Flurry of Recent Deals Highlights Investor Appetite for RIAs Despite Industry Headwinds

The recent Pathstone–Convergent deal and Focus Financial IPO has shown how resilient RIA deal-making can be despite the greatly diminished growth prospects for the industry as a whole. Other recent deals include:

- On August 30, Harwood Wealth Management announced the acquisition of Network Direct Ltd. for £4 million up front and a potential £3 million in earn-out consideration contingent upon Harwood’s ability to convert Network’s client assets into Harwood AUM over a five year period.

- FAB Partners, an alternative investment platform, announced the acquisition of $14 billion private debt manager, CIFC LLC on August 19 for $333 million or 2.4% of AUM and a 60% premium over CIFC’s closing price the day before. Though 2.4% of AUM appears low for a strategic acquisition of an alt asset manager, a quick look to CIFC’s public filings reveals significant declines in revenue and profitability from 2014 to 2015 before ticking back up in the first half of this year.

- On August 24, hedge fund manager Emerging Sovereign Group announced that its management team would buy back the 55% ownership stake it sold in 2011 to PE giant, Carlyle Group. Although deal terms were not disclosed, AUM grew from $1.25 billion to $3.5 billion over this time, so it is probably safe to assume that Carlyle achieved a high IRR on this one.

Indeed, mutual fund outflows and multiple contraction seems to actually have positive implications for sector M&A in 2016 and beyond. The maturation of the mutual fund industry and active equity managers will likely spur consolidation and buying opportunities for those looking to add scale. With valuations and market caps down over the last two years, the affordability index has gotten a lot better for many of these businesses.

Expectations for slower growth (reflected in lower multiples) could be another driver of deal-making, as RIAs look to other asset managers to build or replace AUM depleted by outflows and market movements. If organic growth opportunities are truly stalling, acquisitions are a viable means to offset falling management fees and collect market share for those that can afford to do so.

The volatility over the last week and a half should have a more nuanced effect on the pace of acquisitions. Prospective buyers might be spooked by the sector’s vulnerability to investor sentiment as a high-beta business. Alternatively, the relatively low levels of leverage and balance sheet risk might make it more resilient to credit crunches or changes in capital requirements.

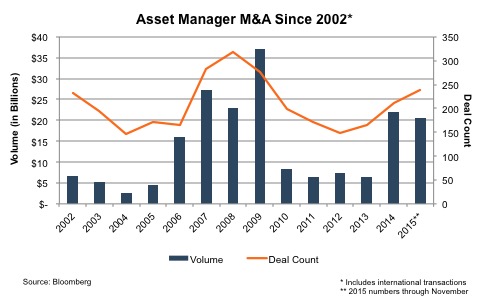

On balance, 2016 could be a record year for asset manager transactions both in terms of deal count and collective volume. While this may be a stretch given the number of distressed sales during the financial crisis, a continuation of the current trend is certainly achievable.

Despite the recent uptick, we believe the backlog of available deals remains fairly robust given the three year pause in transactions from 2010 to 2013 and the aging leadership demographics of many investment management firms. Still, we acknowledge that the decline in transaction activity following the financial crisis of 2008 and 2009 could be indicative of what another bear market could do to M&A trends when the dust settles and AUM has cratered.

RIA Valuation Insights

RIA Valuation Insights