AMG Sees Opportunity in Alt Asset Space

Value Play or Falling Knife?

Last week, Affiliated Managers Group (ticker: AMG) announced the completion of its investment in three alternative asset managers — Capula Investment Management LLP, Mount Lucas Management LP, and Capeview Capital LLP. These transactions are the cornerstone of AMG’s 6/6/16 definitive agreement with Petershill Fund I, a group of investment vehicles managed by Goldman Sachs Asset Management, LP, to acquire all of Petershill’s minority interests in the aforementioned firms as well as two other alternative investment managers, Partner Fund Management and Winton Capital Group, which haven’t yet closed.

Under the terms of the agreement, AMG will acquire these interests for approximately $800 million to be paid in cash at closing (roughly half of which was just paid for Capula, Mount Lucas, and Capeview with the balance expected to close by year-end). Given that RIA disclosures only present ownership percentages in range form and three of the entities are headquartered in London, the ADV is of little use to us in ascertaining the exact interest acquired in these businesses (though it’s probably safe to assume something close to 50% given their typical investment structure discussed in a previous post).

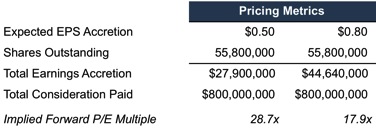

Perhaps more instructive is AMG’s admission that management expects the transaction to increase economic earnings per share by $0.50 to $0.80 in 2017, availing some insight on deal pricing (though much of this accretion is likely due to synergies).

At first glance an effective multiple of 18-29x next year’s earnings seems a bit rich, even in this market, but closer inspection reveals pricing more in line with industry peer measures. The high level of variance in the metrics is largely attributable to the uncertain and variable nature of performance fees and carried interest income.

Such ostensibly high valuations are more a function of depressed earnings from fee pressure and fund outflows than overly bullish sentiment on the sector’s prospects. In an investing landscape dominated by indexing strategies and passive products, investors are becoming increasingly weary of the high fees and recent underperformance associated with many hedge funds and private equity firms. Publicly traded alternative asset managers have clearly fared the worst over the last year relative to other classes of RIAs and trust banks.

AMG apparently sees this decline as a buying opportunity, since these businesses might be the cheapest they’ve been in quite some time. And although trying to catch a falling knife is typically ill-advised, AMG has partially hedged this risk by investing in established hedge fund managers with over $1 billion in client assets. At any rate, the market doesn’t seem convinced — though only time will tell.

RIA Valuation Insights

RIA Valuation Insights