Volatile First Quarter Brings Asset Management Industry Headwinds Back Into Focus

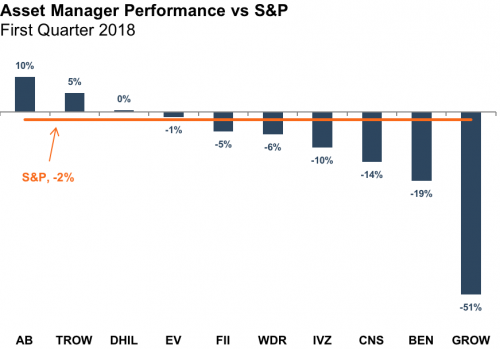

Publicly traded asset managers had a rough first quarter, as volatility returned to the market and major indices posted negative quarterly returns for the first time in over two years. While the overall drop in the market was relatively modest, stock price declines of publicly traded asset managers were generally more significant. It is not surprising that most asset managers have underperformed during periods of declining markets, since the reverse was true during 2017, when most asset managers outperformed the major indices. To the extent top-line volatility is tied to AUM movements and costs are fixed, market swings will have a magnified impact on earnings (and stock prices) for asset managers.

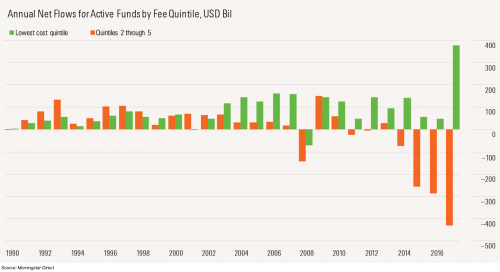

The return of market volatility and the reintroduction to the idea that markets can, in fact, go down, have brought back into focus the industry headwinds which, at least for the last several years, have been allayed by a favorable market backdrop. Notably, outflows from higher cost funds have continued to increase, as shown in the following chart from Morningstar. During 2017, the chart shows accelerating outflows from the most expensive active funds and record inflows into the cheapest ones. These dynamics are problematic for many mutual fund companies and other asset managers that rely on active equity products, which are necessarily more expensive to implement than their passive counterparts.

There was one positive development related to asset flows for active managers during 2017: aggregate outflows for active funds in 2017 were stemmed considerably (in fact were nearly zero). Relative to the significant net outflows active funds have seen the last several years, 2017’s low level of outflows seems like a win for the sector (if you count less of a bad thing as a good thing). Still, if stemming the outflows comes at the cost of lowering fees, the result will be lower revenue yields and profitability.

It appears that stemming outflows without significant fee cuts will be an uphill battle. Active fund outflows are not only attributable to the rise in popularity of low-cost ETF strategies but also sector-wide underperformance against their applicable benchmarks. Both individual and institutional investors are now more inclined to shun active managers for cheaper, more readily available products, particularly when performance suffers.

Active manager performance was better in 2017, although still, less than half managed to beat their passive peers on a net-of-fee basis. According to data from Morningstar, 43% of active managers outperformed passive peers in 2017 versus 26% in 2016.

It appears that as long as active managers are missing the mark on their value proposition (alpha net of fees), ETFs and other passive strategies will continue to gain substantial inflows from active managers, resulting in higher and higher allocations to index products. With improved performance relative to passive funds in 2017 and a volatile market so far in 2018, the opportunity is there to reverse this trend. However, it will take a sustained alpha generation before things start to go the other way, and in the interim, funds with a low active share and high fees are not likely to fare well. We’ve all read that consistently beating the market is nearly impossible, even for the savviest of stock pickers, but none of that research was compiled when passive strategies dominated the investment landscape.

We don’t foresee a huge shift back to active management any time soon, but we realize that we were probably overdue for some mean reversion. It is conceivable that the current market environment could be more conducive to stock picking, but we’ll need more time to judge whether this is truly the case. Regardless, it is hard to imagine that passive investing will completely replace active management. Such a scenario could lead to significant mispricing in the securities markets, which would be fertile ground for enterprising investors and mutual funds. This is why we say that active management may be down but is not out.

Mercer Capital’s RIA Valuation Insights Blog

The RIA Valuation Insights Blog presents a weekly update on issues important to the Asset Management Industry. Follow us on Twitter @RIA_Mercer.

RIA Valuation Insights

RIA Valuation Insights