What Market Volatility Means for Your RIA

Is Volatility the New Normal?

It’s de ja vu all over again. The volatility from the onset of the pandemic two years ago has been creeping back up as investors grapple with the global implications of the war in Ukraine. At the end of last year, most RIA owners were enjoying peak AUM and run-rate profitability. Since then, these measures have likely taken a substantial hit as the S&P 500 and NASDAQ are down 12% and 19%, respectively. When this happened two years ago, the market made a sharp recovery in the preceding quarters, but looking forward, we don’t know where the bottom lies. Most RIA principals are likely grappling with a sizable decline in management fees and earnings for the next billing cycle.

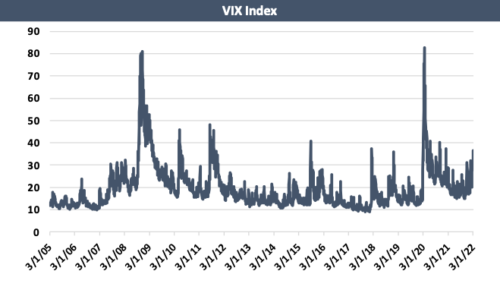

The VIX, which calculates the expected volatility of the U.S. Stock market, hit a new all-time high on March 16, 2020, of 82.69. It gradually declined until Russia invaded Ukraine several weeks ago and has ticked back up ever since.

If one thing has become more clear, it’s that market volatility is likely here to stay – at least for a while. In this post, we explore what this volatility means for you and your RIA.

AUM, aka Revenue Base, Is More Volatile

For RIAs that charge fees on a quarterly basis, the fees charged on March 31, 2022, will likely be significantly lower than the fees charged as of year-end (barring any major advances in the market over the next week or so – which is not out of the question). Many RIAs have quickly adjusted to this new normal. Rather than charging fees quarterly, which makes them more susceptible to the large swings in the market, they have switched to charging fees on a monthly basis to smoothen the impact from a swift correction.

Active Managers May Be Able to Exploit Mispricing in the Market

During times of increased volatility, active managers are generally able to take advantage of the swings in stock valuations away from fair value, allowing them to realize increased returns for their clients. This may be more difficult in the current market as the volatility today is not just driven by increased “fear” in the market, but a lack of liquidity in our financial system.

Over the last few months, bid-ask spreads have widened, and trading volumes have generally declined. A lack of liquidity in market structure is associated with increased risk. In a less liquid market, it is more likely that you could get stuck in a losing position. Additionally, in less liquid markets, prices tend to overreact, making market moves less informative. While there are more winning opportunities presented to active managers, there are also more losing ones.

Sector-Specific Managers Are Missing Out or Killing It

Much of the decline so far this year has been driven by tech stocks, which outperformed most other sectors of the economy over the last few years. Conversely, energy sector fund XLE is up 34% year-to-date after underperforming the broader market for several years. Mean reversion has been a major force so far this year to the benefit and detriment of sector-specific asset managers.

Internal Transactions Have Been Temporarily Sidelined

Many RIA principals are more reluctant to sell at the pricing implied by recent valuations that consider the impact from the market fallout. Additionally, the next generation of leadership may be less inclined to take on the additional risk if their compensation also took a hit. We haven’t seen any evidence of this so far, but it could work its way through the system if these conditions persist over the next few quarters.

External Transactions Might Decline

Since many debt-fueled purchases of RIAs rely on variable rate financing, many prospective external buyers will also be sidelined if borrowing becomes more expensive. Lenders could also get spooked by rising volatility and waning profitability for many RIA firms.

Planning Is More Important Than Ever

During this time when the outlook for global markets and the economy is uncertain, many RIA principals are working to nail down the unknowns associated with business ownership. RIA principals are devoting more time to working on their buy-sell agreements in an effort to protect the working relationships with their partners and ensure they and their families are protected financially in the event of a divorce, partner dispute, disablement, or death.

The current environment is ripe with uncertainty. This presents both challenges and opportunities for principals of investment management firms. As we all know, this will eventually pass, so most of our clients are focused on positioning rather than acting.

RIA Valuation Insights

RIA Valuation Insights