TriState Buys Aberdeen’s Domestic Fixed Income Business

A Pleasant October Surprise

Octoberfest! 1973 BMW 2002 | Photo Credit: Petrolicious

In the late 1960s, BMW introduced a simple product that made the company what it is today. The 2002 was a straightforward, useful, two door coupe with a small but powerful motor, light weight, four seats, and a decent trunk. It was economical, easy to work on, and fun. It sold like crazy, and morphed over time into what is now known as their 3-series, the mainstay of their global automotive line. One lesson from this trajectory is that strategy doesn’t have to be complicated to be successful – a lesson that has broad applications, including the topic of this blog post.

It’s no secret that banks are facing tough times, with lousy spreads, exponential increases in regulation, indifferent customers, and cunning competition. There are many fancy ways to navigate this, but one simple one is deploying capital in attractive financial businesses that generate strong margins – such as asset management.

Banks looking to diversify their revenue stream with investment management fee income would be well advised to study TriState Capital’s acquisition-fueled buildout of its RIA, Chartwell. The Pittsburgh depository started with an internal wealth management arm, bought $7.5 billion wealth manager Chartwell Investment Partners in early 2014, picked up the $2.5 billion Killen Group in late 2015, and last week announced the acquisition of a $4.0 billion domestic fixed income platform strategy from Aberdeen Asset Management.

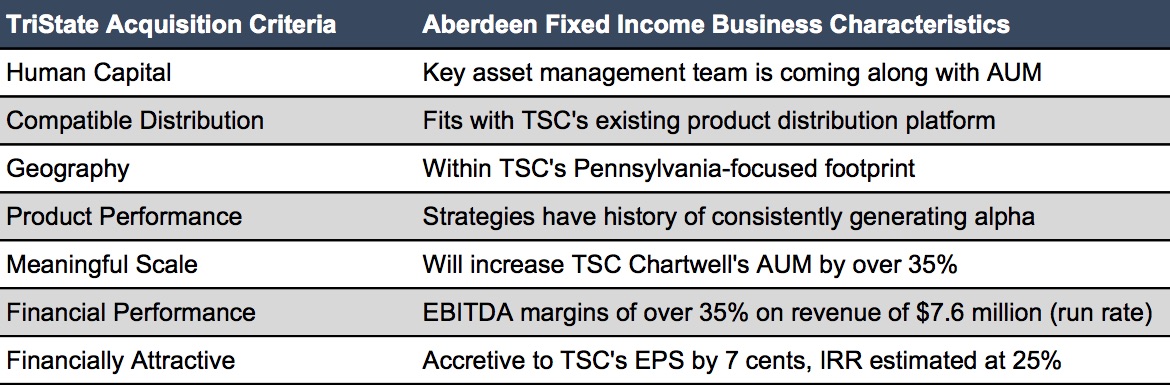

The Aberdeen acquisition represents about $4.0 billion in domestic fixed income over four strategies. Realized fees appear to be just shy of 20 basis points. Six portfolio managers from Aberdeen are coming with the acquisition, and the operation looks fairly profitable on a pro forma basis, with TSC expecting EBITDA on the order of $3.5 million (annualized on a run rate basis), for a margin of approximately 45%.

A few things stand out about the TriState/Aberdeen acquisition.

- Consistent acquisition criteria. TSC has a well-defined acquisition criterion for growing the RIA that has remained consistent from the original Chartwell acquisition. Appropriate and well-defined criteria are significant for any bank looking to augment asset management products through acquisition, because in many cases there are too many, often dissimilar, RIAs from which to choose. TSC seeks out asset management capabilities with compatible product structures, competent management teams, and consistent profitability that will grow and enhance their existing business. They also have consistently shopped within their existing geographic markets.

- Attractive Pricing. TriState’s acquisitions are consistently well-bought. Aberdeen had a strategic motivation to sell these fixed income products, which were a small enough part of their overall business to let go of fairly cheaply. As a consequence, TSC is paying 1.5x run-rate revenue, and more importantly, a little less than 4.0x EBITDA – a very compelling valuation that sets up TriState Chartwell for an attractive internal rate of return.

- Embracing the RIA Strategy. TSC appears to have gotten past the usual cultural angst that depository institutions have developing an RIA. The TriState investment management business has a separate identity, and it doesn’t seem to bother bank management that these acquisitions are dilutive to the bank’s tangible book value – in fact, they don’t even mention it. The RIA does what it is supposed to do – deploy the bank’s excess capital to produce discretionary cash flow. The bank’s earnings grow, and so does the bank’s valuation.

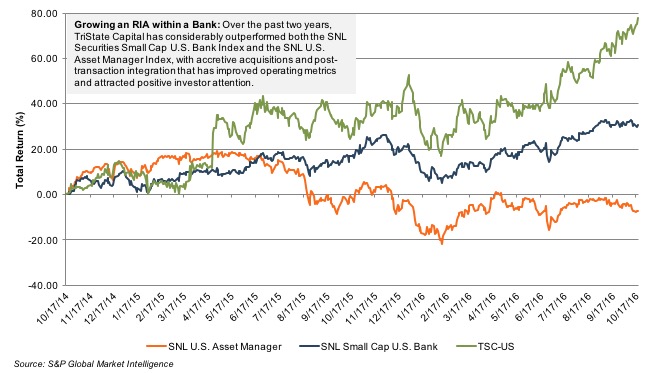

With the latest acquisition, TSC has nearly doubled run-rate assets under management since 2014, putting excess capital at the bank to work in attractively priced acquisitions which have been individually and collectively accretive to earnings. The strategy has worked well for TriState, and investors have taken notice. Over the past two years, TSC’s share price is up nearly 80%, while SNL Securities’ Small Cap U.S. Bank Index is up less than half that much. Asset managers in general have fared much worse, with the broad U.S. Asset Manager Index constructed by SNL showing a modest decline over the same period.

Many banks are understandably wary of trying their hand at investment management. RIAs are a different kind of financial institution in every way, cross-selling is often more myth than reality, and it can be difficult to explain to bank investors how to reconcile the differences in investment management performance characteristics and more traditional bank measures. Still, in a world where banks are caught in the gravitational pull of low NIMs and Basel III, and the asset management industry is in need of consolidation, there is ample reason to consider the possibilities of pairing up for mutual success.

RIA Valuation Insights

RIA Valuation Insights