Reviewing 2024 RIA Performance: Wealth Management

The wealth management industry experienced remarkable growth in 2024, driven by robust market performance, inflation cooling, and shifts in monetary policy. Contrary to earlier concerns of economic instability, the year delivered substantial growth across the RIA sector, signaling resilience and adaptability in an ever-changing financial landscape.

Overview of Industry Performance

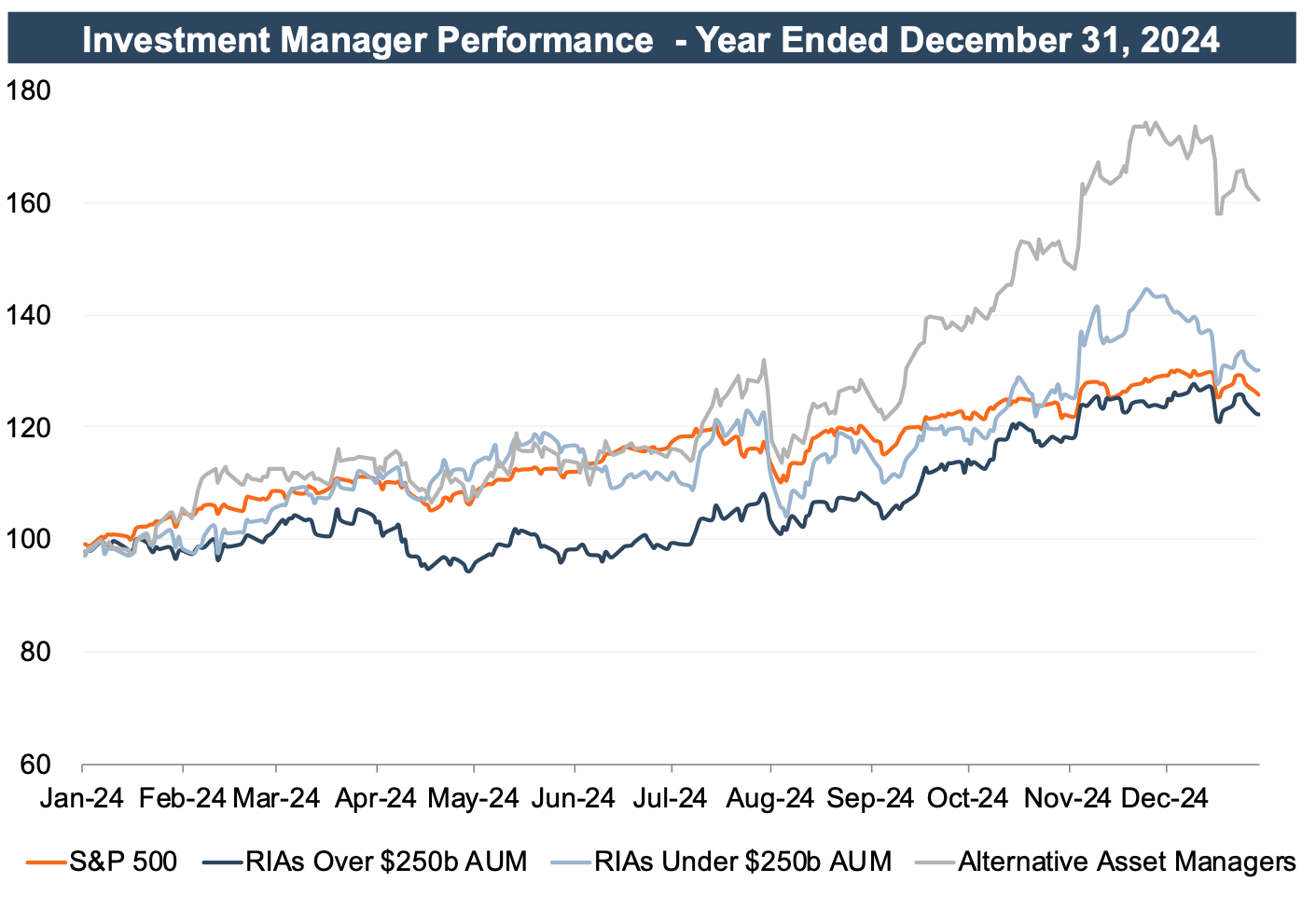

Performance across the industry closely mirrored broader market trends, reflecting the inherent connection between market conditions and Assets Under Management (AUM) balances.

Large publicly traded investment management firms (those with over $250 billion in AUM) were up 22.4% year-over-year, underperforming the broader market (the S&P 500 was up 25.7%). In contrast, smaller publicly traded managers (those with AUM under $250 billion) outperformed the market with a 30.3% increase, and alternative asset managers surged 60.4%. This reflects a continuation of the strong growth seen in 2023 when traditional asset managers and the broader market rebounded significantly from the challenges of 2022.

A key driver of 2024’s market strength was the Federal Reserve’s decisive pivot on monetary policy. With inflation receding steadily throughout the year, the Fed implemented three rate cuts: 50 basis points in September, followed by 25 basis points in both November and December. This easing cycle provided much-needed relief to the markets and reignited risk appetite among investors.

The Federal Reserve may continue to lower interest rates in 2025, especially if economic conditions remain stable and inflation stays within target ranges. Such actions could further support market performance and enhance capital availability for wealth management firms.

The Great Wealth Transfer

Looking forward to 2025 and beyond, one of the biggest opportunities in the wealth management industry is the Great Wealth Transfer, an unprecedented movement of over $68 trillion in assets from Baby Boomers to younger generations. For advisors, this represents both a generational challenge and an unprecedented growth opportunity.

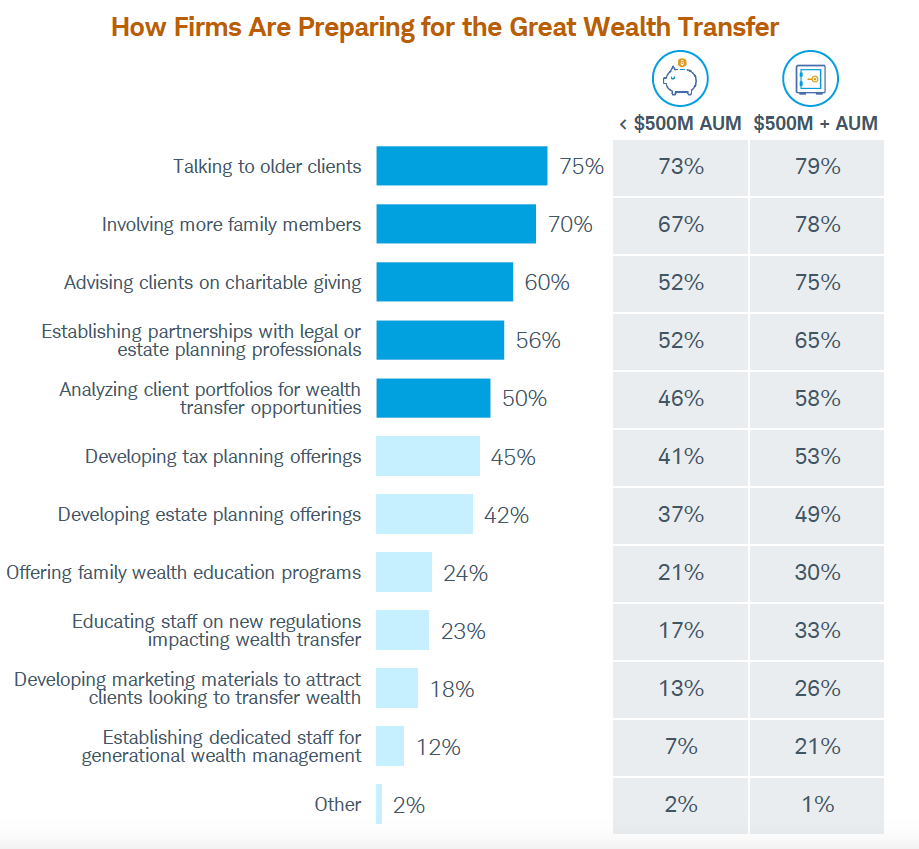

To prepare for this massive transfer, advisors are actively engaging older clients in discussions about estate planning and establishing partnerships with legal/estate planning professionals. Additionally, many firms are investing in multigenerational relationship management by involving heirs in early financial planning discussions and providing tailored resources to educate them on wealth management principles.

This trend was reflected in Charles Schwab’s annual wealth management survey, which revealed that 75% of firms are engaging older clients in estate planning discussions, while 70% are involving more family members in financial planning. These efforts highlight the industry’s commitment to fostering long-term relationships across generations.

The Role of AI

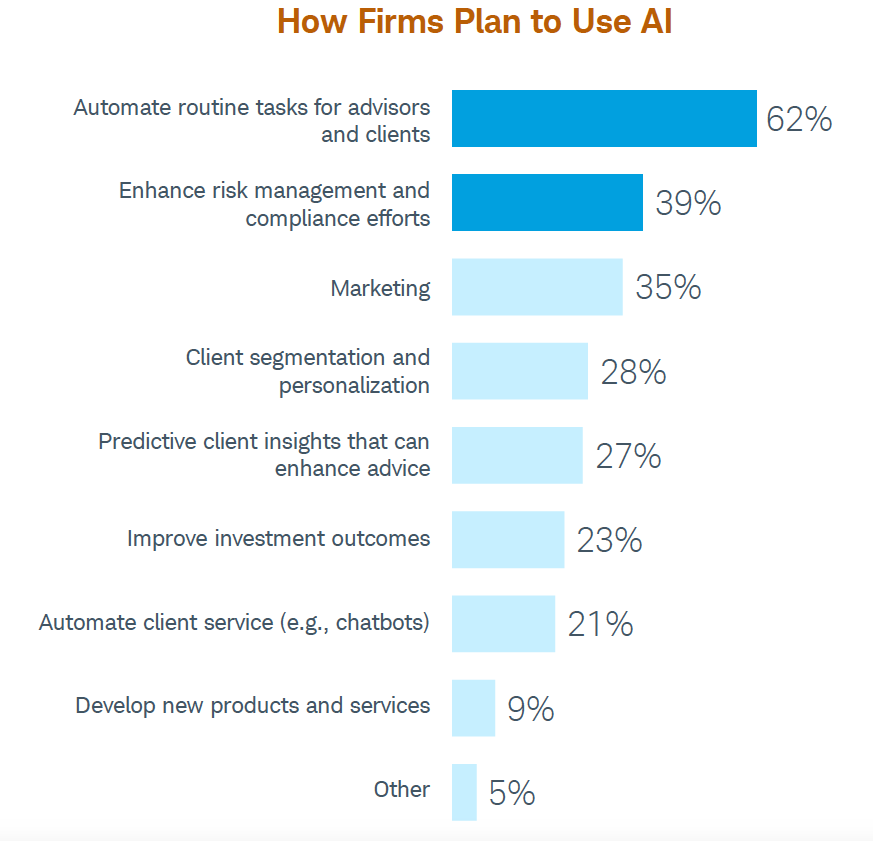

Another opportunity for growth in the wealth management industry comes in the form of AI. According to Schwab’s survey, 54% of respondents expect that the implementation of AI will have the greatest impact on industry growth over the next three years. Firms are increasingly exploring how AI can enhance both client-facing services and internal operations.

AI-driven tools are being developed to automate routine tasks, improve risk management, and provide predictive insights to advisors.

While AI presents enormous potential, adoption remains in its early stages. Just 23% of firms have begun implementing AI into their business, and 30% said they are unsure of their firm’s plan to implement AI in the future.

The slow implementation of AI is primarily the result of caution from wealth management firms, with many firms saying that more work needs to be done before the full benefits of AI can be realized.

Conclusion

As the wealth management industry looks to 2025 and beyond, the dual drivers of demographic change and technological innovation will play a pivotal role in shaping its future. Firms that effectively embrace these trends—by deepening client relationships and harnessing cutting-edge technology—stand to emerge as leaders in an increasingly dynamic and competitive market.

About Mercer Capital

We are a valuation firm that is organized according to industry specialization. Our Investment Management Team provides valuation, transaction, litigation, and consulting services to a client base consisting of asset managers, wealth managers, independent trust companies, broker-dealers, PE firms and alternative managers, and related investment consultancies.

RIA Valuation Insights

RIA Valuation Insights