Wealth Management: Then and Now

How the Wealth Management Industry has Transformed Over the Last Decade

As we enter the new decade, rather than taking time for self-reflection, we prefer to take a step back and reflect on the transformation of the wealth management industry over the last decade.

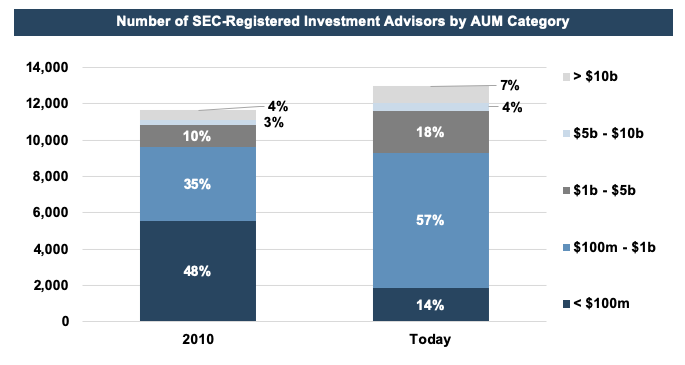

According to the Investment Advisor Association’s 2010 publication, SEC registered Investment Advisors reported $38.6 trillion in assets under management that year. Today, that number has more than doubled to $83.7 million. The number of SEC registered investment advisors, however, has only increased by 12% (11,643 in 2010 and 12,993 today). This means that the average advisor is managing more money today than they were ten years ago, as shown in the graph below.

In 2010, advisors reportedly served approximately 30 million clients compared to 43 million today, suggesting that the increase in assets managed by each advisor is a result of having both more and larger clients.

These statistics suggest it’s been smooth sailing for wealth managers. However, the investment management industry has changed radically over the last ten years, and wealth managers have been forced to adapt in order to maintain their client base and remain profitable. While these changes have not been easy, they have transformed the industry into one more focused on its clients’ needs and better regulated to ensure the safety of its clients’ assets.

Backdrop

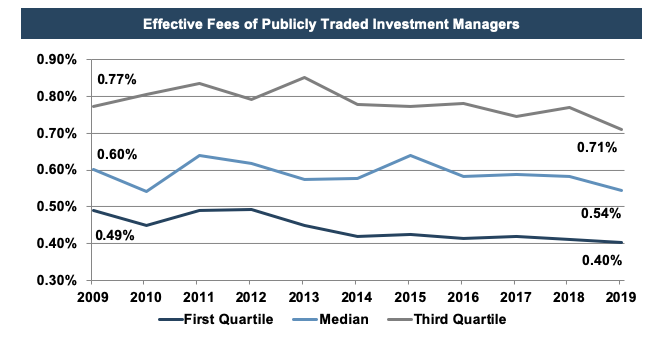

The popularity of passive funds increased in 2009 when the current bull market began. In 2010, about 30% of U.S. assets were held in passively managed funds; last year, we crossed the 50% mark. While active versus passive may still be an intellectual debate, there’s no debate that trillions of dollars are managed passively today at much lower fees than they were a decade ago. The chart below demonstrates the decline in publicly traded investment managers’ effective fees over the last ten years.

Wealth managers, however, have largely side-stepped fee pressure so far, and we don’t hear many instances of wealth management firms bending their stated pricing schedules because of client pushback. However, to justify higher fees in a low fee environment, wealth managers have had to differentiate themselves by providing more specialized solutions for their clients. Ten years ago, Westwood Holdings, a publicly-traded wealth management firm, described themselves as follows on their website:

Westwood is built upon one investment philosophy of controlling overall portfolio risk while providing superior, risk-adjusted returns for our clients.

Today Westwood’s website touts:

At Westwood, we will champion your values and help make your intentions a reality.

Wealth managers have changed their marketing strategy to highlight their more tailored investment solutions (with the underlying message that specialized services are worth the higher fees). But their ability to maintain their fee schedules will likely depend on their capacity to continue servicing clients’ evolving needs while connecting with their next generation.

The trade-off with more specialized investment management is the cost. Providing tailored investment solutions, takes more time, i.e. more human capital. One area where the asset management model beats wealth management is scalability. You can build a bigger wealth management firm, but it usually requires a corresponding increase in advisors and planners. Additionally, as compliance and technology costs have increased over the last decade, wealth managers have had to pay closer attention to their expense base then they had to ten years ago.

At the same time, many principals of wealth management firms reached retirement age over the last decade, often with no plan in place to transition their business. Succession planning has been an area of increasing focus in the RIA industry, particularly given what many are calling a looming succession crisis. In Schwab’s 2019 benchmarking study, which surveyed 1,300 RIAs, a full 92% of respondents indicated that they were considering internal succession, but only 38% of firms have a documented path to partnership. The options for succession planning for aging principals have exploded over the last decade. Debt financing providers have bettered the terms for RIAs, private equity firms are giving more attention to the industry, and M&A opportunities have increased as RIAs try to achieve scale.

Most notably, however, is the increase of consolidators in the space. RIA consolidators have seized the opportunity to address both the needs of retiring shareholders and continuing principals, by offering liquidity for founders as well as back-office infrastructure. Consolidators can provide selling partners with substantial liquidity at close, an ongoing interest in the economics of the firm, and a mechanism to transfer the sellers’ continued interest to the next generation of management. Additionally, they can offer back office services such as IT, compliance, and human resources which allows RIAs to preserve their margins despite the cost of hiring more advisors.

2020 Vision

Looking forward, wealth managers will have to continue streamlining back office processes so that they can prioritize spending on compensation. Investments in technology and compliance will continue to require additional resources. Wealth managers must make conscious decisions about where they will find cost saving efficiencies without sacrificing superior service for their clients.

Going forward, more and more RIAs will have to evaluate offers from consolidators and decide whether this kind of partnership right for them. Planning ahead for the eventual transition of your business will set you up with more options for retirement and a better understanding of where you are willing to make concessions.

RIA Valuation Insights

RIA Valuation Insights