What Wealth Managers Need to Know About the Income Approach

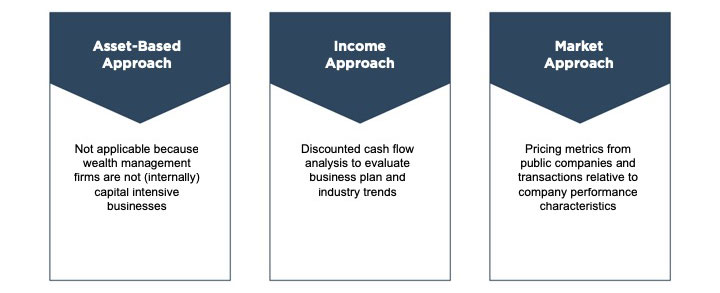

There are three general approaches to determining the value of a business: the asset-based approach, the income approach, and the market approach. The three approaches refer to different bases upon which value may be measured, each of which may be relevant to determining the final value. Ultimately, the concluded valuation will reflect consideration of one or more of these approaches (and perhaps several underlying methods) based on those most indicative of value for the subject interest. The chart below summarizes the methods typically used to value wealth management firms under each valuation approach.

This week, we take a look at how the income approach is used to value wealth management firms.

What is the Income Approach?

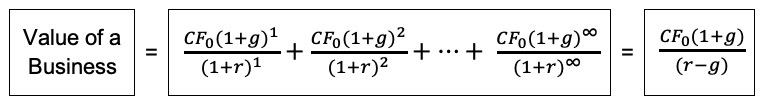

The income approach is a general way of determining the value of a business by converting anticipated economic benefits into a present single amount. Simply put, the value of a business is directly related to the present value of all future cash flows that the business is reasonably expected to produce. The income approach requires estimates of future cash flows and an appropriate discount rate with which to determine the present value of future cash flows.

Methods under the income approach are varied but typically fall into one of two categories:

- Single period capitalization of free cash flow

- Discounted future cash flow model (DCF)

Single Period Capitalization Model

The simplest method used under the income approach is a single period capitalization model. Ultimately, this method is an algebraic simplification of its more detailed DCF counterpart. As opposed to a detailed projection of future cash flow, a base level of annual net cash flow and a sustainable growth rate are determined.

The denominator of the expression on the right (r – g) is referred to as the “capitalization rate,” and its reciprocal is the familiar “multiple” that is applicable to next year’s cash flow. The multiple (and thus the firm’s value) is negatively correlated to risk and positively correlated to expected growth.

There are two primary methods for determining an appropriate capitalization rate—a public guideline company analysis or a “build-up” analysis. The most familiar method applies the P/E ratio from a guideline public company analysis. A build-up analysis can be based upon the Capital Asset Pricing Model (CAPM) or Adjusted CAPM (ACAPM). Both the P/E ratio and the built-up capitalization factor articulate the risk and growth factors that investors believe underlie earnings measures.

Discounted Cash Flow Model

Wealth management firms are frequently valued using the DCF method because this method allows for detailed modeling of revenue and expense items over the discrete projection period. A discrete projection period of three to five years is typically employed so that AUM trends, fee levels, and operating expenses can be modeled with reasonable certainty based on the current trends and business model. Beyond the discrete projection period, it is assumed that the business will grow at a constant rate into perpetuity. In circumstances where no changes in the business model or capital structure are expected, a single period capitalization method may suffice.

The discounted cash flow methodology requires three basic elements:

- Forecast of expected future cash flows

- Determination of terminal value

- Selection of an appropriate discount rate

DCF Element #1: Forecast of Expected Future Cash Flows

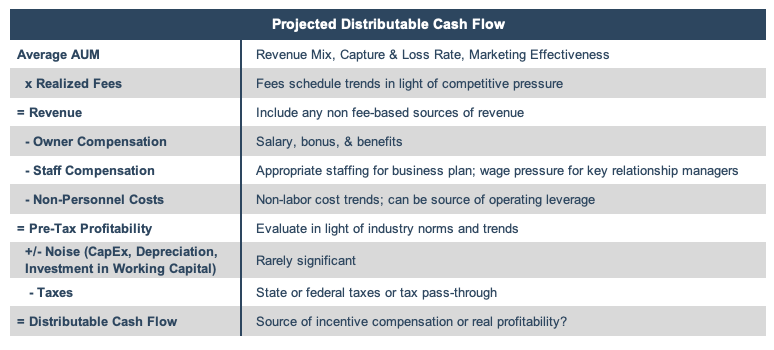

A DCF model requires a base level of cash flows to use as a starting point to model future growth and profitability.

The base rate of profitability is determined by a wealth manager’s current revenue and cost structure, with possible adjustments made. It is often said that wealth managers generate revenue while they sleep, as revenue is a function of assets under management and is typically not performance or commission based. The fee-based revenue model used by most wealth management firms allows us to determine an ongoing (run rate) level of revenue by multiplying assets under management at any given day by the business’ average realized fee structure.

The base rate of expenses for wealth management firms is typically based on reported expenses over the most recent annual period, with adjustments made for various items (the most significant of which typically relates to normalizing compensation).

Projecting Cash Flow for Wealth Managers

We typically view the discounted cash flow method as superior to the single period capitalization approach as it is more dynamic and allows for the discrete forecasting of cash flows. Projections of future cash flows rely on many assumptions as explained below.

Assets Under Management

Trends in AUM growth should include new business gained and expected market returns based on overall asset allocation. When determining growth in AUM, it is important to ask what has historically driven growth and if it is reasonable to assume that this trend will continue. For example, has a firm’s historical AUM growth been driven by market movement or by new client generation? Markets have good years and bad years, but strong client relationships (and the ability to generate new ones) result in a continual source of new assets to manage. As mentioned in a prior post, “Client assets (AUM) do correlate to a great extent with the market, but client relationships do not.” Without proper relationship management, assets leave and revenue suffers.

Markets have good years and bad years, but strong client relationships (and the ability to generate new ones) result in a continual source of new assets to manage.

Further complicating new AUM generation, many wealth managers have aging customer bases and are struggling to attract younger clients who are more likely to choose passive alternatives. As managers struggle to gain new clients in light of the competitive environment, effective marketing has become increasingly important.

Realized Fees

Projected realized fees are typically evaluated in light of historical levels. However, fee compression has plagued the industry in recent years, and in light of increasing fee consciousness among clients, many wealth managers are cutting fees in order to stem outflows.

Compensation

Wealth management is a relationship business, and relationships require the time and energy of a dedicated staff. The majority of a typical wealth management firm’s expenses are personnel expenses, which include salaries, bonuses, and other benefits for employees and owners. Compensation generally tracks revenue closely, making operating leverage more pronounced with non-compensation related expenses than compensation related expenses.

Compensation programs tend to evolve in wealth management firms and over time take on a life of their own. Inevitably, compensation programs tend to be intertwined with business models and ownership. The valuation process typically includes an analysis of the compensation program to formulate a normalized margin that can be used to value the firm.

The valuation process typically includes an analysis of the compensation program to formulate a normalized margin that can be used to value the firm.

The compensation structure for owners is often affected by the tax environment. The corporate structure of a firm (C Corp vs S Corp or other pass-through entity), as well as the current federal and state tax environment, frequently determines whether firms pay out profit as bonuses or distributions. For example, in states with high corporate tax rates but no personal income tax, income is more likely to be paid out in the form of bonus compensation rather than distributions in order to reduce taxable income at the corporate level.

Non-Compensation Operating Expenses

Marketing expenditures have increased as wealth managers seek to attract new, often younger, clients. We have seen an increased focus on branding as wealth managers seek to connect with clients on a more personal level. Additionally, spending on technology has increased as wealth managers update their platforms to increase transparency and cater to younger clients who prefer to manage their accounts online. This increased reliance on technology has allowed some wealth managers to reduce overhead combatting margin compression.

With some exceptions, wealth managers’ non-compensation operating expenses are generally fixed in nature, which allows wealth managers to take advantage of operating leverage over time.

DCF Elements #2-3: Terminal Value & Discount Rate

Once it is assumed that the business will achieve a constant level of performance, the remaining cash flows are capitalized and represented by a terminal value. An appropriate discount rate is used to discount the forecasted cash flows and the terminal value to the present.

The sum of the present values of all the forecasted cash flows (both the discretely forecasted periods and the terminal value) is the indication of value for a specific set of forecast assumptions.

Reconciliation of Value

Your firm’s valuation should clearly articulate the observations, assumptions, adjustments, and empirical data upon which the income method is based. If your valuation provider cannot develop and report their analyses in a manner that you sufficiently understand, get clarification or a new appraiser. You may not agree 100% with the conclusion, but you should understand the methods used and recognize your wealth management firm in the report.

Additionally, your firm’s valuation should make sense in light of industry trends and valuations observed within the public and private markets.

Next week, we will look more closely at the market approach and how it can be used to better understand the value of wealth management firms.

RIA Valuation Insights

RIA Valuation Insights