Asset Manager M&A Activity Accelerates in 2018

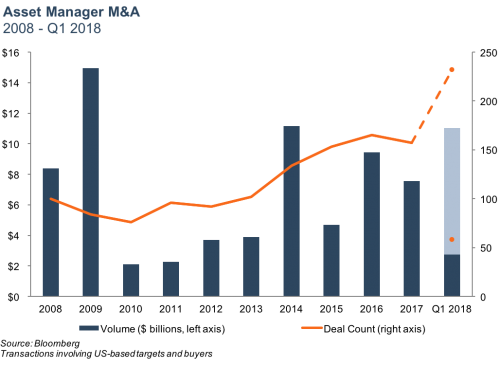

Asset manager M&A was robust through the first quarter of 2018 against a backdrop of volatile market conditions. Total deal count during the first quarter was up 32% versus the first quarter of 2017, though total disclosed deal value was down 25%. In terms of deal count, M&A is on pace to reach the highest levels since 2014, although we note that the quarterly data can be lumpy. Several trends which have driven the uptick in sector M&A have continued into 2018, including revenue and cost pressures and an increasing interest from bank acquirers.

Notable Trends

The underpinnings of the M&A trend we’ve seen in the sector include increasing compliance and technology costs, broadly declining fees, and slowing organic growth for many active managers. While these pressures have been compressing margins for years, sector M&A has historically been muted. This is due in part to challenges specific to asset manager combinations, including the risks of cultural incompatibility and size impeding alpha generation. Nevertheless, the industry structure has a high degree of operating leverage, which suggests that scale could alleviate margin pressure for certain firms.

“Since I’ve been in the industry, there’s been declarations of massive consolidation. I do think though, this time there are a set of factors in place that weren’t in place before, where scale does matter, largely driven by the cost coming out of the regulatory environments and the low rate environments in cyber and alike. And, you have to be, as a firm, you have to be able to invest in the future. And I think a number of smaller-sized firms are finding that hard.”

Martin Flanagan – President and CEO, Invesco Ltd. 1Q17 Earnings Call

“You need to have, of course, the right product set. But you need especially to have underlying firms, which are positioned as best they can in terms of alignment and focus to sustain alpha generation. And in that respect, scale is the enemy, not the friend.”

Sean Healey – 1Q17 Earnings Call, Affiliated Managers Group Inc

Consolidation pressures in the industry are largely the result of secular trends. On the revenue side, realized fees continue to decrease as funds flow from active to passive. On the cost side, an evolving regulatory environment threatens increasing technology and compliance costs. Over the past several years, these consolidation rationales have led to a significant uptick in the number of transactions as firms seek to gain scale in order to realize cost efficiencies, increase product offerings, and gain distribution leverage.

Acquisition activity in the sector has been led primarily by RIA consolidators, with Focus Financial Partners (which itself was acquired by Stone Point Capital and KKR in a $2 billion deal last year), Mercer Advisors (no relation), and United Capital Financial Advisers each acquiring multiple RIAs over the last year. While these serial acquirers account for the majority of M&A activity in the sector, banks have also been increasingly active acquirers of RIAs in their hunt for returns not tied to interest rate movements. Despite a rising yield curve and the negative impact of goodwill on tangible book value, we suspect that RIAs will remain attractive targets for bank acquirers due to the high margins (relative to many other financial services businesses), low capital requirements, and substantial cross-selling opportunities.

The Market’s Impact

Recent increases in M&A activity come against a backdrop of a bull market that continued unabated through 2017 but faltered during the first quarter of 2018. Steady market gains have continued throughout 2017 and have more than offset the consistent and significant negative AUM outflows that many active managers have seen over the past several years.

In 2016, for example, active mutual funds’ assets grew to $11 trillion from $10.7 trillion, despite $400 billion in net outflows according to data from Bloomberg. While the first quarter of 2018 saw negative returns for most major indices, the gains seen during 2017 have yet to be eroded. At the end of the first quarter, the S&P was down nearly 10% from its peak in late January 2018, but the index is still only 2% below year-end 2017. As a result of increasing AUM and concomitant revenue growth (perhaps notwithstanding this last quarter), profitability has been trended upwards despite industry headwinds that seem to rationalize consolidation.

Conclusion

With no end in sight for the consolidation pressures facing the industry, asset manager M&A appears positioned for continued strength or potential acceleration regardless of which way the markets move during the remainder of 2018. Given the uncertainty of asset flows in the sector, we expect firms to continue to seek bolt-on acquisitions that offer scale and known cost savings from back-office efficiencies. Expanding distribution and product offerings will also continue to be a key acquisition rationale as firms have struggled with organic growth.

With over 11,000 RIAs currently operating in the U.S., the industry is still very fragmented and ripe for consolidation. An aging ownership base is another impetus, and recent market gains might induce prospective sellers to finally pull the trigger. More broadly, the recent tax reform bill is expected to free up foreign-held cash and increase earnings, which could further facilitate M&A’s upward trend during the rest of 2018.

Mercer Capital’s RIA Valuation Insights Blog

The RIA Valuation Insights Blog presents a weekly update on issues important to the Asset Management Industry. Follow us on Twitter @RIA_Mercer.

RIA Valuation Insights

RIA Valuation Insights