What’s the Latest on Broker Protocol?

It’s been several months since Morgan Stanley and UBS departed from the Protocol for Broker Recruiting, and the industry is continuing to feel the ripple effects of their maneuver. Much remains to be seen, but many analysts expect more firms to abandon the protocol despite Wells Fargo’s and Merrill Lynch’s recent announcements to stick with it for now. All of these firms were early adopters of the protocol, which has grown to include nearly 1,800 firms today.

A Changing Tide

Historically, firms have joined the protocol with the expectation that they could maintain a lock on their advisors due to their distinct advantages in trading capabilities and investment offerings over the independent model. However, recent technological advancements make it easier for advisors to become registered and serve clients on their own. Advisors also now have the option of the consolidator route through which firms like Dynasty Financial Partners, HighTower Advisors, Focus Financial Partners, and United Capital provide them with liquidity options and greater autonomy to serve clients and recruit other advisors.

There’s also the issue of vesting schedules and expiring contracts that were signed at the peak of the last financial crisis. Many of the brokers who signed retention deals at Merrill Lynch or UBS in 2009 are now fully vested and more incentivized to jump ship. Meanwhile, the FAs at Morgan Stanley who received retention deals as a result of the JV with Smith Barney in 2009 will become free agents at the end of this year.

Another side effect of the protocol is the increasing consolidation of the IBD space. Many wirehouse FAs are turning to the IBD model to gain access to an RIA platform with the continued support and resources that a broker-dealer can provide. According to an InvestmentNews report, the three largest IBDs (Ameriprise, LPL Financial, and Raymond James) saw a 42% increase in FA recruitment during 2017. Simply put, the RIA/IBD hybrid model is a more appealing alternative over the wirehouse model in the eyes of many FAs looking for a change.

The Undercurrent

Still, firms like Raymond James that have used the protocol to successfully poach advisors from their competitors will likely stick around. The few net winners in the wirehouse recruitment saga over the last ten years have little or no reason to abandon protocol. Many have lost more advisors than they’ve recruited; therefore, it’s hard to stay with a program that clearly hasn’t helped them. One could certainly view the departure of Morgan Stanley and UBS as a concession of their own inability to effectively recruit and retain during the protocol era.

Many FAs may find it more difficult to sell their book of business (or at least realize full value) in a post-protocol world. If it’s riskier and more expensive to join another broker-dealer, then current employers could use these circumstances to reduce payouts to their advisors. It could also be more challenging to transfer clients to another platform, thereby limiting the number of prospective buyers. In short, FA economics are not likely to improve when their employers decide to break protocol.

Impact on RIA Valuations & Deals

What about RIA valuations? Abandoning protocol should make it easier to retain FAs but also makes it harder to recruit from other firms that have done the same. We’ll call that a tie. If RIAs can use this to gain leverage over their advisors and offer lower payouts, then margins and profitability should improve. Valuations should improve on higher earnings, so, on balance, this could be bullish for RIAs and the wealth management industry (at least from the employer’s perspective). Still, not everyone will abandon protocol. Many RIAs do not recruit experienced hires and will likely be unaffected by recent events.

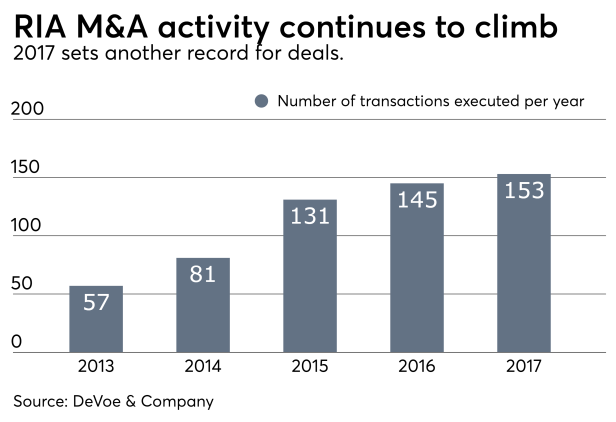

The effect on sector deal making will likely be more nuanced. Matt Sonnen and his team at PFI Advisors see this as a major opportunity for RIAs to recruit from the wirehouses before the door shuts and more firms abandon protocol. It appears that we’ve already seen some of this take place:

This trend should continue until the dust settles at which point it will make the transition process riskier and more expensive. When this happens we could see a curtailment of the recent momentum though it seems unlikely that we would revert back to 2013-14 levels in the absence of another bear market. We’ll keep you apprised of how all this shakes out in future posts.

Mercer Capital’s RIA Valuation Insights Blog

The RIA Valuation Insights Blog presents a weekly update on issues important to the Asset Management Industry. Follow us on Twitter @RIA_Mercer.

RIA Valuation Insights

RIA Valuation Insights