Private Equity’s Silent Push into the RIA Space

Is Private Equity the Solution to Your Succession Planning Needs?

Private equity pervades the RIA industry, but most of their recent interest is through consolidators or roll-up firms. In this week’s post, we’ll discuss the implications of this trend and other considerations for RIA owners’ contemplating the PE route.

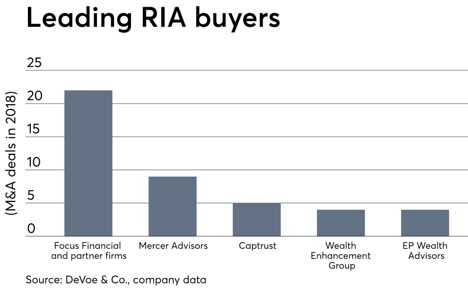

You may have not heard much about private equity firms’ addition of RIAs to their portfolios in recent years. But that doesn’t mean they’re not interested. The reality is that PE firms collectively have established an indirect interest in hundreds of RIAs via their investments in RIA consolidators. This strategy enables private equity to achieve diversification and scale in a single purchase rather than buying dozens of investment managers and hoping a majority will work out. Many of the leading RIA consolidators are or have been backed by PE. Recent examples include investments made by Stone Point Capital (Focus Financial), Thomas H. Lee Partners (HighTower Advisors), TA Associates (Wealth Enhancement Group), and Oak Hill Capital Partners (Mercer Advisors).

Since private equity firms are increasingly interested in growing their RIA exposure, there has been a lot of pressure for these PE-backed consolidators to increase their portfolio holdings via acquisition. This has largely been positive for wealth manager valuations as consolidators bid up their pricing to grow AUM and appease their PE backers. Private equity firms have gained broad exposure to the RIA space in recent years through this portal of indirect ownership.

Like any other prospective buyer, there are pros and cons associated with a private equity partnership.

Does this mean they’re not interested in making a direct investment in your firm? Not necessarily; but remember that their primary objective (perhaps more than any other type of buyer) is to generate large returns to investors, which may be hard to achieve with an RIA with less than $1 billion under management. Larger investment managers, though, do offer the scale, (usually) higher margins, and predominantly recurring revenue models that have captured the attention of many PE firms over the years.

Like any other prospective buyer, there are pros and cons associated with a private equity partnership. At the moment, many PE firms are flush with capital and willing to pay a substantial portion of the total consideration in cash up front. Most can afford to buy a majority interest and typically do so to assume control over future operations. Sellers generally appreciate the down payment but are less enthusiastic about relinquishing control. Many RIA owners aren’t comfortable with the latter, so these discussions sometimes don’t get past the initial call.

Private equity, however, is not a permanent solution. PE firms aim to grow their investment as much as possible over the next five to seven years before flipping it to a new buyer at two or three times what they initially paid. This scenario means they often put pressure on RIAs to take on more clients and/or reduce costs, so they can maximize profitability for a prospective sale. Additionally, this means a new owner with new demands will take over in the not so distant future.

Is a Private Equity Investment the Right Solution for You?

Private equity is sometimes used to cash out a former partner or outside investor when the current owners don’t have the capital or desire to take on this additional investment personally. Selling (outside) partners usually favor this type of investment because PE firms can pay more up front. Principals remaining in the business usually don’t want any ownership lingering in the hands of former employees, but in this scenario, they’ve effectively swapped one outside investor for another. There’s no guarantee that the second one will be any better.

Private equity can also be a relatively straightforward path to diversification for existing principals. In many cases, a significant portion of an RIA principal’s net worth is tied up in his or her business with no immediate access to liquidity. PE firms allow these owners to take some cash off the table and reduce their dependency on the business. RIA principals will have to weigh the benefits of diversification and instant liquidity with the costs of losing control to outside ownership.

Your due diligence on the prospective buyer is just as important as their due diligence on you.

On balance, private equity’s interest in the space has been good for the RIA industry. They’ve likely had a positive effect on wealth manager valuations and are a significant source of liquidity for an otherwise illiquid business. This doesn’t necessarily mean they’re a good partnership for your firm, so you still need to consider what you’d be giving up in a sale and how it could impact other employees and stakeholders. Even if the price is right, it still may not be a good fit for you and your team. Your due diligence on the prospective buyer is just as important as their due diligence on you.

We strongly recommend hiring a team of experienced and trusted advisors to help navigate this process.

RIA Valuation Insights

RIA Valuation Insights