Despite the old maxim of a rising tide lifting all boats, the current markets are clearly more buoyant for wealth management firms than asset management firms. Many asset managers are trading at or near all-time lows from a valuation perspective, while financial advisory shops continue to accumulate client assets. For this week’s post, we’ll take a closer look at this trend, and what it means for the broader industry.

The Story for Asset Managers

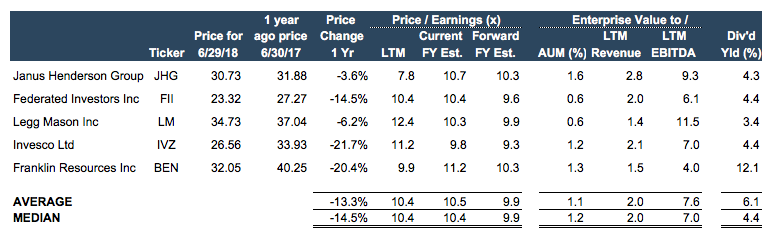

Don’t interpret this as our being bearish on asset management. Almost every asset management firm, public or private, is more valuable today than it was in 2009. The explanation for that is simple: rising markets lead to higher AUM, management fees, and earnings, so many of these businesses are worth 2-3x (or more) what they were a decade ago because profitability has (easily) tripled in the last nine years. As appraisers, we’re more concerned with the multiple (i.e. valuation) applied to these earnings since that’s what we take from the market and relate to our client company’s performance to derive value. Here’s how the market is currently pricing some of these businesses:

Notwithstanding the run-up in their market caps since the last financial crisis, earnings multiples for asset management firms have mostly contracted, particularly recently. There are a number of rational explanations for this – fee compression, flight to passive strategies, ETFs, fund outflows, maturing industry, etc. This seems quite overdone for a business with a strong recurring revenue model and high margin potential through continued gains in AUM (like we’ve seen).

So what gives? You’ll recall from your corporate finance classes in college that this multiple is a function of risk and growth. While there are certainly risks facing this business today, we don’t necessarily think the business’s cost of capital has increased much (if at all) over the last year as the sector’s risk dynamics haven’t changed much over the last year. Lower valuations must, therefore, be indicative of sliding growth prospects. Clearly, the market is telling us that the industry’s current headwinds (regarding fees and outflows) are likely to persist and may even be questioning the longevity of the bull market.

Different Story for Wealth Managers

Wealth managers chart another path. There’s not a whole lot of public market perspective on these businesses due to the lack of publicly traded wealth management firms, but there is some. Silvercrest Asset Management (ticker: SAMG), which provides family office and financial advisory services, is up more than 30% over the last year and currently trades at just over 21x trailing twelve months earnings.

Then there are all the recent headlines surrounding Focus Financial Group, a serial acquirer of wealth management firms. Admittedly, we’ve contributed to some of this. As a result, you probably didn’t even know about the Victory Capital (multi-boutique asset manager) IPO that happened earlier this year. The market currently values Focus at nearly 5x revenue and Victory at well under 2x revenue even though VCTR is profitable and FOCS is not. Arbitrage opportunity?

To be fair, these businesses have always been priced differently. Wealth managers often elicit a higher multiple because of their lower risk profile. Their clients (mostly individuals) are typically less concentrated and more likely to stick around when performance suffers. Asset managers on the other hand, typically enjoy higher margins since it’s less costly to service fewer relationships. This trade-off is nothing new and likely to persist.

The Overarching Narrative

The recent widening of the multiple gap and disparate performance over the last year suggests the two businesses are riding completely different trajectories. Again, the market seems to think that the fee compression and flight to passive movements are here to stay, and wealth management firms may be the indirect beneficiary of these trends. We don’t disagree with this but think there will always be a place for active management, especially for those firms with solid long-term performance and steady inflows. Still, this bull market seems to have forgotten about a sector that typically thrives in a bull market.

Moving forward, we expect some mean reversion but aren’t ignoring what the market is telling us about the outlook for asset managers – it’s probably going to get worse before it gets better. Solid performance can buck this trend for any RIA, but consistently delivering alpha is a tall order. Since most firms underperform the market after fees, perhaps it’s not surprising that sector has struggled so much recently. Still, this has almost always been the case, so the industry’s current woes are more likely attributable to fee compression (or fear of fee compression) and surging demand for passive products. A bear market might actually help (relative) performance as many asset managers outperform during times of financial stress, but that would also strain revenue and profit margins. Attractive valuations could spur deal-making and consolidation, which could alleviate some of these pressures. We’ve seen some of this, but suspect more is on the way. Either way, we’ll continue to monitor these pricing trends and let you know how this all shakes out.