What Does “The Market” Say Your RIA Is Worth?

GameStop Theory in a Consolidating Industry

A better “Red It” – 2008 Porsche Boxster S (photo: netcarshow.com)

Long before Reddit investors discovered that you could Occupy Wall Street more effectively with out of the money call options than you can with tents, Porsche briefly turned itself into a hedge fund and used a similar tactic to try to take over Volkswagen. The story sheds some light on how market pricing does, and does not, reveal the value of a business. Benchmarking the value of an RIA off the behavior of a few aggressive consolidators has similar limitations.

Barbarians from Bavaria

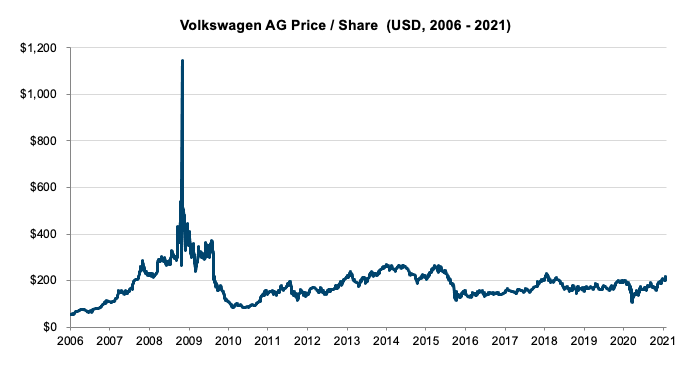

Around 2005, a niche automaker from Stuttgart revealed that it intended to become the largest shareholder of the largest automaker in Germany. At the time, VW Group sold more cars each week than Porsche sold annually, but its share price lagged its industrial scale. Porsche had a CFO with larger ambitions and developed a strategy to use market manipulation to do what seemed impossible. Within a year of its announcement, Porsche’s stake in VW reached 25%, and then 30% by March 2007. Porsche denied mounting a full takeover intent, instead suggesting that it was protecting VW from hostile suitors (an accusation that turned out to be a confession).

By late 2008, Porsche’s ownership stake had climbed to over 40%, and it held options to purchase another 31.5%. The burgeoning stock price for VW was recorded as a gain at Porsche – profits that exceeded what Porsche made from selling cars. At the peak, VW was trading for more than 20 times where it was before Porsche started accumulating shares. If Porsche could’ve gained control of 75% of Volkswagen’s stock, it would trigger a change of control, and Porsche could strip VW’s balance sheet with 8 billion euros. Alas, the credit crisis intervened on VW’s behalf and Porsche’s self-inflicted wounds created insolvency that could only be remedied with a sale to, you guessed it, Volkswagen.

GameStop Theory

By now you’ve read plenty about the short squeeze on GameStop and other heavily shorted financial instruments and commodities (today it’s silver). It seems like it was only a few months ago that cryptocurrencies were exciting. We won’t bite at the opportunity to weigh in on whether or not loosely organized hordes of retail investors at aptly-named Robinhood should be allowed to out-manipulate billionaire hedgies.

We will, however, consider the valuation implications of unusual market behavior. The investment management industry hasn’t been the target of vigilante options traders, and we’re not aware of any sub-billion-dollar managers launching a leveraged effort to take over, say, Focus Financial. But the RIA press is fond of breathless speculation about ever-higher prices being paid for firms. One of the absolute truths of the current environment for buying and selling investment management firms is that there has never been a larger number of capital providers offering a greater variety of transaction terms.

The question is, what does it mean to you and the value of your firm?

The Rules of the Game

Some things haven’t changed. Valuation operates in an alternative returns world. In other words, the value of any given investment opportunity depends on the rate of return it generates compared to other opportunities with a similar risk and growth profile.

Value is a function of cash flow, rate of return (relative risk), and growth. Assuming cash flow is a constant, for valuations to increase, either cash flow growth expectations must be higher or the expected rate of return must be lower – or both.

It is through this lens that we have to view the news about industry consolidation. When a particular buyer makes an eye-watering bid for an RIA, one or more of these three basic elements is in play.

- The buyer has a unique circumstance that allows them to extract more profitability from the target firm than other bidders or than the firm could extract on its own. There is ample reason to be skeptical of this expectation. Investment management is labor intensive, and clients don’t like their relationship or investment people turning over. While there are some back office efficiencies that come from some transactions, it usually isn’t enough to be meaningful. In our experience, most buyers are genuinely interested in the talent-acquisition angle of an acquisition, because good and experienced industry veterans are rarely available.

- The buyer has a unique expectation of the growth opportunities inherent in an acquisition. Organic firm growth comes from market tailwinds and marketing discipline. It’s hard to forecast market tailwinds, especially in this environment, and marketing discipline can be built more cheaply than it can be acquired.

- The buyer is willing to accept a lower rate of return than competing bidders. This is the technical definition of winner’s curse. When Goldman Sachs paid up for United Capital, it wasn’t a big enough deal in the overall GSAM universe to dilute earnings, and it sped up Goldman’s foray into serving the mass-affluent. So even though Goldman accepted a lower return on the deal from a closed-form perspective, it had larger implications for the company that justified getting it done. Just because I found an exception doesn’t make it the rule. All else equal, the highest multiple is the lowest earnings yield, so the buyer is just willing to get less out of the deal.

Just Because You Can, Doesn’t Mean You Should

One of the pioneers of the RIA industry was a smallcap manager who also happens to be the father of a friend of mine. One choice piece of wisdom that he passed on to his kids: “just because you can, doesn’t mean you should.”

You can rationalize valuing RIAs higher today because interest rates are low and the space offers one of the few growth-and-income plays that has worked well for several decades. Time will tell, but interest rates are probably low because economic growth is low. If the market is leveraged to the economy, and RIAs are leveraged to the market, the rules of valuation suggest that low rates don’t necessarily defend higher multiples.

Investment management firms used to be considered a value investment. If that’s no longer true, will internal transactions be possible? Will firms be compelled to sell into complex financial engineering schemes that cut every analytical corner in an effort to buy high and sell higher? The NPV of financial engineering, over time, is zero (before fees). No SPAC is going to change that.

Does the high bidder set the market? On paper, yes. But the market for RIAs consists of tens of thousands of active participants, many of whom are quietly willing to sit out if financial returns aren’t high enough. Full stop.

A Plug for Mercer Capital’s Upcoming RIA Practice Management Insights Conference

Mercer Capital has organized a virtual conference for RIAs that is focused entirely on operational issues – from staffing to branding to technology to culture – issues that are as easy to ignore as they are vital to success. The RIA Practice Management Insights conference will be a two half-day, virtual conference held on March 3 and 4.

Join us and speakers like Jim Grant, Peter Nesvold, Matt Sonnen, and Meg Carpenter, among others, at the RIA Practice Management Insights, a conference unlike any other in the industry.

Have you registered yet?

RIA Valuation Insights

RIA Valuation Insights