Wealth Management in Turbulent Times

Navigating the Challenges Ahead

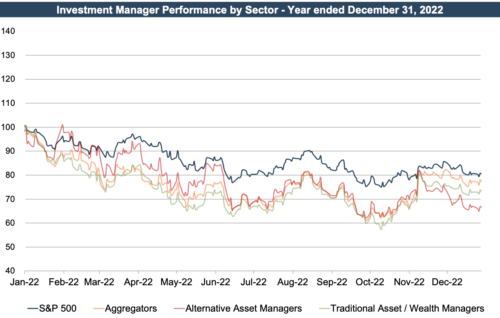

2022 proved to be a challenging year for the stock market as a whole and the RIA industry. With persistent inflation, rising interest rates, a tight labor market, and heightened geopolitical tensions, it’s no surprise that this resulted in the decline of nearly all stock market sectors over the last year, which was especially true for the RIA industry. Investment manager performance is very much levered to the stock market due to its direct effect on AUM balances and the operating leverage inherent in the RIA model.

Public firms with substantial operations in the wealth management space were down 27% year-over-year, underperforming the broader market (the S&P 500 was down 19%) and aggregator models, like Focus Financial and CI Financial (down 23%).

This is in stark contrast to the uptrend seen for much of 2021. Prices for aggregator models accelerated into December of 2021, peaking as transaction activity in the space hit a fever pitch, fueled by higher multiples and the threat of changes in tax law that would make selling after year-end potentially disadvantageous.

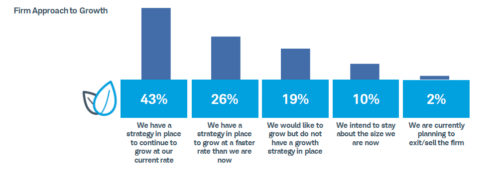

The annual Schwab survey of wealth management firms confirmed the bullish sentiment going into 2022, with 69% of advisors expecting to grow at their current rate or faster.

Click here to expand the image above

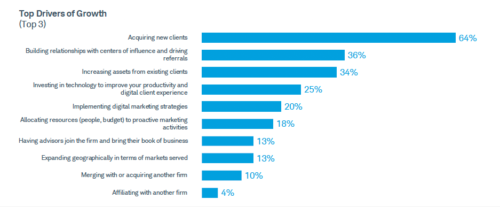

Despite all the media attention given to consolidation activity in the wealth management sector, it’s noteworthy that the advisors surveyed by Schwab saw ample opportunity to grow their firms organically. Nearly two-thirds of firms saw new client acquisition as a top driver of growth, while only 10% expected M&A to be a growth driver.

Click here to expand the image above

It is worth noting that the 2022 survey represents sentiment in October 2021 (when the study was conducted). In the fourteen months that have transpired since the survey, the market has had to digest higher inflation, a new uptrend in global interest rates, the Federal Reserve shrinking its balance sheet, and the war in Ukraine. The survey taken in late 2022 (when it’s released) could prove that advisors now have a more pessimistic outlook on the market.

By the spring of 2022, many trends favoring wealth managers began to shift, threatening margins and valuations. Inflation in the U.S. hit a 40-year high in June of 2022 at 9.1%. In the second half of the year, inflation eased as the Federal Reserve aggressively raised interest rates and the economy began to cool, ending the year at 6.5%.

The Federal Reserve began increasing interest rates in March of 2022 and ended up hiking rates six more times during the year. By December 2022, the Federal Reserve’s target rate was between 4.25% and 4.5%, the highest level in over 15 years. Higher interest rates have undermined valuations in both debt and equity markets, taking an unusually strong toll on everything from U.S. treasuries to tech stocks. This shift created a downward gravitational pull on assets under management and, therefore, revenue for wealth management firms. At the same time, inflationary forces have pushed up both labor and non-labor expenses for RIAs. The consequence could be challenging for margins in 2023 and could deflate some of the positive influences on profitability that have provided a tailwind to RIA valuations for several years.

Valuations may face additional pressure as rate increases by the Federal Reserve result in higher yields for other income-producing assets (making them a more attractive alternative to investing in RIAs), and the cost of capital increases on both the equity and debt sides of the equation for leveraged consolidators of wealth management firms.

With the prospect of a potential recession in 2023, the worst may still be ahead. While facing uncertainty heading into 2023, it will be important for wealth management firms to have a strategy in place to navigate these challenges and capitalize on opportunities that may arise.

RIA Valuation Insights

RIA Valuation Insights