Why TAMs (Traditional Asset Managers) Continue to Thrive Despite Industry Headwinds

The Memphis Tams from the 1970s and Mike Conley from the Memphis Grizzlies in a Throw-Back Uniform

Condensed History of the TAMS – An American Basketball Association Franchise

Memphis is home to the NBA franchise, the Memphis Grizzlies. One of the predecessor organizations to our hometown Grizzlies was the Memphis Tams. Aptly named for the only professional basketball team in the [T]ennessee, [A]rkansas, and [M]ississippi tri-state area, the Tams were a quick afterthought in the ABA’s history, enduring a lackluster 45-123 record in just two seasons in the early seventies. My dad was one of the few attendees of their home games, played at the now obsolete Mid-South Coliseum, which never saw attendance crest the 5,000 mark. He recalls a bizarre “mustache clause” in each of the player’s contracts, that offered a $300 bonus to those who would grow one and a rather dubious hat-shaped mascot (apparently “tam” is also short for a tam o’shanter, which is a traditional Scottish bonnet, similar to the one donned by Meg Griffin on Family Guy). It was one of Memphis’s most pathetic sports franchises.

Fortunately, this is no longer the case. The current Memphis mascot, though equally dubious given the lack of grizzlies in the tri-state area, is far more intimidating and appropriate for a professional sports franchise. The Grizz are one the few teams to have made the playoffs in each of the last seven seasons and regularly contend for one of the top spots in the tough Western Conference. The club has quietly become one of the league’s most consistent and well-attended franchises, despite attracting virtually no national media coverage or superstar athletes in its 22-year history.

Current Performance of TAMS – Traditional Asset Managers

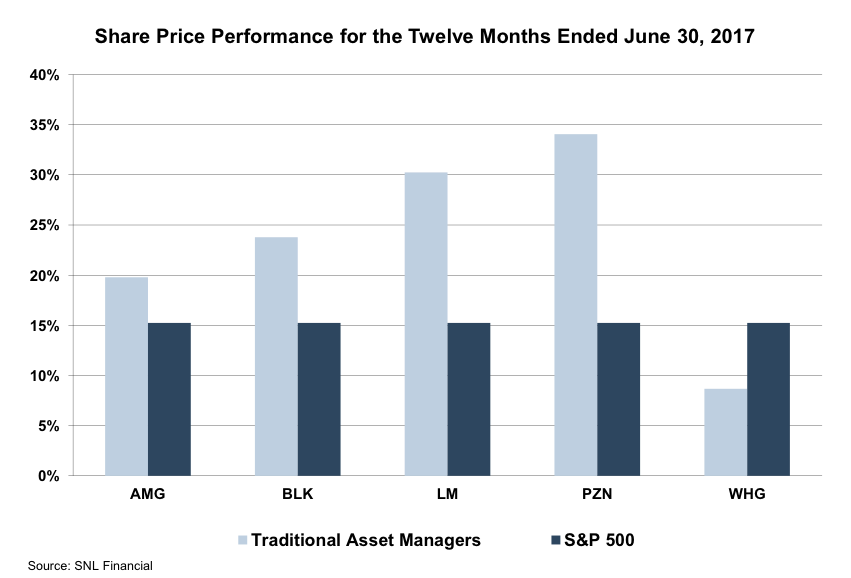

Most traditional asset managers (also sharing the TAM initials), a similarly consistent, yet overlooked subset of the RIA industry, are in bull market territory over the last year in the face of fee compression and continued outflows from active equity products.

While hedge funds and PE firms tend to dominate current RIA headlines, TAMs are quietly gaining market share as investors question performance fees and the lack of transparency offered by many alternative asset managers. Indeed, all five components of our publicly traded TAM group below are up over the last year, and four of them have bested the market by a fairly considerable margin.

Why Are TAMs Performing Well?

We would attribute the group’s gains to both systematic and non-systematic factors. That is, the market’s gain (a systematic force affecting all stocks, especially RIAs) has clearly helped the group’s collective AUM balance, while non-systematic forces such as solid investment performance (PZN), new account additions (BLK), and prior acquisitions (AMG/LM) account for much of the residual success of the individual components. In our experience, most well-established RIAs similarly attribute their success to systematic (market-related) and non-systematic (marketing-related) growth factors.

Conclusion

So, despite their name, most TAMs have performed more in line with the Grizzlies rather than its predecessor over the last several years. In fact the last true bear market for the TAMs and the Grizz alike occurred in the 2008-09 downturn when the TAMs collectively lost over half their market cap, and Memphis lost over two-thirds of its games. Since then, the (RIA) TAMs have more than doubled in value, and the Grizzlies have had one of the highest winning percentages in the NBA. Of note, the only time the Grizz had a worse record than the Tams occurred in the 1998-99 season, when the team went 8-42 and played in Vancouver, which is an actual bear market.

Mercer Capital provides business valuation and financial advisory services to traditional asset managers. If you’d like to discuss a valuation for transaction need in confidence, give us a call.

RIA Valuation Insights

RIA Valuation Insights