Unpacking Your RIA’s Income Statement

Performance Measurement Is More than Profits and Losses

The Mother of All SUVs – the Jeep Wagoneer (a 1984 model)

Americans love road trips. We love them so much that we purpose-build roads to make long journeys easier, and then we build huge vehicles — essentially rolling living rooms — so we can enjoy the comforts of home wherever we go. It’s not like that in other countries. I spent two weeks this summer traveling lane-and-a-half wide roads through Scotland in a barely large enough European car with entirely inadequate cupholders. I know of what I speak.

While piloting my large-for-Scotland, small-for-America SUV through the Highlands, dodging stone walls and braking for grouse, my mind kept wandering to a board meeting I recently attended. In it, the chief financial officer of a sizable RIA had reviewed the company’s financial statements in painstaking detail. Revenue recognition. Lease accounting. Accelerated depreciation. By the time it was over, I had learned a couple of new things about bonus accruals but not much about the firm’s performance. There was nothing wrong with the presentation except for the content.

It wasn’t the fault of the CFO. My problem with Generally Accepted Accounting Principles is that GAAP is too generic to assist with detailed performance analysis. GAAP focuses on the “what,” but users of financial statements (managers, investors, board members) need to know the “why.” Mercer Capital’s founder used to train new analysts to “talk to the numbers until the numbers talk to you.” Sage advice, but sometimes you need more numbers to finish the story.

What I recommended to this CFO, and what I’m not putting out there for general consumption, is to develop financial reporting that measures performance according to key themes. The data still has to reconcile to GAAP, but there’s no reason to stop there. The following is a list of some of my “why” metrics to talk to your numbers until they talk to you — or at least torture them until they confess.

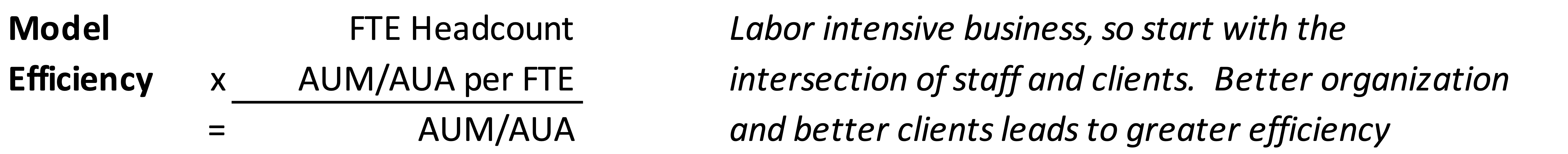

Model Efficiency

Revenue, for an investment management firm, is largely a function of how much client capital is handled by the organization. Of course, AUM appears nowhere on a GAAP financial statement. But a predicate to AUM is the staff (quantity and quality) who will handle it.

Whether your business model is focused on asset management, wealth management, or providing trust administration, you’re in a service business that is necessarily labor-intensive. A simple metric for considering the labor intensity of your business model is how much AUM or AUA you manage or administer per full-time equivalent employee. Calculate that number, and then track how it has changed over time. Then, think of the amount of money you manage as a function of how well you’ve staffed your model and how well your model utilizes staff.

The degree of labor intensity in your firm is a measure of several things: 1) your opportunity for operating leverage (do more with the same number of people), 2) your vulnerability to staff losses, and 3) the importance of an effective recruiting and development program to the growth of your firm.

Once you observe trends in your firm’s model efficiency, you can start to consider what influences those trends and what would enhance them. In any service business, talent share is market share, but how you employ your talent is as important as the volume of talent. Improving employee effectiveness involves recruiting and training, as well as organizational processes, tech stacks, and client selection.

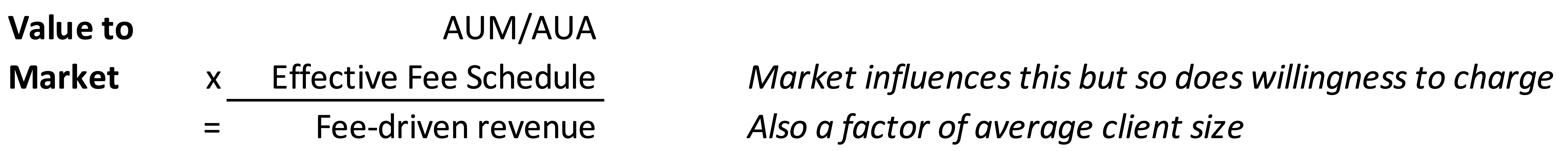

Value to Market

How much fee revenue does your AUM/AUA generate for the firm? Ignore your stated fee schedule for the moment and simply divide your revenue for a given period into your average assets under management/administration during that same period. That is a measure of the value of your services to the market or market position.

Market position might be reflected in the variance of your realized fees to your fee schedule (i.e., how much your firm negotiates fee pricing to gather or retain clients). Many sectors of the investment management space have experienced fee pressures over the past seven or eight years, but not all of them. The trend in your effective realized fees is telling your firm’s value to the market. It also may indicate how well your model is positioned relative to your competitors.

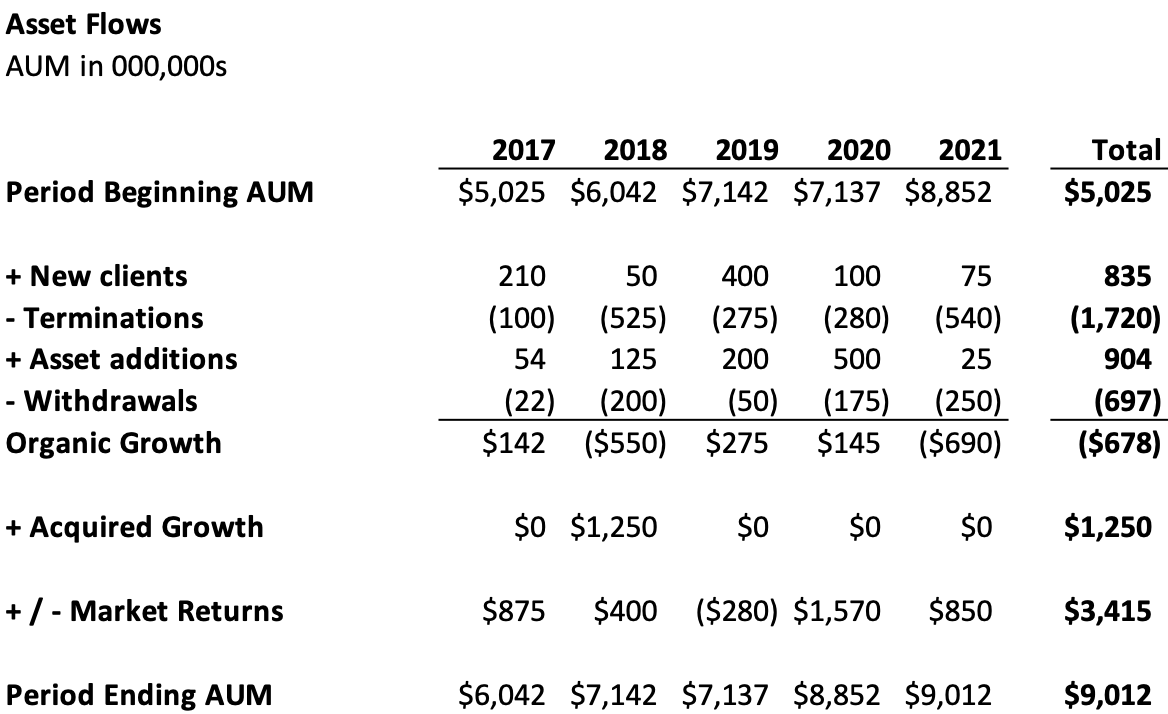

Asset Flows

The raw amount of AUM/AUA also matters — and a separate discussion would be looking at trends in asset flows to disaggregate organic growth from acquired growth and market growth over time.

Do you know where your business comes from? Is it a result of net client acquisition, additional funds from existing clients, acquisitions, or market activity?

Organic growth is an underreported challenge in the investment management space. Too many firms have put financial markets in charge of their growth over the past decade and, as a result, hollowed out their client acquisition strategies. This tactic works until it doesn’t.

Many firms try to acquire their way into growth, but combining two firms that aren’t growing doesn’t result in one firm that is growing.

The recent history of your AUM tells of the growth characteristics of your firm and can at least allude to the competitive strengths and weaknesses you manage. Ideally, your firm has a demonstrated history of organic growth and market returns. Solid performance is the best foundation for acquisitions, and with that in hand, you have a three-pronged strategy for growth.

Business Mix

Marching down the income statement, one characteristic of many investment management businesses is non-fee revenue. This might be revenues from consulting, financial planning, tax preparation, or any other sort of revenues not charged as a function of the scale of client assets.

There is no optimal level of non-fee revenue for any investment management firm. For some, non-fee revenue represents real diversification that provides revenue stability in the face of market volatility. For others, it’s a distraction (necessary or not) from the organization’s core mission.

Some believe wealth management and accounting go well together because wealth management clients need tax planning and compliance, and vice-versa. Others see accounting as a dead-end for wealth management because accounting is generally not scalable, nor does it offer the profit margins of investment management businesses. There’s no perfect answer, and deciding the optimal level of non-fee revenue is a strategic question that can’t be answered on a P&L.

What the mix and the trend in the mix over time will tell, however, is the degree to which a firm devotes resources to activities that are not directly related to investment management. Thinking about whether or not that trend is consistent with the strategy and vision of the organization can be revealing.

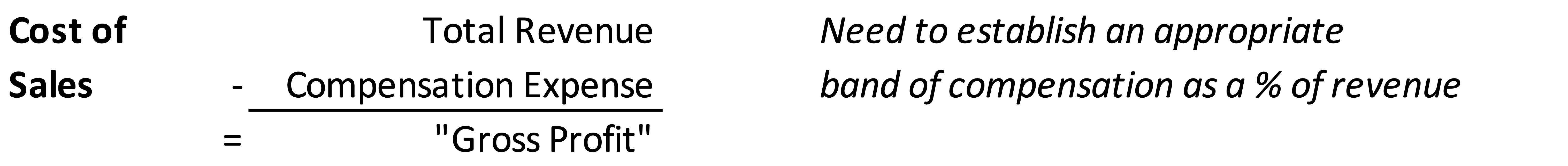

Cost of Sales

The GAAP income statement for an investment management firm doesn’t usually recognize “cost of goods” sold in the classic sense. COGS is more of an accounting entry for variable costs experienced by, say, manufacturing firms to recognize the markup on raw materials and other costs that go into producing a finished good. Nevertheless, there is a real cost to providing investment management services, which can be represented by the total cost of compensation and benefits.

Again, this is a non-GAAP effort to develop financial reporting that depicts key performance characteristics that will assist with the strategic oversight of that business. Netting compensation expense against revenue to develop a non-GAAP measure of gross profit is, we think, a useful way to focus on the largest expense borne by an RIA or independent trust company, and usually a metric that needs to be maintained within a certain range.

That range will vary by the specifics of the business model. And monitoring the tradeoff between returns to labor and returns to capital (profit margin versus compensation expense) is a measure of how the company allocates resources and how effective that allocation is.

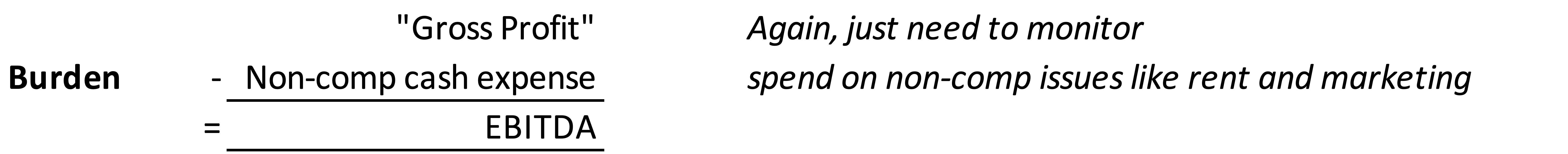

Burden

We’ll use another non-GAAP term, burden, to describe cash expenses other than compensation and benefits at an RIA. This is everything from rent to professional fees to marketing costs. Like compensation, burden represents a tradeoff with profitability but is a number best thought of as operating within a range.

Burden supports the business model, but it isn’t paying for a producing asset like staff. For this reason, it really should be thought of separately from compensation expense. The reasonable range for a given firm’s burden will vary depending on dozens of factors, but if non-comp expenses are isolated and studied on their own merits, it makes for a more direct way to consider the reasonableness of those expenses.

Given that investment management is typically an owner-operator model, burden is the only portion of revenue that doesn’t go directly to the people involved in the success of the enterprise. An RIA team extracts a “return on involvement” that includes salary, incentive compensation, benefits, and equity returns. Burden is, numerically, the drag on return on involvement. Necessary, but a drag nonetheless.

Strategic Financial Statements

The goal of this exercise should be to view the financial performance of an RIA from a strategic perspective rather than the generic and mostly unhelpful lens of GAAP. Revenue for an investment management platform is not simply a “sales” number that stands on its own merits but a function of business model efficiency, value to the market, and business mix. GAAP wants to depict every cost on an RIA’s income statement as operating expenses, but industry participants know that compensation policy carries very different implications for the growth and returns of the company than the copier lease or occupancy costs.

Ideally, strategic financial statements should accurately depict the narrative of a company’s model and execution. How productive is the staff? What is the trend in pricing the service? How much money does it cost to produce a dollar of revenue?

With Labor Day approaching, the end of summer vacation is in sight. Time to head back home, settle in, and get to work. But while you’re unpacking your bags, think about unpacking your financial statements. A thoughtful decomposition of your GAAP financials can get at what really matters to the performance of your firm. Financial metrics are there to open lines of inquiry and discussion and give you an informed basis to make better practice management decisions.

RIA Valuation Insights

RIA Valuation Insights