What Does the RIA Valuation Process Entail?

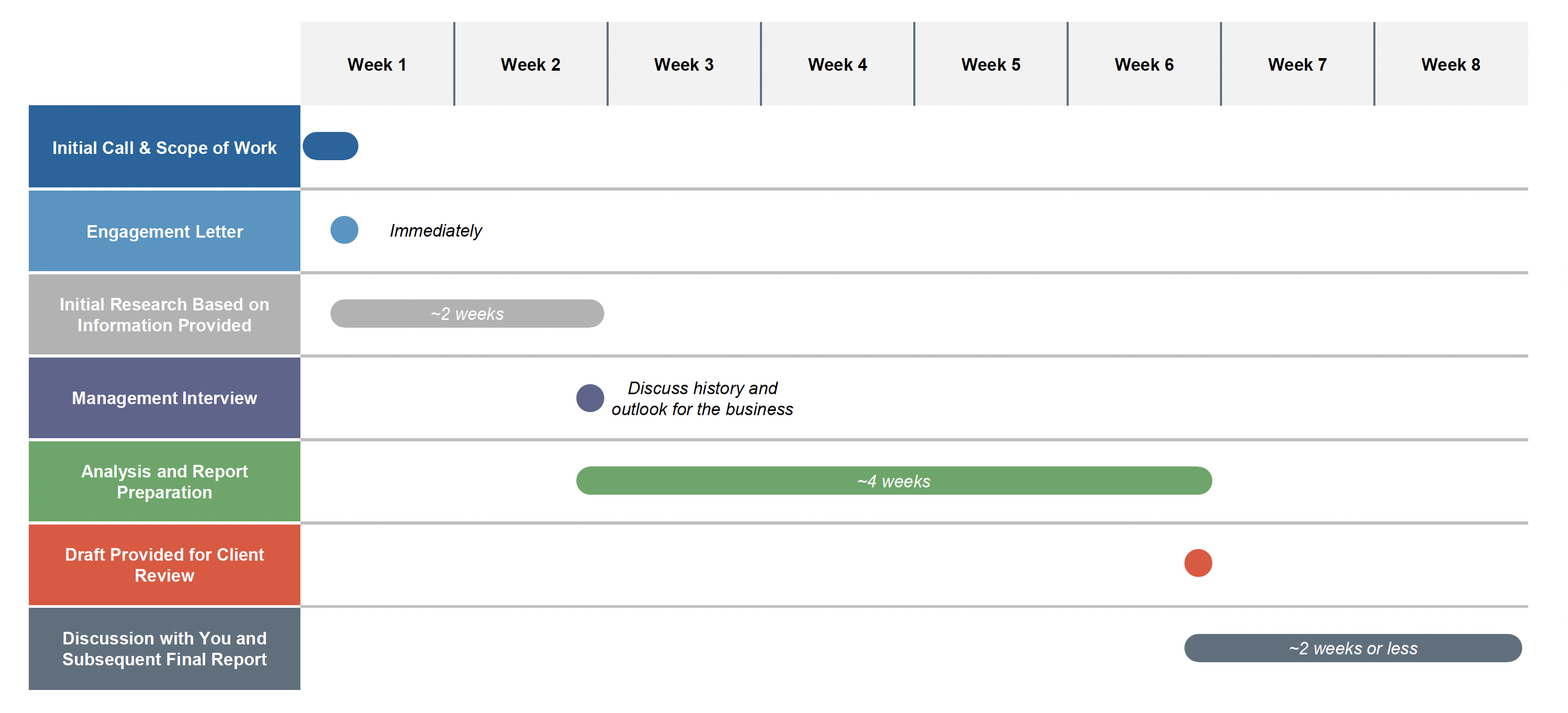

As you can imagine, we get this question a lot from prospective clients. They’re often taken aback when we tell them it typically takes six to eight weeks from start to finish, but that’s probably because they don’t realize what it all entails if they’ve never had one done.

For this week’s post, we’ll channel our inner Nick Saban and focus on the process.

Phase 1: Information Gathering and Review

Once an RIA client signs our engagement letter to value their business, we immediately follow up with an information request outlining the financial, operational, and corporate documents we’ll need to value the firm. These files typically include financial statements, projections, AUM detail, tax returns, client demographic overviews, operating agreements, marketing materials, succession plans, and any prior valuations or offers for the business, among other things. We understand that many clients do not have all this detail, and we don’t expect clients to create documents that don’t already exist.

Once we’ve reviewed the information from the clients and entered it into our systems, we schedule our client interview with the company’s management team.

Phase 1 generally takes 1-3 weeks in total.

Phase 2: Management Interview and Additional Due Diligence

After we’ve reviewed the information requested from the client, we schedule our interview with the RIA’s management team (either in person or via Zoom) to gain a better understanding of the company, get the story behind the numbers, ask any questions we had on the documents provided, and understand leadership’s outlook for the business.

This meeting is also an opportunity for the client to ask us questions about industry trends or the valuation process in general. There’s usually some follow-up from that meeting for additional documents or clarification on the items provided within a few days of the management interview.

Phase 2 usually takes a week or so.

Phase 3: Valuation Analysis and Report Drafting

After we’ve completed our due diligence, we proceed with our valuation analysis.

We won’t go into too much detail on the various valuation methodologies in this post, but it generally involves a DCF model that calculates the present value of the RIA’s expected cash flows and market methodologies that employ earnings multiples from publicly traded investment management firms or acquisitions of similar RIAs over the last few years.

Once the analysis is set up, we have a valuation committee involving the analyst(s) and senior client contact to firm up the valuation.

After the math is checked, we proceed with the report, which, depending on the scope of the engagement, will include details about the company, the valuation methodologies, assumptions utilized, and industry or market forces affecting the business.

The draft report is always reviewed by the most senior analyst before submission to the client.

Phase 3 generally takes 3-4 weeks from start to finish.

Phase 4: Final Report and Next Steps

After we’ve sent the client our draft report, it usually takes around a week for them to review it before we schedule a call to go through it and answer any questions they have. We then send them our final report and often schedule a follow-up call to discuss any next steps resulting from the valuation analysis. Sometimes, this entails consulting around succession planning, owner compensation, future valuation work, acquisition opportunities, or ways to help them transact the business internally or externally. If it’s something outside our wheelhouse, we try to direct them to someone who can help.

Every valuation process is a bit different, but they generally follow this outline. It typically takes six to eight weeks from start to finish, but this timeline can be tailored to fit your needs (within reason).

Click here to expand the image above

If you have any questions about the process or think it might be something you’re interested in getting done, don’t hesitate to give us a call.

About Mercer Capital

We are a valuation firm that is organized according to industry specialization. Our Investment Management Team provides valuation, transaction, litigation, and consulting services to a client base consisting of asset managers, RIAs, trust companies, broker-dealers, PE firms, and alternative managers.

RIA Valuation Insights

RIA Valuation Insights