The Valuation of Asset Management Firms

To many people, asset management is the business model dreams are made of. A few skilled people in one office can make millions providing a sophisticated and straightforward service. Billing simply requires deducting fees from client accounts, and the upward drift of the markets propels revenue growth. Looked at from the inside-out, however, it is a fiercely competitive industry in which one is judged unforgivingly by the numbers, and depending entirely on relationships between owners, employees, and clients. Profit margins can be huge, but can evaporate in two quarters of a bear market.

On one level, all RIAs (registered investment advisors) are alike, as there are significant similarities between development of fee income and the composition of the expense base to support the revenue that generates and sustains profitability. Nonetheless, recognizing the distinct characteristics of a given investment management firm is necessary to understanding its value in the marketplace.

All Businesses Sell

Like all private companies, ownership interests in RIAs eventually transact. Whether voluntary or involuntary, these transactions tend to be among the most important of the owner’s business life.

The table below depicts events ranging from voluntary transfers such as gifts to family members or an outright sale to a third party to involuntary transfers such as those precipitated by death or divorce. An understanding of the context of valuing your business is an important component in preparing for any of these eventualities.

Industry Conditions & Issues

The idea of independent investment advisors gathered steam as high net worth clients migrated from the transactional sales mentality of brokerage firms. The financial advisory business model transformed from large wire house shops, and cold calling staffs paid by transaction-based commissions, to credentialed professionals paid on the basis of assets under management, or AUM. The popularity of RIAs centered on the fiduciary responsibility associated with such practices, as well as the greater degree of accessibility and high touch nature of their business operations. Additionally, the smaller size of independent advisors allowed for greater innovation and more specialized services. The number of total investment advisors registered with the SEC has increased four-fold from approximately 6,000 in 1999 to over 30,000 today (excluding all investment advisors only required to register with their respective states). Parallel to the proliferation of RIAs is the rise of state-regulated independent trust banks in the wake of mega-bank mergers and bailouts following the financial crisis of 2008. While there has been some consolidation of firms, the rate of acquisition in the industry has been far outpaced by startup formation.

In spite of all the changes taking place in recent years, there remains some debate regarding whether the asset management industry is mature or evolving. If anything, it is continuing to niche into more discrete asset classes, investment styles, and client focus.

Rules of Thumb

There are both formal and informal approaches to value, and while we at Mercer Capital are obviously more attuned to the former, we don’t ignore the latter. Industry participants often consider the value of asset managers using broad-brush metrics referred to as “rules-of-thumb.” Such measures admittedly exist for a reason, but cannot begin to address the issues specific to a given enterprise.

Understanding why such rules-of-thumb exist is a good way to avoid being blindly dependent on them. During periods of consolidation, buyers often believe that the customer base (or AUM in the case of an asset manager) of an acquisition candidate can be integrated with the acquiring firm’s existing client assets to generate additional profits. So if most asset managers are priced at, say, 10x earnings and profit margins are 40%, the resulting valuation multiple of revenue is 4.0x. If revenue is generated by average fees of 50 basis points of assets under management, then the implied valuation is about 2% of AUM. Note, however, all the “ifs” required to make the 2% of AUM rule of thumb work.

As with other businesses, the revenue of asset management firms is a function of price and quantity. In this case, price represents the rate charged for assets under management, and quantity reflects the asset base or AUM for RIAs. Value, however, is related to profits, which can only be derived after realizing the costs associated with delivering asset management services. High priced services are typically more costly to deliver, so margins may fall within an expected range regardless of the nature of the particular firm. Still, larger asset managers generally realize better margins, so size tends to have a compounding effect on value.

Activity ratios (valuation multiples of AUM, AUA, revenue, etc.) are ultimately the result of some conversion of that activity into profitability at some level of risk. If a particular asset manager doesn’t enjoy industry margins (whether because of pricing issues or costs of operations), value may be lower than the typical multiple of revenue or AUM. On a change of control basis, a buyer might expect to improve the acquired company’s margins to industry norms, and may or may not be willing to pay the seller for that opportunity.

In the alternative case, some companies achieve sustainably higher than normal margins, which justify correspondingly higher valuations. However, the higher levels of profitability must be evaluated relative to the risk that these margins may not be sustainable. Whatever the particulars, our experience indicates that valuation is primarily a function of expected profitability and is only indirectly related to level of business activity. Rules- of-thumb, if used at all, should be employed with an appropriate level of discretion.

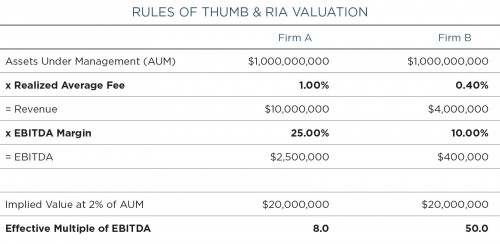

As an example of this, industry participants might consider RIAs as being worth some percentage of assets under management. At one time, asset manager valuations were thought to gravitate toward about 2% of AUM. The example below demonstrates the problematic nature of this particular rule of thumb for two RIAs of similar size, but widely divergent fee structures and profit margins.

Firm A charges a higher average fee and is significantly more profitable than Firm B despite having identical AUM balances. Because of these discrepancies, Firm A is able to generate over six times the profitability of its counterpart. Application of the 2% rule yields a $20 million valuation for both businesses, an effective EBITDA multiple of 8x for Firm A and 50x for Firm B. While 2% of AUM, or 8x EBITDA, may be a reasonable valuation for Firm A, it is in no way representative of a rational (or non-synergistic) market participant’s realistic appraisal of its counterpart; it would imply an effective EBITDA multiple of 50x. It is our experience that money managers with higher asset balances, fee structures, and profit margins typically attract higher AUM multiples in the marketplace. In the case of RIAs with performance fee components to their revenue stream, the math gets a bit more interesting.

Background Concepts of “Value”

The industry issues discussed above can and should impact the valuation of asset managers, but a professional valuation practitioner considers other issues as well.

Many business owners are surprised to learn that there is not a single value for their business or a portion of their business. Numerous legal factors play important roles in defining value based upon the circumstances related to the transfer of equity ownership. While there are significant nuances to each of the following topics, our main goal is to help you combine the economics of valuation with the legal framework of a transfer (whether voluntary or involuntary).

Valuation Date

Every valuation has an “as of date” which, simply put, is the date at which the analysis is focused. The date may be set by legal requirements related to a certain event, such as death or divorce, or may be implicit, such as the closing date of a transaction.

Purpose

The purpose of the valuation is significant to how the valuation is performed. A valuation prepared for one purpose is not necessarily transferable to another. The purpose of the valuation is likely to determine the “standard of value.”

Standard of Value

The standard of value is a legal concept that influences the selection of valuation methods and the level of value. There are many standards of value, the most common being fair market value, which is typically used in tax matters. Other typical standards include investment value (purchase and sale transactions), statutory fair value (corporate reorganizations), and intrinsic value (public securities analysis). Using the proper standard of value is part of obtaining an accurate determination of value.

Level of Value

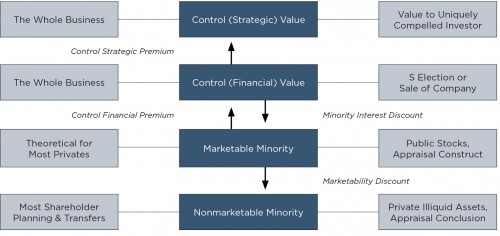

When business owners think about the value of their business, the value considered commonly relates to the business in its entirety. From this perspective, the value of a single share is the value of the whole divided by the number of outstanding shares. In the world of valuation, however, this approach may not be appropriate if the aggregate block of stock does not have control of the enterprise; in some cases, the value of a single share will be less than the whole divided by the number of shares.

The determination of whether the valuation should be on a controlling interest or minority interest basis can be a complex process, and it is also essential. A minority interest value often includes discounts for a lack of control and marketability; therefore, it is quite possible for a share of stock valued as a minority interest to be worth far less than a share valued as part of a control block. Grasping the basic knowledge related to these issues can help you understand the context from which the value of a business interest is developed.

Typical Approaches to Valuation

Within the common valuation lexicon, there are three approaches to valuing a business: the asset approach, the income approach, and the market approach.

The Asset Approach

The various methodologies that fall under the umbrella of the asset approach involve some market valuation of a subject company’s assets net of its liabilities. In the case of an RIA, the primary “assets” of the business get on the elevator and go home every night. In some contexts, it may be useful to evaluate the worth of a company’s trade name, assembled workforce, customer list, or other intangible assets. The balance sheet can be significant regarding the presence of non-operating assets and liabilities or excessive levels of working capital, but the value of any professional services firm, including asset managers, is usually better expressed via the income and market approaches.

The Income Approach

The income approach usually follows one of two methodologies, a discounted cash flow method or a single period capitalization method. The discounted cash flow methodology (or DCF) requires projecting the expected profitability of a company over some term and then “pricing” that profitability using an expected rate of return, or discount rate. Single period capitalization models generally involve estimating an ongoing level of profitability which is then capitalized using an appropriate multiple based on the subject company’s risk profile and growth prospects. In either case, the income approach requires a thorough analysis of the risks and opportunities attendant. In the case of valuing asset managers, the income approach can be a useful arena to delineate issues unique to the industry and the particular company.

Within the spectrum of asset managers, entities styled as family office operations may exhibit lower growth (which, all else equal, would suggest lower valuations), but also more stable client bases (with higher probability of recurring revenue, which tends to raise valuations). On the other end of the spectrum, valuing a hedge fund manager might require balancing the potential for supernormal earnings growth with supernormal earnings volatility.

A wealth manager or independent trust company might fall somewhere in between these two extremes. These RIAs tend to enjoy a loyal (sticky) customer base, but often at the price of lower margins expected in a multi-discipline, high-touch business where client expectations for technical expertise and customer service compound staffing costs. There are similar opportunities for earnings leverage as with any asset manager, but these can be tempered by the nature of services that these asset managers provide.

The Market Approach

Of the three approaches to value, the market approach may be the most compelling due to the high availability of pricing data. The market approach can be accomplished in a number of ways: by looking at the valuation multiples implied by outright sales of similar businesses, or by observing the trading activity in shares of publicly held companies.

While the market approach may be the most useful way to value assets managers, it is often the most misused. It is possible to find transactions involving investment management companies or publicly traded trust banks and RIAs that are similar to a given RIA, but it is also important to understand and isolate what is different about the subject company that can affect value.

Market data also has its drawbacks. Transactions data may offer limited information about multiples paid for various measures of profitability, and there may be no real way to isolate potential synergies reflected in the transaction pricing that might have been unique to the buyer and seller. Publicly traded investment management firms offer more thorough and consistent data, but they tend to be much larger and more diversified than closely-held RIAs.

The potential differences in margin and product line have already been discussed in this article, but smaller asset management firms may have other limitations that are a product of scale. These issues include greater dependence on certain managers or clients, the loss of which could be difficult to replace without a detrimental impact on the financial returns of the business. Narrow product offerings or problems in the economic area served by the RIA could also constrain growth opportunities. Of course, it’s also possible that a subject enterprise might have a better than market opportunity because of a particular customer base served or a particular product offering.

In any event, the valuation multiples implied by transaction activity or public asset managers may and often do require some adjustment for various factors before application to the subject RIA.

Putting It All Together

Valuation analysis is not complete if it is left untested. In the valuation of RIAs, whatever methodologies are employed should ultimately reconcile to a conclusion of value that is reasonable given expectations for the company relative to industry pricing. This might ultimately fit within some kind of rule of thumb, but only by coincidence. Experience has taught us that in the asset management industry, as elsewhere, maximizing opportunity and minimizing risk usually enhances value.

RIA Valuation Insights

RIA Valuation Insights