When Buy-Sell Agreements Blow Up

What Would Mom Do?

Ferrari FF, spotted last week in Grenoble, France

Nobody’s perfect.

You’re a successful portfolio manager but you forgot Mother’s Day this past weekend. What now? May I suggest you buy mom the ultimate grocery-getter: the Ferrari FF. I spotted the one photographed above outside my hotel last week in Grenoble, France, where I was for an all-too-quick business trip. The Ferrari FF has the credentials typical of Maranello: a 6.3 liter V-12 producing 651 horsepower and 504 foot pounds of torque that through the all-wheel drive system propels the FF to 60 miles per hour in less than four seconds on its way to a top speed of 208 mph.

Unlike a new Bentley Bentayga – getting one of these for mom won’t imply that you just want her to take over carpool for the grandchildren. Your mom may ask whether or not anyone really needs a two door station wagon that goes two hundred miles per hour and costs $300 thousand. Just tell her that the FF is a good example of the answer to a question that no one ever asked.

The subtitle of Chris Mercer’s original book on buy-sell agreements is “Ticking Time Bombs or Reasonable Resolutions?” Implicit in this title is that parties to buy-sell agreements too often discover the painful implications of the question never asked. I think about this every time we work on a dispute resolution project involving a buy-sell disagreement. In particular, I think about one of the first ones that I worked on, where maybe there was no disagreement, but should have been.

Where There are Winners, There are Losers

Many years ago we were hired to do valuation work for the estate of the founder of a successful RIA, who died unexpectedly. We were not asked to value the estate’s interest in the asset management firm as this was provided for by a mechanism in the buy-sell agreement. We were merely asked to check the math and make sure the estate wasn’t being short-changed. Long story short, it wasn’t.

There’s no point in going into the particulars of the pricing mechanism in that RIA’s shareholder agreement, (as that would be tangential to the story) but the value implied was rich. It might have been achievable in a change-of-control sale to a highly motivated buyer, with capacity, under the very best of circumstances. As it was, the company was required to redeem the interest with the help of some life insurance and, as I recall, some term financing. The decedent was the largest shareholder at the firm, and to the extent that anyone is a “winner” in these circumstances, the estate got the best of the pricing mechanism in the buy-sell agreement.

Unfortunately, where pricing creates winners it symmetrically creates losers. The firm was on the hook for the redemption, which means that the remaining, or continuing, shareholders of this RIA were forced to overpay for the estate’s interest, effectively diluting the economic value of their ownership for years to come. Compound this with the loss of the founder’s contributions to the firm (he was an important client relationship manager), and the continuing partners had to essentially rebuild the value of their ownership. With favorable markets and good stock picking, they succeeded. We’ve seen other RIAs that, put in a similar circumstance, would not have fared so well.

However, going to the other extreme (forcing buy-outs at a heavily discounted value) isn’t necessarily better. Economically, to the extent that a minority shareholder is involuntarily redeemed at a discounted value, the amount of that discount (or decrement to pro rata enterprise value) is arithmetically redistributed among the remaining shareholders. Generally speaking, courts and applicable corporate statutes do not permit this approach because it would provide an economic incentive for shareholder oppression.

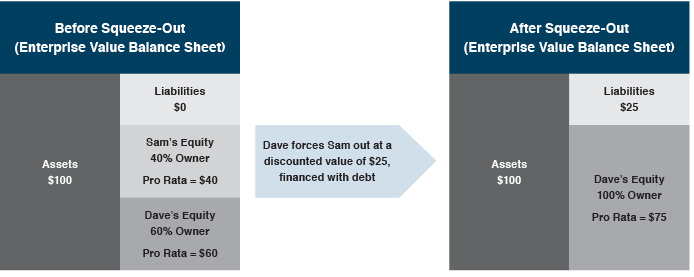

By way of example, assume a business is worth (has an enterprise value of) $100, and there are two shareholders, Sam and Dave. Dave owns 60% of the business, and Sam owns 40% of the business. As such, Dave’s pro rata interest is worth $60 and Sam’s pro rata interest would be valued at $40. If the 60% shareholder, Dave, is able to force out Sam at a discounted value (of, say, $25 – or a $15 discount to pro rata enterprise value), and finances this action with debt, what remains is an enterprise worth $75 (net of debt). Dave’s 60% interest is now 100%, and his interest in the enterprise is now worth $75 ($100 total enterprise value net of debt of $25). The $15 decrement to value suffered by Sam is a benefit to Dave. This example illustrates why fair value statutes and case law attempt to limit or prohibit shareholders and shareholder groups from enriching themselves at the expense of their fellow investors.

Answering the Question Nobody Asks

So, when you look at your firm’s shareholder agreement, think about the question – “Does my buy-sell create winners and losers?” If so, are you content with whom those winners and losers might be?

Does the pricing mechanism create winners and losers? Should value be exchanged based on an enterprise valuation that considers buyer-seller specific synergies, or not? Should the pricing mechanism be based on a value that considers valuation discounts for lack of control or impaired marketability? Exiting shareholders want to be paid more and continuing shareholders want to pay less, obviously. What’s not obvious at the time of drafting a buy-sell agreement is who will be exiting and who will be continuing.

There may be a legitimate argument to having a pricing mechanism that discounts shares redeemed from exiting shareholders, as this reduces the burden on the firm or remaining partners and thus promotes the continuity of the firm. If exit pricing is depressed to the point of being punitive, the other shareholders have a perverse incentive to artificially retain their ownership longer and force out other shareholders. As for buying out shareholders at a premium value, the only argument for “paying too much” is to provide a windfall for former shareholders, which is even more difficult to defend operationally.

What Would Mom Do?

Ownership works best when it is structured to support the operations of the firm. Maybe this is easier said than done, but the lesson certainly applies to the mechanics of a buy-sell agreement. Your mom probably told you that “nobody ever said life was fair,” but she wasn’t giving license to promote unfairness. Balancing the fairness to both exiting and continuing shareholders in your buy-sell agreement will support the operations of your RIA, which will help build enduring value in the firm, ultimately benefiting everyone.

RIA Valuation Insights

RIA Valuation Insights