Simmons First National Acquisition of Ozark Trust and Investment

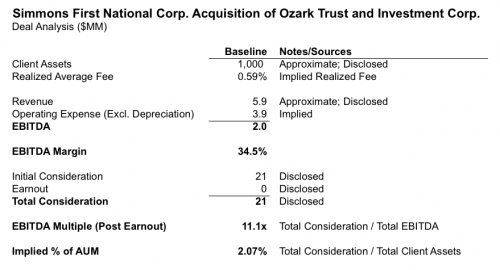

On April 29th, 2015, Simmons First National Corporation (NASDAQ ticker: SFNC), announced it has entered into an asset-purchase agreement to acquire Ozark Trust and Investment Corporation (OTIC) and its wholly owned subsidiary, the Trust Company of the Ozarks (TCO), a Registered Investment Advisor (RIA) headquartered in Springfield, Missouri. The Trust Company of the Ozarks administers over $1 billion in client assets for over 1,300 clients with a 16% AUM compound annual growth rate. Simmons First National Corporation has agreed to a purchase price of $20.7 million, with a consideration of 75% stock and 25% cash. The deal is to close in quarter 3 of 2015. Unlike most acquisitions of closely held RIAs, the terms of the deal were disclosed via a conference call and investor presentation; the details of which are outlined below.

Similar to the Boston Private/Banyan Partners deal late last year, management delineated how the Trust Company of the Ozarks’ attributes met Simmons First’s strategic rationale:

- Cultural Fit. Simmons understands the importance of cultural fit with any acquisition. Through the due diligence process, Simmons found TCO’s culture to be very compatible to that of its own. TCO is conservatively managed, yet has achieved impressive AUM growth since 2007.

- Strong Relationship Between TCO and Liberty Bank. Gary Metzger, Chairman & CEO of the former Liberty Bank, served on the TCO board of directors since its inception in 1998. Moreover, Jay Burchfield, TCO Chairman, served as an Advisory Director of Liberty Bancshares, Inc. The respective staffs of TCO and the former Liberty Bank have a strong, long-standing relationship.

- Market Expansion. Simmons has identified TCO as a high priority acquisition opportunity following the acquisition of Liberty Bank. Simmons believes the acquisition of TCO will provide the needed trust and investment management scale for its increased footprint in Southwest Missouri. TCO is the only independent trust company in Missouri outside of St. Louis or Kansas City. With total AUM of approximately $1 billion, TCO will increase total AUM of Simmons First Trust Company by almost 25%.

- “Sticky” Clients and Assets. TCO has made customer service a focus of its business, which has created a loyal client base. Generally speaking, trust services and AUM do not transfer easily. Moreover, it is hard to replicate TCO’s client service trust and investment management model. TCO’s team has established long-term relationships with all of TCO’s key customers.

- Strong Experienced Team. TCO’s team has over 200 years of combined experience. TCO’s Senior Management has excellent community relationships. The team has consistently matched or outperformed industry benchmarks. TCO’s team has expressed optimism in being able to grow the business further and take advantage of Simmons’ platform.

- Reputable Branch Name. TCO is among the region’s most reputable trust companies and is well-known throughout Southwest Missouri.

These recent deals are particularly instructive to other industry participants since, of the nearly 11,000 RIAs nationwide, approximately 80 (<1%) transact in a given year, and the terms of these deals are rarely disclosed to the public. Part of this phenomenon is attributable to sheer economics – a new white paper from third-party money manager, CLS Investments, argues that many advisors lose out financially in an outright sale of the business.

Another recent publication titled “Advisors: Don’t Sell Your Practice!” in research magazine ThinkAdvisor notes that many principals earn more in salary and bonuses than they would from the consideration they would otherwise receive in an earn-out payment over a period of time, as many of these deals are structured.

In other words, returns on labor exceed potential returns on capital for many advisors, particularly for smaller asset managers that typically transact at lower multiples of earnings or cash flow. In these instances, an internal transaction with junior partners might make more sense for purposes of business continuity and maximizing proceeds. For larger RIAs, recent deals suggest that buyers are willing to pay a little more for the size and stability of an advisor with several billion under management.

RIA Valuation Insights

RIA Valuation Insights