Warren Buffett and the Intrinsic Value of Investment Management

A Few Reflections on the 2019 Berkshire Hathaway Shareholder Letter

1955 Mercedes 300SL “Gullwing.” Not every car experiences the “J-curve” of depreciation that Gullwings have. Around the time Buffett got rolling with Berkshire Hathaway, teenagers could buy these used and race them when their parents weren’t looking. Today, it takes seven figures to get (carefully) behind the wheel of one. Image by Rex Gray via Flickr.

In a world where non-stop financial commentary is as commonplace as it is tedious, one man’s market insights get an unusual amount of attention: Warren Buffett’s annual shareholder letter. Buffett is an ironic icon of the investment management industry. He’s made his fortune from active investment management, but regularly articulates his skepticism of the same. He’s doubtlessly inspired more people to found RIAs than any other individual, yet his firm, Berkshire Hathaway, is not an RIA. And his annual treatise on the performance of his company is full of common-sense wisdom that, based on Berkshire’s track record, is anything but common.

Buffett’s annual letter may be the most anticipated event of the financial reporting season, and this year’s letter – released on Saturday – did not disappoint. My favorite passage, decrying the use of “adjusted EBITDA” as a proxy for operating earnings, recounted a story from another famous American:

Abraham Lincoln once posed the question: “If you call a dog’s tail a leg, how many legs does it have?” and then answered his own query: “Four, because calling a tail a leg doesn’t make it one.” Abe would have felt lonely on Wall Street.

The Rap on GAAP

Also common to Buffett’s annual letter was his comparing and contrasting intrinsic value (what assets are “worth”) and market value (how assets are “priced”). Readers of this blog don’t need any further explanation of why he would revisit such a topic each year, but Buffett actually opened this year’s letter with the issue because of a change in accounting rules which requires Berkshire Hathaway to mark the value of its positions in public equities to market on its balance sheet, and report any corresponding gains or losses on the company’s P&L.

This new fair value reporting requirement makes sense at first glance (why not use market pricing if available?), but Buffett effectively and emphatically deconstructs this accounting standard by noting that 1) it doesn’t require the company to adjust the value of Berkshire Hathaway’s marketable securities for taxes on embedded capital gains paid at the realization of market value, and 2) it doesn’t have a corresponding standard for the company’s interests in entire businesses which, because they are owned outright by Berkshire, aren’t publicly traded. So while Berkshire Hathaway’s holdings of Apple and American Express are marked to market, GEICO is held at cost.

During the volatile fourth quarter of 2018, Berkshire Hathaway’s marketable securities portfolio registered “gains” and “losses” by this standard of $4 billion on several individual days (an amount equivalent to the company’s reported earnings for the entire year). Yet Buffett notes the companies owned by Berkshire Hathaway generated operating earnings in 2018 that exceeded their previous high (in 2016) by 41%! The Oracle’s message is clear: GAAP is actually obscuring Berkshire Hathaway’s performance rather than reporting it.

Does the Market Obscure the Value of Investment Management?

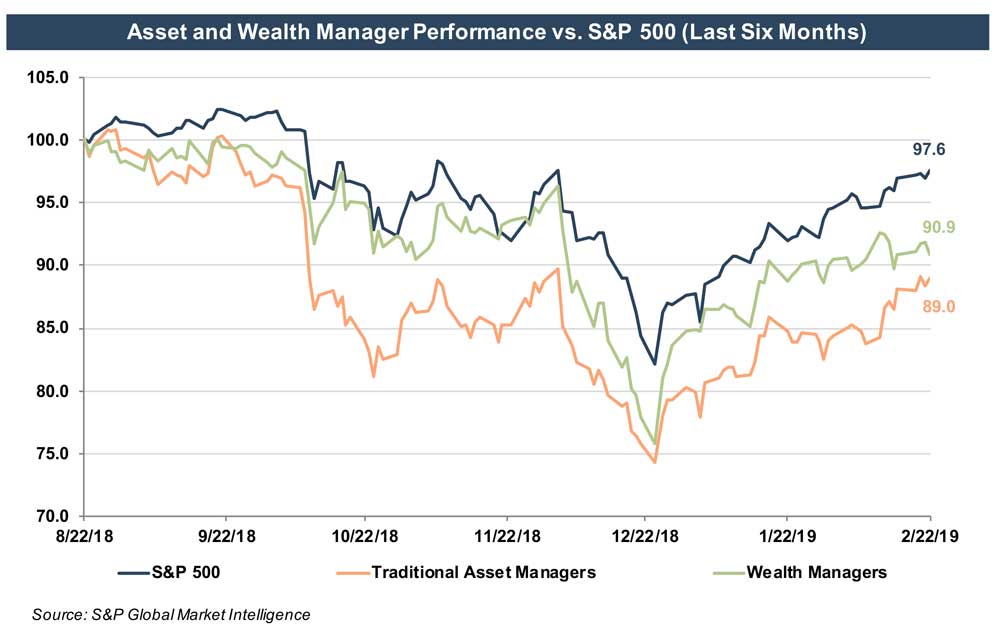

Market pricing of investment management firms over the recent past has shown a similar level of volatility, such that owners of RIAs, BDs, and trustcos (our clients) may be wondering what the impact of market behavior is on the “value” of their firms. It’s a simple question with a complicated answer.

In the valuation community, there are three traditional approaches to value: asset, income, and market. The asset approach is a basket of balance sheet focused methodologies that aren’t usually considered to mean much to the value of firms where it is commonly stated that the “assets get on the elevator and go home each night” (more on that later).

The market approach can be tricky to apply to the valuation of a closely held asset manager.

The market approach can be tricky to apply to the valuation of a closely held asset manager. How does one compare the public pricing of a behemoth like Franklin Resources to, say, a niche institutional equity manager with $3.0 billion in AUM? If BEN is priced at 6x EBITDA or 10x EBITDA, is that relevant to a firm with one strategy and a couple dozen employees? Moreover, if – over the past six months – BEN dropped 15%, appreciated to a recent high, then dropped 20%, and is now priced roughly even with where it was six months ago (which is what has happened), does that mean the value of a closely held asset manager oscillated similarly?

Buffett, of course, uses what he perceives as market mispricing to buy securities at a discount to what he thinks they are worth. By “worth,” he means intrinsic value. As illustrated by the discussion above, it’s sometimes difficult to derive intrinsic value from market approaches. The income approach, however, is useful.

I won’t drag you through all the numbers, but I modeled a sample wealth management firm through 32 years of market gyrations to see what impact market movements had on the discounted cash flows of the business (a decent empirical estimate of intrinsic value). My inputs were:

- Starting AUM of $1.0 billion

- Modest accretion of client assets under management (net of client withdrawals and terminations)

- Aggregate average portfolio returns of 6.5% after fees

- Distinction between fixed and variable costs (mostly compensation) in the expense base

- Discount rate of 15% and a terminal multiple of 8x net

I ran ten-year DCFs over each year of the model to see 1) if there was a positive buildup of value estimated under this income approach, and, 2) what was the resulting multiple implied in each year of the analysis. With a 32-year time series, this gave me 22 point estimates of value.

The result of this exercise suggests the stability of intrinsic value for investment management firms, regardless of market circumstance. There was a general upward trend in the estimate of intrinsic value over the forecast period, even in bad market conditions, probably because an upward trending market and a successful client acquisition program are more than enough to overcome the inevitable downturns. The multiple implied by these intrinsic value estimates ranged from 7.25x EBITDA to 9.25x EBITDA, with the average and median multiple falling near 8.0x. The multiple derived was, obviously, dependent on the discount rate, but the point is that the range was fairly tight regardless of market circumstance.

Narrative over Numbers: What Is the Intrinsic Value of Investment Management?

One reason Buffett’s letter is more widely read than this blog is he doesn’t simply bombard his readers with numbers. He also tells the story of his investments in a narrative format which makes sense without reference to margins and the cost of capital. In recent years Buffett has not failed to extol the virtues of his investment in GEICO. He loves the property & casualty insurance business because people give them money (premiums) in advance of them having to give some of it back (claims) and in the meantime they can invest the money (float). That float has helped build Berkshire Hathaway’s investment base into the powerhouse it is today. The story tells the numbers even better than the numbers tell the story.

It really isn’t fair to say that the assets of our clients’ firms get on the elevator and go home every night.

The narrative of investment management goes a long way to explaining the intrinsic value of an RIA. It really isn’t fair to say that the assets of our clients’ firms get on the elevator and go home every night. No doubt the talented teams which staff these firms are hugely responsible for their success – and those assets don’t increase or diminish in value with market volatility. But the team is only part of the story. Client assets (AUM) do correlate to a great extent with the market, but client relationships do not. In fact, bad markets can put clients into “play,” offering opportunities to pick up new relationships and new AUM from competing firms. The opposite is also true—strong client relationships are a source of assets to manage, in good times and bad, and serve to underpin the intrinsic value of an investment management firm.

Finally, the intellectual property of a firm: the investment management process, the client service experience, and the marketing program which drives new client acquisition all work to ensure that a firm has a steady (if not always stable) stream of revenue and profitability in bull markets and bear markets.

Avoiding the Curveball of Market Pricing

Most partners in RIAs instinctively view the value of their firms from the perspective of intrinsic value. We generally agree with this, but caution that market pricing still offers information and parameters which can’t be ignored, especially in a world of alternative returns. Our assignments often revolve around the concept of “fair market value” – and the second word in that standard cannot be ignored.

Even in a fair market value framework, though, it can be useful to remember that buyers and sellers of investment management firms usually don’t perceive the value of these firms to be nearly as volatile as market pricing of publicly traded RIAs. A useful perspective is that of the antique car market. With few exceptions, even cars which eventually become very collectible experience steep depreciation during the first couple of decades after their manufacture. Most never recover, but those with some discernible mystique eventually become worth what they initially sold for, some of those sell for their initial price adjusted for inflation, and a precious few become worth much more. The value of this last group of sought after automobiles, however, is not the steel and glass and rubber, but the intangibles of beauty and engineering prowess. Speed and scarcity don’t hurt either.

A focus on building intangible assets cements the foundation of intrinsic value for investment management firms, in good markets and bad. Do that and you’ll have a warehouse full of Gullwings.

RIA Valuation Insights

RIA Valuation Insights