Twilio and the Rise Of Debt Financing

Despite the inhospitable IPO climate, one tech company managed to brave the market with just the right mix of novelty and disruption to garner attention and reap rewards. Twilio, a cloud communications platform designed to help developers add messaging, voice and video to web and mobile applications, went public on June 23. Priced at $15 per share, Twilio’s share price closed at $28.79, the largest single-day increase of an IPO in over two years, which increased the company’s market cap by 95% to nearly $2.4 billion. The next day, on June 24, the UK voted to leave the European Union. Brexit effectively wiped out over $2 trillion in global equity, ushering in weeks of market volatility and a freefall of the pound. Despite the global volatility, Twilio’s share price as of June 30 was up to $36.50 per share. Optimistic investors lauded the IPO as an indication of a turnaround in the venture-backed IPO market, and for good reason. Over the 2010 to 2015 period, more than half of the 200 tech companies that went public were trading below their initial IPO price by mid-2016.

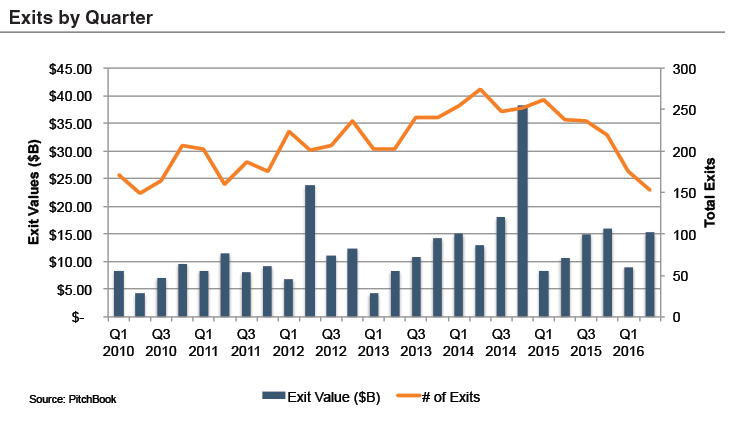

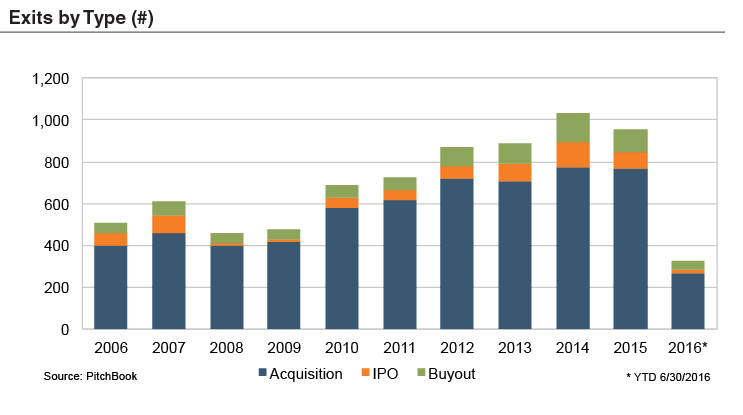

The number of venture capital exits completed in the second quarter of 2016 (153) was the lowest total since the second quarter of 2010, with only 19 venture-backed IPOs in the first half of 2016 (well below the 52 IPOs completed in the first half of 2015). As discussed previously, unfavorable IPO market conditions have led many companies to alternative exits such as M&A. A growing number of venture capital firms have also turned towards another source for cheap cash: debt.

Given the current interest rate environment, several unicorns, including Airbnb, Didi Chuxing and Uber, have capitalized on the cheap debt available in the market as an alternative to issuing more equity. The debt markets are proving unusually receptive to venture financing, for example giving Uber, a cash flow negative company with famously opaque financials, over $1.6 billion at 5.0%. Concerns over weaker credit standards in the banking industry have risen as competition for quality loans has driven down loan yields. Prolonged periods of low interest rates have compressed margins and impeded any profitability gained from an increase in loan growth alone. Since the Fed first announced progressive rate hikes in December, banks have positioned themselves as asset sensitive in order to benefit from an increase in rates that has yet to occur. In fact, thanks to Brexit and the wave of capital market uncertainty it created, the central bank has even discussed cutting short-term rates. In order to maintain profitability, banks need lending volume – which is where unicorns come in. Venture capital has taken advantage of the perfect storm that is the banking industry to acquire low-cost debt and build credit for future rate negotiations, should the need ever arise. In addition, private companies use debt financing to avoid breaching the 2,000 accredited investor threshold for remaining private. Crossing the 2,000 limit would require full disclosure of company financials, which could bring to light certain underperforming metrics these companies have been trying to overcome, as evidenced by their refusal to undergo an IPO. Whether more companies choose to go down the debt route is yet to be seen, but it is a financing vehicle that enables companies to avoid having to leave the sympathetic capital still available in private markets.

RIA Valuation Insights

RIA Valuation Insights