2008.” Inflows were less than half the $350 billion average for the prior year, and outflows approximated 4% of beginning assets.

At year-end, Morningstar predicted that if current trends in asset flows continued, passive U.S. equity funds would likely catch up with active funds’ market share in the next few months of 2019. Most of our clients expect this trend will continue for a few more years before stabilizing and ultimately reversing. January 2019 brought a more positive outlook for actively managed funds which “for the first time in five years outshone their passive counterparts.”

Mediocre Performance

Headlines have recently brought attention to the mediocre performance of many active managers (“Active fund managers trail the S&P 500 for the ninth year in a row”). One of the primary reasons for active funds’ lackluster performance is the number of active funds who participate in closet indexing. Closet indexers claim to manage a unique portfolio designed to generate active returns while their active share (percentage of holdings that differ from the benchmark) is actually quite low. Last year, thirteen active fund managers agreed to voluntarily disclose their active share in order to increase transparency. Actively managed funds charge higher fees in exchange for the promise of excess return. Closet indexers typically generate returns in line with the benchmark but at a higher cost than a passive investment in the underlying benchmark.

Competition from Passive Alternatives

According to Morningstar’s semiannual Active/Passive Barometer (published in February), “just 38% of active U.S. stock funds survived and outperformed their average passive peer in 2018, down from 46% in 2017.” For the twenty years ending December 2015, the S&P 500 index averaged 9.85% a year, while the average equity fund investor earned a return of only 5.19%. There has been much written about the shift from active to passive investing, and high costs and active manager underperformance are largely to blame.

Valuations

On average the stock prices of asset managers fell 17% year-over-year. Trailing valuations fell by over 30% from a median of 15.8x trailing earnings in March 2018 to 10.5x trailing earnings in March 2019. The broader stock market has recovered somewhat from the pullback observed at year end, but asset manager valuations have improved more modestly. Forward multiples, however, are more in line with historical norms.

Is the decline in active management a result of increased competition or mediocre performance? We think it’s both. In general, clients (especially institutional investors and high net worth individuals) are still willing to pay for superior performance. We think best-in-class asset managers could come out ahead of their passive counterparts in the long run, but the problem is that best-in-class asset managers are, by definition, few and far between.

RIA Valuation Insights

RIA Valuation Insights