Unpacking the Relative Success of Victory Capital

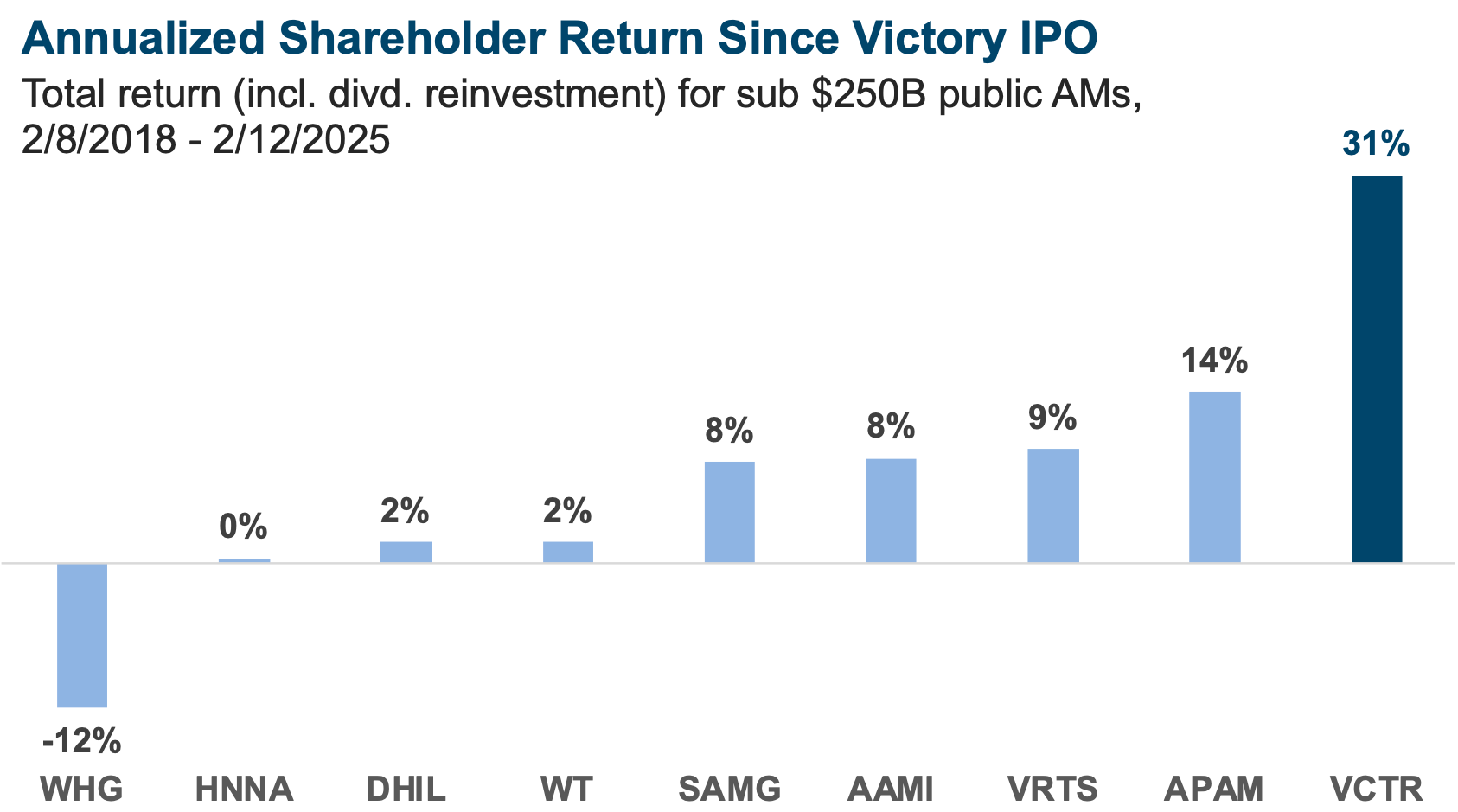

Victory Capital is a relative newcomer to the small list of publicly traded asset managers. Since its IPO, it has quietly outperformed many publicly traded peers by employing an acquisition-driven growth strategy that has delivered impressive shareholder returns. In this post, we take a closer look at the factors driving Victory’s success.

San Antonio-based asset manager Victory Capital was initially a wholly owned subsidiary of KeyCorp, where it functioned as the bank’s asset management division. In 2013, Victory became a stand-alone entity after a spin-out from KeyCorp to a Crestview fund. At the time, Victory had about $22 billion in AUM. In 2018, Victory went public via IPO with approximately $62 billion in AUM, having grown via several acquisitions during its tenure as a private equity-backed company.

Growth Through Acquisitions

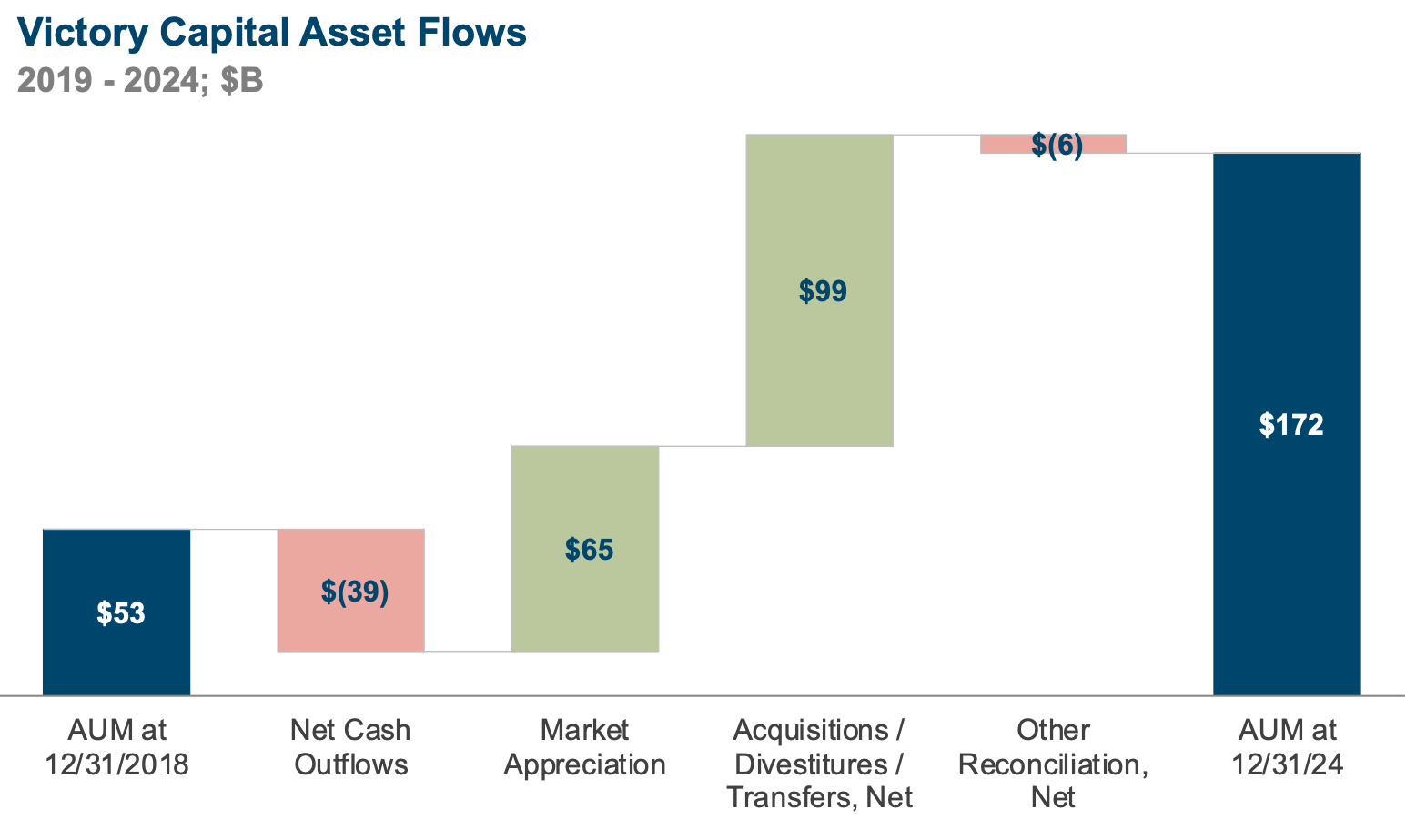

Since IPO, Victory has continued to grow through M&A—most notably buying USAA’s retail-focused, military-affiliated asset management business in 2019 (bringing on approximately $70 billion in AUM) and ETF model strategy provider WestEnd Advisors in 2021 (bringing on approximately $18 billion in AUM).

In 2024, Victory announced a strategic partnership with Amundi, through which Amundi’s US business will be combined with Victory, and the parties will enter into a 15-year distribution and services agreement aimed at increasing Victory’s reach internationally.

Through its acquisitions, Victory has built a $172 billion AUM (as of year-end 2024) multi-boutique model offering various strategies under different brand names to a client base that ranges from retail to institutional. Victory’s various investment management franchises operate semi-autonomously but share an integrated, centralized operating and distribution platform.

As a public company, Victory has been a roaring success for shareholders—at least relative to its publicly traded peers. Its total shareholder return since IPO has been the highest amongst our sub $250B AUM comp group—and by a lot:

Takeaways from Victory’s Operating Performance

Victory’s relative success from a shareholder perspective makes it an interesting case study for asset management firms. A closer look at Victory’s operating results reveals some interesting dynamics:

- Perhaps surprisingly, Victory hasn’t reported positive organic growth annually since 2019. Since then, aggregate asset outflows have added up to nearly $39 billion, averaging about 4% of beginning assets under management annually. Victory’s asset growth has come entirely from market appreciation and acquisitions.

- Victory’s medium and long-term investment performance has been favorable, with 59% of assets outperforming their benchmarks over a 3-year period and 79% beating over a 10-year period. While strong relative performance hasn’t translated into organic growth, it has presumably helped to mitigate outflows to some extent.

- Like many asset managers, Victory’s effective management fees have trended downwards in recent years with increasing fee pressure from passive products. Victory’s effective fee level was 52.6 basis points in 2024, down from 59.6 basis points in 2019.

- Despite lower fee levels, Victory’s revenue has grown at a 7.8% CAGR since 2019, reaching approximately $890 million in 2024. Rising revenue against a semi-fixed cost base has translated into operating leverage—Victory’s adjusted EBITDA margin expanded to 53.2% in 2024, up from 43.9% in 2019.

- Victory has been relatively shareholder-friendly in its capital deployment since its The firm has paid a consistent and growing dividend since 2019, and the total share count has steadily decreased since the IPO as the firm has bought back shares. While the firm has taken on some leverage to fund its acquisitions, net debt to adjusted EBITDA was under 2x at year-end 2024.

Taken on balance, Victory’s operating performance has been solid, but it’s also perhaps a bit underwhelming relative to what we might expect for the firm at the front of the pack amongst its public peer group.

While Victory has performed relatively well, it’s also not been immune to factors affecting the rest of the industry. Like many of its peers, Victory’s fee levels have declined, and the firm has struggled to hold on to assets, relying on the market and acquisitions for AUM growth.

To some extent, this speaks to the bifurcation of the asset management industry and the tough spot that many mid-size managers occupy: smaller managers can sometimes gain a significant amount of traction and grow quite rapidly as institutional assets flock in, but capacity constraints soon constrain growth, and scale begins to threaten the firm’s identity. Like its similarly-sized public peers, Victory occupies an asset manager no man’s land—too large to be a sought-after boutique, yet too small to have the distribution reach of the largest players.

A Consolidation Success Story?

Victory has navigated this perhaps better than most: the firm’s multi-boutique model seeks the best of both worlds by delivering scale without losing the focused identity that led to success in the first place. In an industry filled with consolidation models that range from mere financial entanglement on one end to full-on control and integration on the other, Victory seems to have found a sweet spot.

There’s also been some strategic rationale to Victory’s acquisitions: with its 2019 acquisition of USAA’s asset management business, Victory acquired a strong base of largely military family clients, which have proven sticky relative to traditional institutional clients, mitigating outflows.

And with acquisitions like WestEnd, Victory has positioned itself to benefit from secular industry tailwinds as assets increasingly move into ETF products. On the distribution front, the recent partnership with Amundi aims to increase reach and drive organic growth.

While we don’t have all the details on what Victory has paid for its acquisitions relative to the financial performance acquired, the financial and market performance of Victory seems to suggest that the acquisitions have been structured in a way that is accretive to shareholders. Both the USAA and WestEnd acquisitions included large contingent pieces, which served as both a seller incentive and risk mitigation for Victory.

Additionally, by taking controlling stakes in its acquisitions, Victory is able to fully integrate acquired firms, which has led to greater cost synergies and leaner operations than some of its peers (e.g., AMG, which typically takes minority stakes). Victory’s adjusted EBITDA margins have averaged close to 50% in recent years, while competitor margins typically range from 20-30%.

Despite a challenging competitive environment, the asset management business model remains a nice one—and Victory has taken better advantage than most. Like its peers, Victory has a largely recurring revenue model that grows with the market. Combined with a few accretive acquisitions and a little operating leverage, the result has been a growing stream of shareholder benefits that have driven attractive returns for Victory shareholders despite lackluster organic growth.

About Mercer Capital

We are a valuation firm that is organized according to industry specialization. Our Investment Management Team provides valuation, transaction, litigation, and consulting services to a client base consisting of asset managers, RIAs, trust companies, broker-dealers, PE firms, and alternative managers.

RIA Valuation Insights

RIA Valuation Insights