Value Finally Outperforms Growth After Twelve Year Lull

Value Stocks Are Finally Besting Growth, But Is It Sustainable?

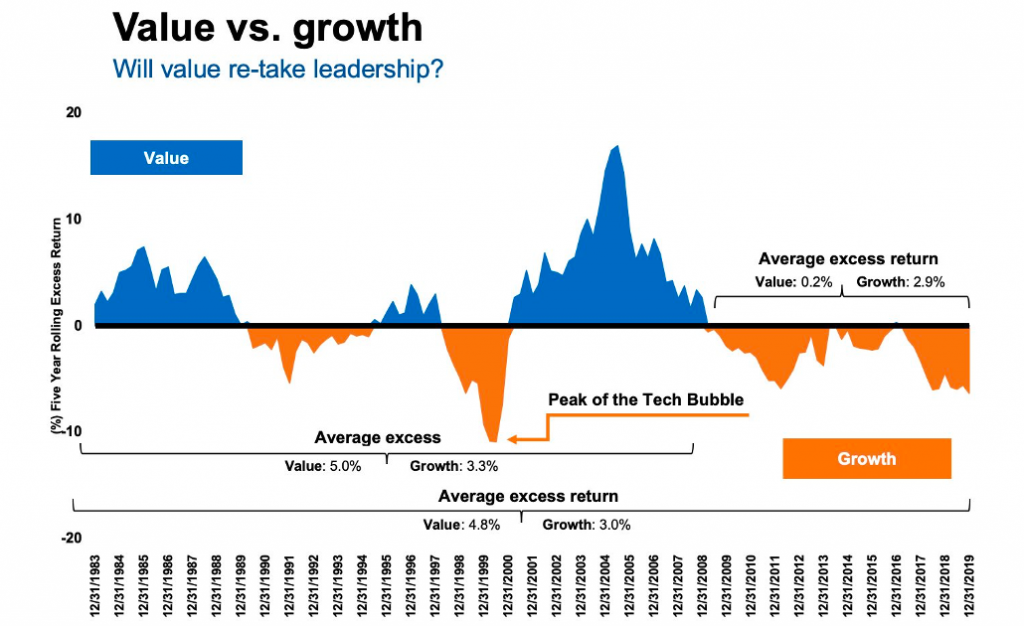

Growth-style investments have outpaced their value counterparts by a considerable margin since the Financial Crisis of 2008 and 2009. Propelled by an 11-year bull market from 2009 to 2020 and additional lift to tech stocks in a work-from-home environment, growth investing dominated value-oriented equities until just a few months ago. Now, the long-running trendline appears to be rolling over.

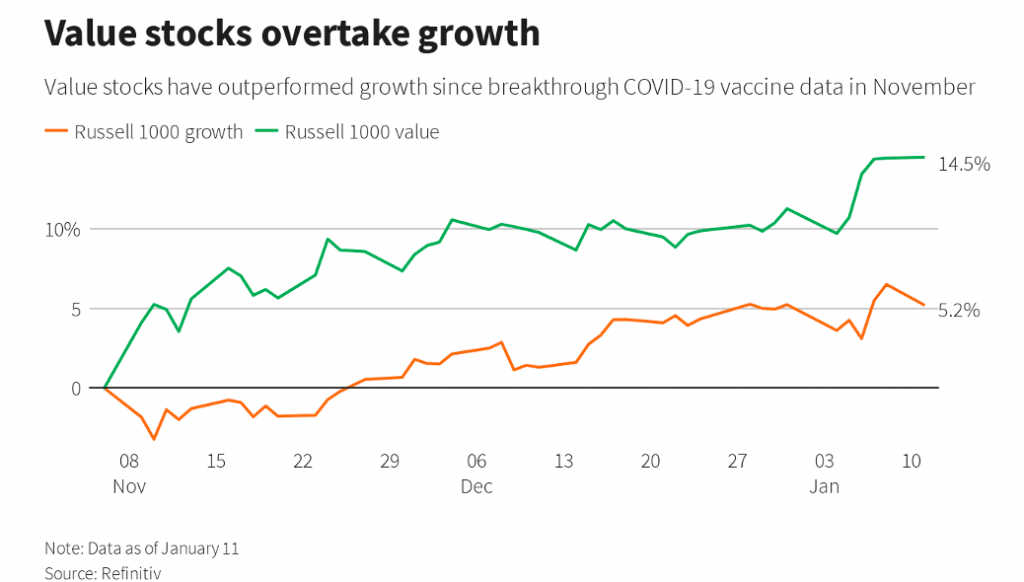

With rapid vaccination rollouts and continued improvements in the global economy, value stocks, which were especially depressed by the pandemic this time last year, have soared relative to growth strategies over the last few months.

If you believe in mean reversion, value’s comeback was inevitable and probably has some room to run. We’ve blogged about this before (Are Value Managers Undervalued?), and while we were a bit premature on the timing (we’re never wrong), it appears that this mean reversion is finally taking place. We don’t know how long this value resurgence will last, but given the duration and magnitude of growth’s prior reign (see first chart above), it’s not unreasonable to assume it could endure for a few more years at least.

On the flip side, growth-oriented investment firms may finally have to deal with poor returns (relative to the market) in addition to prevailing industry headwinds like fee compression and asset outflows to passive products. Most value asset managers have already adapted to this double whammy, so growth firms should prepare for potential AUM losses if we’ve really hit another inflection point in the value versus growth rivalry.

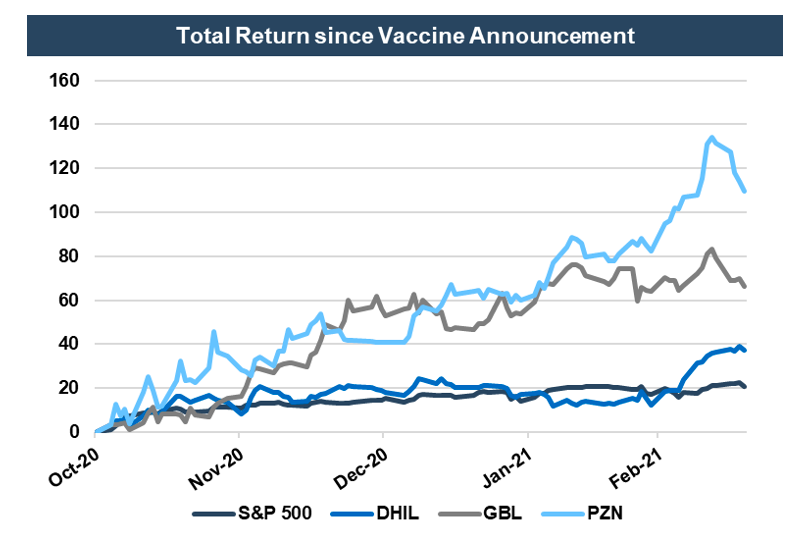

Value firms, on the other hand, are finally starting to shine. After years of outflows and subpar returns, publicly-traded value managers, Gabelli (GBL), Diamond Hill (DHIL), and Pzena (PZN) have significantly outperformed the S&P 500 (navy blue line below) since the vaccine announcement in early November.

This recent outperformance suggests that value’s dominance could persist a few more years if the market is anticipating significantly higher inflows, AUM balances, and ultimately greater revenue and earnings figures in the coming quarters. Increased investor optimism surrounding the share prices of value firms is perhaps the best indication of a value resurgence even if we have only just started seeing that in the actual numbers.

Value firms may finally be enjoying their heyday, but sector risks remain. Much of this resurgence is attributable to continued vaccination rollouts and a swift economic recovery, and any setbacks on either of these fronts could derail value’s recent momentum. Since most U.S. indices are trading close to an all-time high, the market doesn’t seem too worried about this, but last year has shown us how quickly investor sentiment can change. The quest for yield in a zero interest rate environment has also increased demand for value stock dividends, but the recent rise in Treasury yields could curb their relative advantage.

It’s too early to call it a full recovery, given the decade-plus dominance of growth preceding this uptick, but recent progress is promising for the sector. We may again be premature in calling this, but we are taking note of what appears to be an important inflection point for the active management industry.

RIA Valuation Insights

RIA Valuation Insights