Who Should Own Your RIA?

The Best Ownership Model Is One That Supports the Business Model

For over seventy years, the Lotus marque has produced many brilliant cars but has never had an ownership model that supported consistent success. (1987 Lotus Esprit Turbo - Calreyn88, CC BY-SA 4.0

Aside from the initial startup years, when fledgling RIAs struggle to achieve profitability, the most difficult period that most firms endure is the transition from the founding generation of leadership to G2.

For those that make the transition, getting from the second generation to the third, and so forth, is comparatively easy. Much of this difficulty relates to a contemporaneous transition of ownership — not just the identities of the owners but also the structure of the ownership.

Does Your Ownership Model Support Your Business Model?

One common problem our clients bring us is that their ownership model no longer supports their business model. Some realize this before they speak to us; others soon figure it out.

Many of our clients are firms that have successfully made it through their startup years and have prospered through their 20th or 25th anniversaries. By all outside appearances, they’ve made it. They’ve exceeded their original business plans, with billions more under management generating millions more in profit than they imagined. They have happy clients, nice offices, satisfied regulators, and good standing in their communities.

Internally, though, the leadership senses something is off. Growth has slowed. Margins are waning. Median staff age is edging closer to retirement. The future seems much less clear. Many are surprised to find themselves at an inflection point right when they’ve achieved what they previously would have considered success.

How to shake off the mature firm malaise? Most start by scouring the financials. More growth might help. Tweak the marketing plan. Join the many seeking acquisitions. Scale and margins go hand in hand in an industry with high levels of operating leverage.

But more of the same sometimes just gets you, well, more of the same. Bigger, yes, but with the same, bigger problems. The answer may not be on the P&L; it may be on the cap table.

The Four Primary RIA Ownership Models

If you think your firm is at this point, it may be time to reconsider your ownership model. Very often, the ownership model that makes a firm in the early years can break it in the longer term. Changing ownership models is a laborious process, but it isn’t optional.

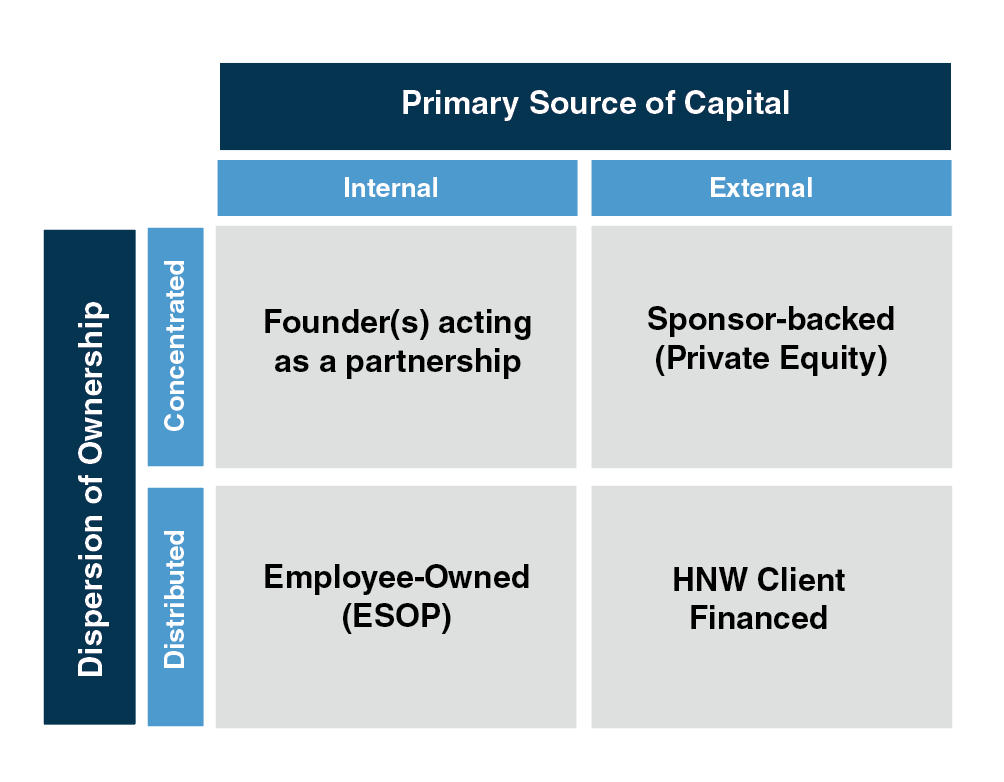

RIAs are typically owned one of four ways, depending on whether their ownership is internal or external and whether or not the dispersion of ownership is broadly distributed or more concentrated.

Characteristics of Concentrated, Internal Ownership Models

Founder-owned firms (concentrated, internal) are, obviously, characteristic of the first generation of ownership for many RIAs. These firms might be owned by one founding leader or a group operating as partners.

This ownership model has tremendous advantages in the early years of a firm when ownership returns and compensation to leadership are often harder to distinguish. Concentrated internal ownership leaves no guesswork as to the alignment of interests and makes for the more efficient decision-making needed when a firm is getting established. This assumes, of course, that the partners can generally agree, as this model doesn’t manage internal disputes very well.

Time is the enemy of this ownership model; corporations last longer than careers. Admitting (or expelling) partners from a founder-led model is both perilous and expensive. Ownership succession is a constant focus but difficult to envision because any firm only has one generation of founders.

Distributed, External Ownership Models

Client-financed firms (distributed, external) make up the other typical form of first-generation ownership. Often, a management team breaks away with the assurance from UHNW investors that they will help bootstrap the operation.

This model is especially prominent in state-chartered independent trust companies, where regulatory capital requirements mandate a significant opening balance sheet and where the founders came from commercial banks where the shareholder and staff lists had little overlap. Client-financed firms often have large numbers of independent directors who rely on management to make operating decisions.

Distributed, external ownership models offer more flexibility for owners coming and going. But this model can still present issues as the founding generation of external investors reaches an age at which they want to monetize their investment.

Absent an internal market or way to fund redemptions this may force the sale of the firm. Also, as the economics of the firm’s success are portioned between owners and labor, it’s easy to have disagreements about compensation practices and distributions.

Distributed, Internal Ownership Models

Employee-owned firms (distributed, internal) are typically a generation of ownership subsequent to the founding group. Broad ownership may be achieved in a major transaction, such as the establishment of an Employee Stock Ownership Plan (ESOP), or gradually through a series of purchases by employees or grants of equity compensation.

This ownership model has the advantage of being a perpetual model so long as it is carefully and regularly maintained. That maintenance usually involves establishing some kind of internal market for the stock, with annual independent valuations prepared to set buyer and seller expectations. Buy-sell agreements with restrictions on transfers are critical to securing internal ownership, and a strong board of directors is important to maintain discipline in decision-making.

Concentrated, External Ownership Models

Sponsor-backed ownership (concentrated, external) is the model that makes most of the headlines these days, but private equity is involved with less than 20% of the RIA community by AUM.

PE is making a best-efforts attempt to professionalize ownership in the RIA space, with ownership agreements, reporting requirements, and lists of consents and discretions to carefully delineate who controls what in a sponsor-backed firm. This is a G2 ownership model, opted into because PE can offer better prices to G1 owners, better discipline for long-term stewardship of the organization, and the possibility of operating efficiencies for continuing partners. The downside is loss of control and everything that goes along with that.

Of the four ownership models, this is the newest and the one we ultimately know the least about. Ask me in 20 years how it’s going.

Who Should Own Your Firm?

You manage money. You manage clients. You manage staff. But do you manage your ownership?

If you recognize your ownership model in the list above, and if you see a schism forming between how your company is owned and how it is operated, it’s time to stop and think. What is the best ownership model today, and what will the best ownership model for your firm be in, say, five years?

The pivot from one model to another is time-consuming and complex. You can try to avoid the brain damage of all this by selling your problems (and your assets) to somebody else, but they’re going to want your help in making the best of that transaction (more brain damage).

So, take a deep breath, and if you’d like some help thinking this through, give us a call.

There is no one best ownership model. We think the best ownership model for your firm is the one that best supports your business model.

RIA Valuation Insights

RIA Valuation Insights