Will Direct Indexing Become the Next ETF?

Since their launch in 1993, exchange traded funds (ETFs) have steadily attracted assets from mutual funds and active managers that have struggled to compete on the basis of performance and overall tax efficiency. Now many industry observers believe that the same may very well happen to ETFs with the recent rise of direct index investing (DII). For this week’s post, we look into the pros and cons of DII and the implications for the investment management industry.

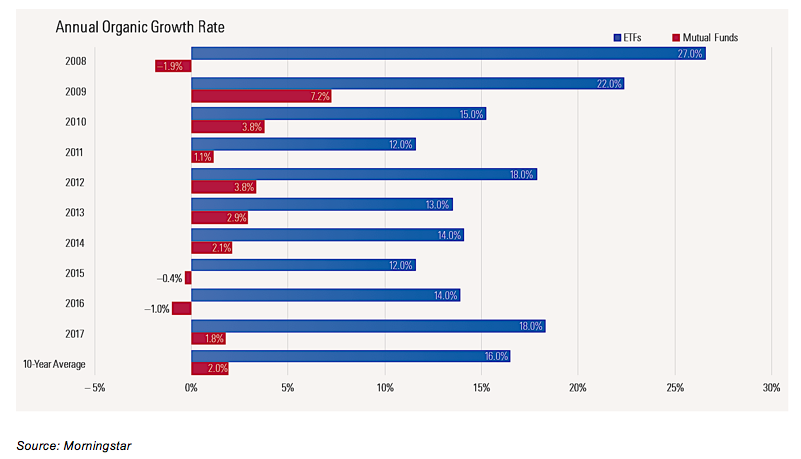

Exchange traded funds took market share from mutual funds because most active managers do not deliver on their value proposition. That is, most active managers underperform their relevant benchmark after fees. ETFs, by their very design, cannot underperform the index they track (ignoring tracking error, which is usually negligible) and are usually quite inexpensive. ETFs gained traction with this obvious advantage and have dominated asset flows over the last decade.

After years of domination, ETFs appear to have a worthy contender in the form of DII. Both are intended to be a form of passive investing designed to track a certain index. The key distinction between the two is that a direct indexing investor actually owns the index’s underlying shares in a separately managed account, as opposed to units in a fund that track the index. Since owning all the stocks in, say, the S&P 500 or Wilshire 5000 (and in proportion to their market weighting) is not feasible for most investors, DII portfolios are usually comprised of a representative sample of securities that should mimic the index’s performance over time.

Advantages and Drawbacks

This design creates certain advantages and disadvantages to direct indexing versus ETF investing. By only investing in a subset of a given index, DII can achieve alpha, unlike passive ETFs. Of course, direct indexing can also underperform a benchmark, and depending on the sample size, can expose investors to idiosyncratic risk factors that ETFs minimize or eliminate through diversification. DII is therefore not a purely passive investment vehicle, and advisors should make their clients aware of this fact.

Just as ETFs are considered more tax efficient than mutual funds, DII has certain tax advantages over ETF investing. Since direct indexers are investing in the underlying shares as opposed to a fund that holds the underlying shares, they can harvest losses when some of these securities decline in value. DII also allows investors to avoid selling the top gainers, while ETF sales effectively involve selling every share of the underlying index pro rata. Over time, such efficiencies can lead to considerable tax alpha relative to ETF and mutual fund strategies.

Direct indexers can also tailor their portfolios to their unique circumstances better than an “off the shelf” ETF. DII can selectively avoid certain sectors of the economy or pursue businesses with higher governance standards. Such customization can be highly beneficial to investors with significant portfolio concentrations or ESG mandates.

Liquidity is also a concern with ETF investing. The rising popularity of ETF products has caused distortions in the market when their daily volume exceeds that of their underlying securities. This disparity can be exacerbated during sell-offs. On August 24, 2015, a sharp decline in the overseas markets led to trading halts in eight S&P 500 stocks, which precipitated a “liquidity traffic jam” for 42% of all U.S. equity ETFs. In one example, shares of the Vanguard Consumer Staples ETF (VDC) fell over 30% while the underlying holdings only dropped 9%.

Still, DII is often more costly and time-consuming than ETF investing. Picking representative securities and building customized portfolios can require considerable resources that are not needed for ETF investing. Trading costs are also higher, albeit at a diminishing rate with advances in rebalancing automation and fractional share investing. Monitoring costs can also be greater, especially for portfolios seeking to minimize tracking error.

Weigh Your Options

On balance, DII is not for everyone. It probably does not make sense for smaller accounts with no diversification issues to pursue such a potentially costly investment strategy. ETFs and robo-advisors are probably better suited for many retail investors, including the mass affluent.

For high net worth clients with significant concentrations and/or ESG needs, on the other hand, direct indexing is likely the superior option. ETF products and robo-advisory firms are simply not equipped to provide the specialized level of services that DII can accommodate for these investors. This void creates opportunities for wealth management firms and their advisors. RIAs providing comprehensive wealth management services can tout direct indexing as a tax-efficient investment strategy that can be tailored to a client’s particular situation.

This may sound familiar. Wealth management firms have been providing these kinds of services well before the invention of ETFs. The difference is that now, with advances in technology and lower transaction costs, these kinds of services can be profitably offered to most high net worth families and not just the ultra-wealthy. Given the growing number of high net worth investors and rising demand for personalized investment solutions, direct indexing should be a boon for the wealth management industry as these trends continue to play out.

Mercer Capital’s RIA Valuation Insights Blog

The RIA Valuation Insights Blog presents a weekly update on issues important to the Asset Management Industry. Follow us on Twitter @RIA_Mercer.

RIA Valuation Insights

RIA Valuation Insights