What Should You Expect as an RIA Buyer or Seller?

Advisor Growth Strategies’ New Study Offers Insights into RIA Deal Mechanics

RIA M&A has been a well-publicized topic in the industry. There was a record level of RIA M&A in 2018, and so far in 2019 there are no signs that deal pace is slowing down. Against this backdrop, a new study conducted by Advisor Growth Strategies (AGS) and sponsored by BlackRock sheds light on the realities facing RIA buyers and sellers. Based on transaction information for over 50 RIA deals, the study examines the relationship between deal price and deal terms. The full study is available here.

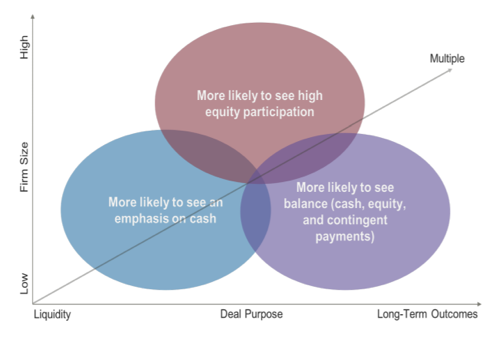

The study categorizes RIA deals based on purpose (short-term or long-term), size (small target or large target), and payment structure (certain or uncertain). The synthesis of these factors impacts the transaction multiple, as shown in the chart from the study below.

While the deal multiple is a convenient short-hand way to summarize a transaction, as the chart above suggests, it does not tell the full story. Still, the deal price and multiples are what makes the headlines (if terms are publicly disclosed at all) because the nuances of an earn-out arrangement don’t make for an exciting press release.

You Pick the Price, I’ll Name the Terms

Because of the lack of transparency and media focus on non-price deal terms, the market norms and trends for this important aspect of RIA M&A are often unfamiliar to first time buyers or sellers. However, non-price deal terms can be just as important or even more important than the deal price. This is particularly true in RIA deals, where buyer stock and/or contingent consideration may account for a significant portion of total deal value. The AGS study provides some insight into the state of deal terms in the RIA M&A market from the perspective of both buyers and sellers. We’ve highlighted some of the key takeaways from the study below.

- While there are many small (and successful) RIAs, the largest 5.4% of firms by AUM control 63.2% of AUM. The largest RIAs command premium multiples, but these firms are a minority. The study (which focused on smaller RIAs) found that the median adjusted EBITDA multiple for M&A transactions between 2015 and 2018 was 5.1x, and there was little variation over the period. RIAs must choose between pursuing scale through inorganic growth or maintaining a boutique approach.

- Large acquirers (e.g., Focus Financial, HighTower, CapTrust, Mercer Advisors) are setting the pace for deal terms. Given the proliferation of capital providers in the space, providing a successful long-term outcome is now the differentiator for these “acquisition brands.” Compared to smaller, less frequent RIA acquirers, the acquisition brands have a leg up based on their demonstrated and repeatable growth engine, robust human capital and technology, ability to add service diversification, and access to capital. For sellers, the turn-key offerings provided by acquisition brands are a benchmark for establishing rational expectations.

- RIA deal terms now provide an average of 60% of cash consideration at closing. For buyers, this means a high barrier to entry and critical need for a solid integration strategy. For sellers, liquidity at close is nice, but accepting a relatively high upfront payment may not maximize the overall valuation.

- While RIA cash flows have been increasing, multiples have remained relatively consistent between 2015 and 2018. Buyers must find a balance between price and terms based on the transaction’s purpose to get sellers to commit.

- Up to 40% of consideration is being paid in buyer stock. In general, larger deals saw a greater proportion of total consideration in the form of buyer equity. For buyers, this means that it is critical to demonstrate the merits of their business model and to articulate a path to liquidity (particularly for privately held acquirers). For sellers, the burden is on them to evaluate the investment merits of their acquirer. When buyer stock is part of the consideration, the buyer and seller are in the same boat after the transaction, so it is critical that both parties evaluate the investment merits of the combined entity.

- Buyers are assuming more of the risk in RIA transactions. 75% of the transactions in the study had less than 25% of the total consideration allocated to contingent consideration, and the contingent payments were relatively short-term (all were less than three years). Given these terms, buyers must be willing to assume some of the risk of the transaction and have a clear integration plan.

M&A Outlook

With over 11,000 RIAs operating in the U.S., we expect that consolidation will continue and deal volume will remain strong. The AGS study suggests that, at least for most firms, multiples have been relatively consistent over the last several years. Without major changes to deal terms and structure, this may continue to be the case. Market forces have and will continue to impact non-price deal terms. Acquisition brands are a growing force in the industry, and their influence on deal terms will likely grow accordingly. At some point, every RIA will likely become either a buyer or a seller and will confront the tradeoffs between price and deal terms and other market realities as they exist at that time.

RIA Valuation Insights

RIA Valuation Insights