Westwood Looks to Replace Lost AUM and Revenue with Salient Partners Acquisition

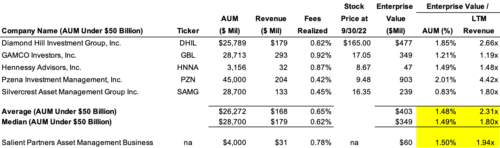

Two weeks ago, Westwood Holdings Group (ticker: WHG) completed its acquisition of Salient Partners’ asset management business. The purchase price consisted of $35 million in cash at closing plus a potential $25 million in earn-out payments (in WHG stock and cash) contingent upon hitting specific revenue retention and growth rates over the next 2-3 years. The deal is expected to add $4 billion in AUM and $31 million in annual revenue to WHG, pricing the total consideration (cash up front plus earn-out payments) at 1.5% of AUM and just under 2x revenue, which is right in line with WHG’s public peers.

Click here to expand the image above

This valuation seems reasonable, especially considering 42% ($25 million) of the $60 million purchase price is contingent upon hitting specific revenue retention and growth objectives after closing. These metrics support WHG management’s assertion that the deal represents an “attractive valuation, structured with back-end protection through prudent growth and revenue retention hurdles.”

Another (unstated) rationale for the deal is AUM and revenue replenishment. WHG assets under management and revenue peaked in 2017 at $24 billion and $134 million, respectively, and have since fallen to $11.5 billion and $68 million, respectively (prior to this acquisition). Westwood’s stock price has followed a similar trajectory, peaking at $70.84 in October 2017 and currently sitting at $11.27. This acquisition added 33% in AUM and 47% in revenue and should be immediately accretive to earnings. The Street agreed, and WHG’s stock price increased 6% on the day of the announcement.

Masking losses through acquisitions is typically a risky proposition, but this may be an instance where it actually makes sense. WHG had some excess cash and investments on its balance sheet, which it employed to purchase a sizeable asset management business at a reasonable price. By acquiring an asset manager with distinct energy infrastructure, private investment, tactical equity, and real estate strategies, WHG will be able to diversify its predominantly U.S. value product offering while earning a higher effective fee on total client assets. As part of the transaction, Westwood will also acquire a 47% stake in Broadmark Asset Management, which subadvises a liquid alternative strategy on the Morgan Stanley platform.

In a year where most investment management firms have endured a precipitous drop in AUM, revenue, and earnings, this acquisition could be a blueprint for future transactions. Asset manager values are down significantly over the last year, so there’s ample opportunity to add client assets and revenue for a reasonable price. These deals also tend to accrete immediately, and earn-out consideration provides downside protection against adverse market events or client losses. We’re still seeing strong deal flow for wealth management firms without the corresponding gains for asset manager M&A. If this deal goes well, we could finally see a year where asset management dealmaking outpaces RIA M&A. As always, we’ll keep an eye on it and report back.

RIA Valuation Insights

RIA Valuation Insights