Will Rate Cuts Improve RIA Multiples?

Most economists and market participants now believe the Federal Reserve will start cutting interest rates at its September meeting as inflationary trends show signs of easing. Naturally, we’re interested in how expected rate cuts will affect the investment management industry’s transaction multiples. Many industry observers believe anticipated rate cuts will have little or no impact on the sector since most RIAs don’t have any debt on their balance sheets. While it’s true that most investment management firms do not employ leverage in their capital structure, lower interest rates will nonetheless impact their cost of equity and, consequently, their valuations. We can illustrate this by way of a common decomposition of the most prevalent valuation metric in the RIA space — the EBITDA multiple.

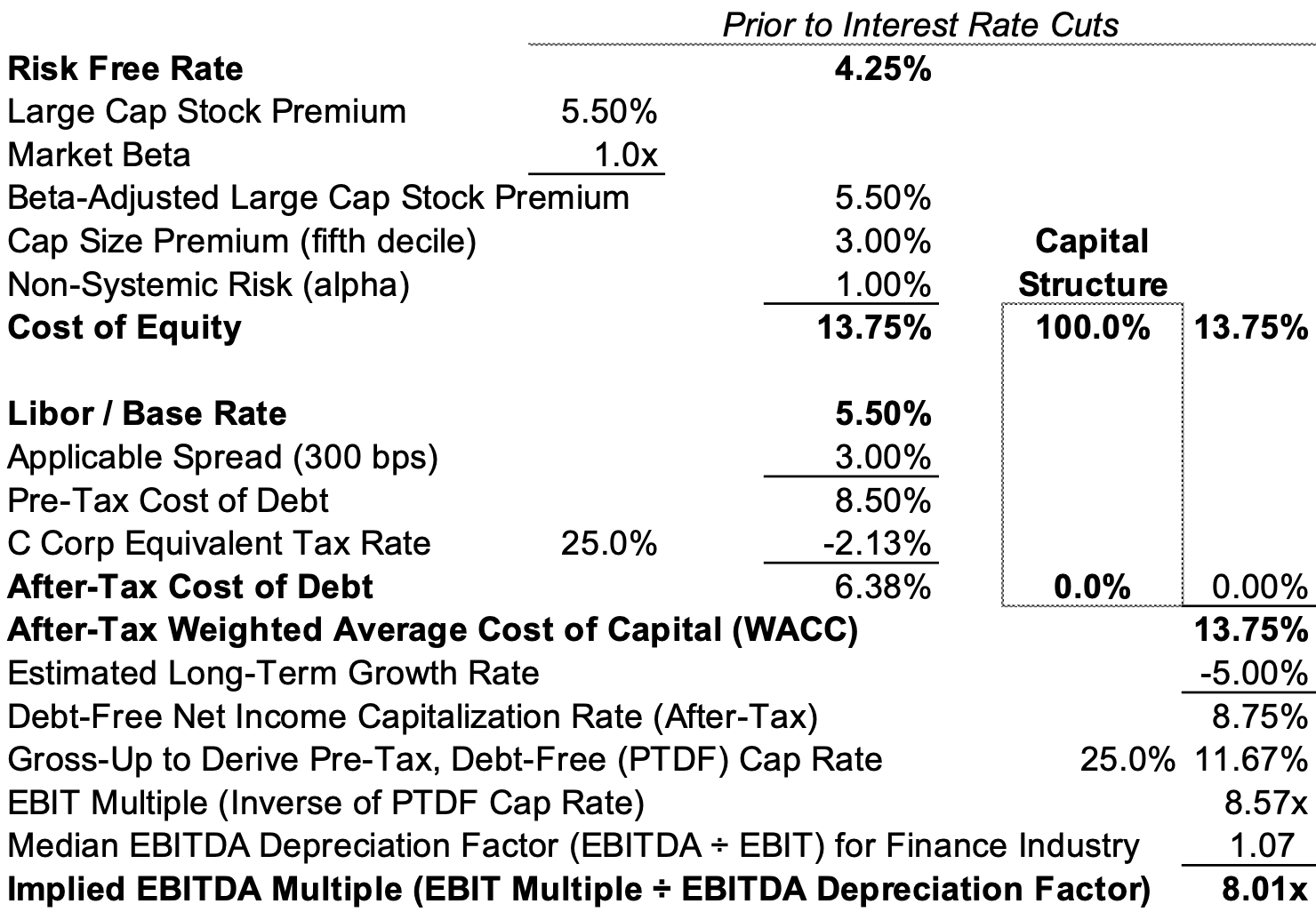

In the interest of simplicity and to avoid trying to show side-by-side discounted cash flow models, we’ll use the EBITDA single period income capitalization method. We won’t dwell on every detail, but you can read more about it in a related article on our website.

This method uses the capital asset pricing model (CAPM) to develop EBITDA multiples based on a company’s risk/growth profile, interest rate levels, and historical returns on publicly traded stocks. We’ve incorporated it here to determine what happens to EBITDA multiples when interest rates go down. This methodology is especially useful to the RIA industry because EBITDA is the most cited performance metric since AUM and revenue rules of thumb tend to vary with profitability. Further, EBITDA is usually a good proxy for cash flow when capital expenditures and interest payments are minimal.

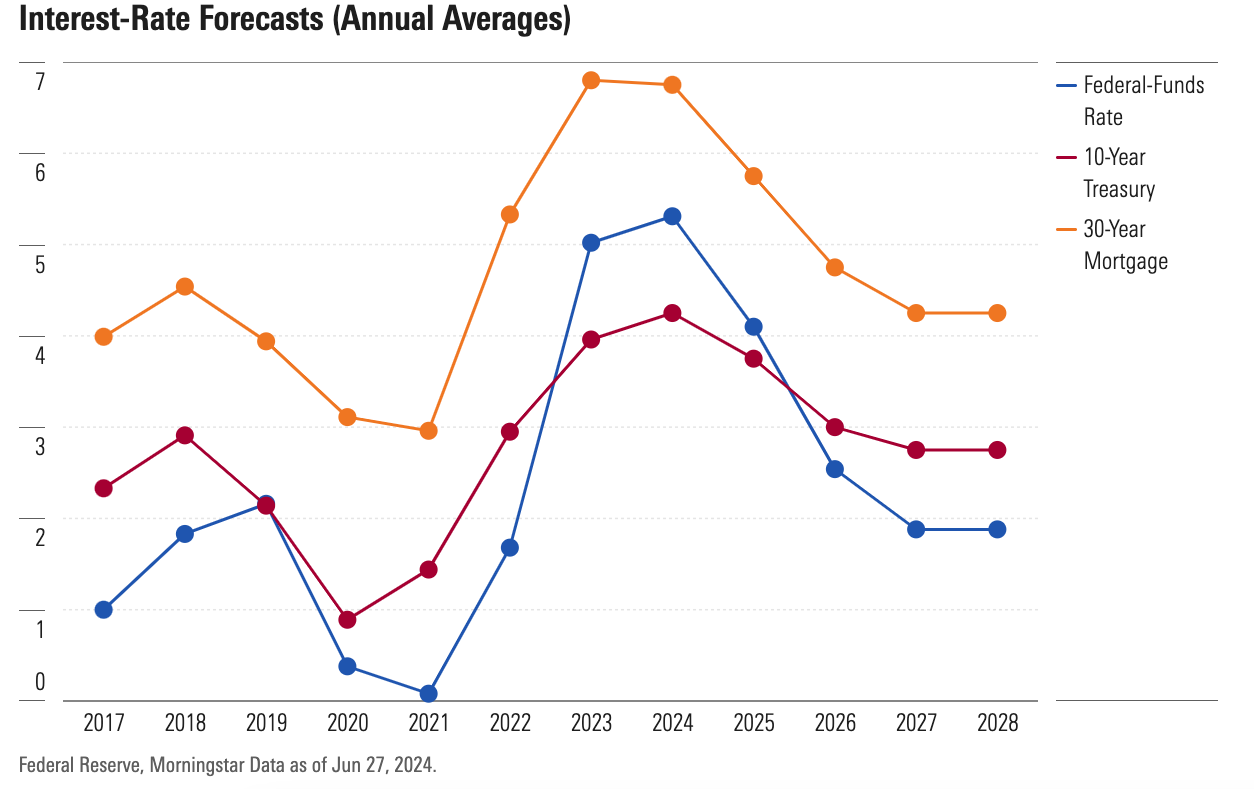

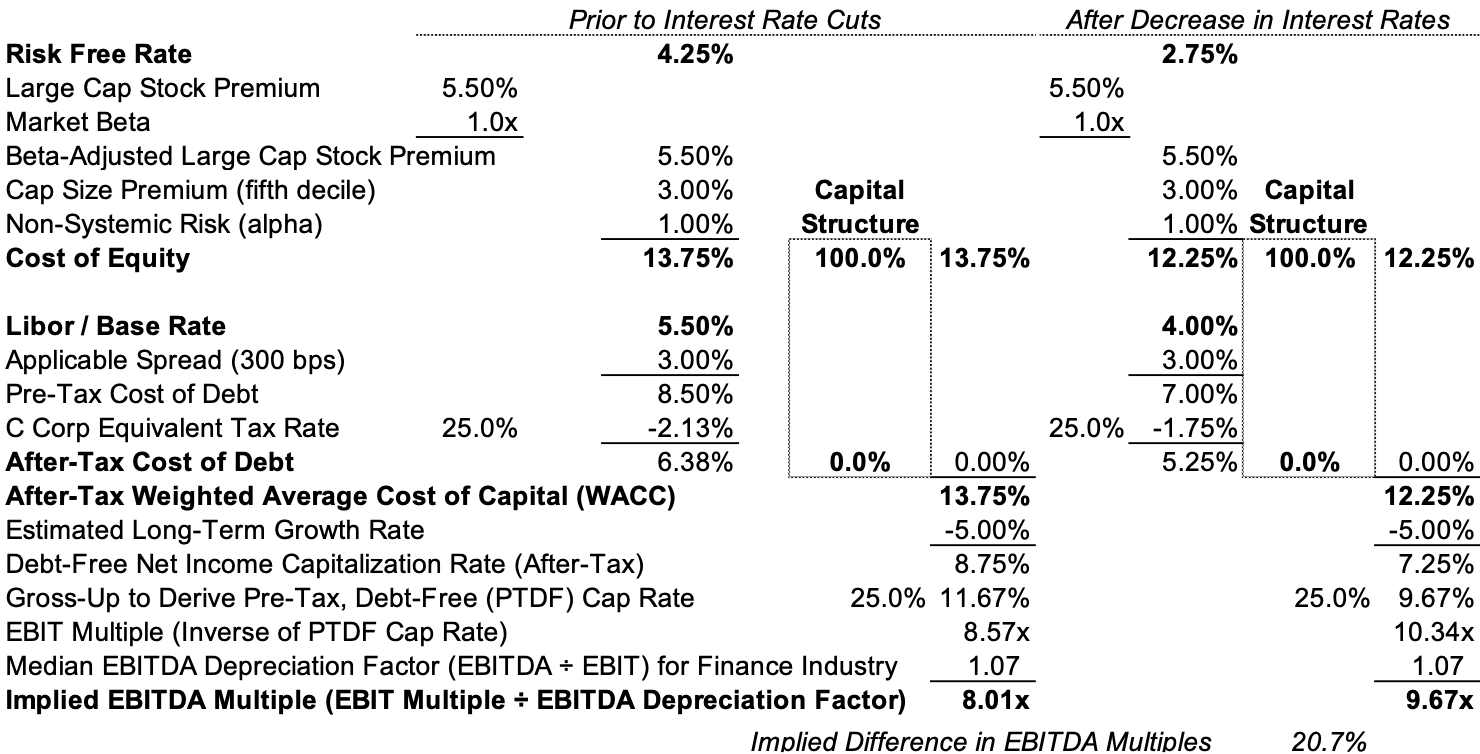

In the first example, we’ll demonstrate the impact of a 150 basis point decrease in interest rates on EBITDA multiples for RIAs with no debt in their capital structure. We’ve assumed this increase based on an expected 1.5% decline in the 10-Year Treasury yield over the next three years.

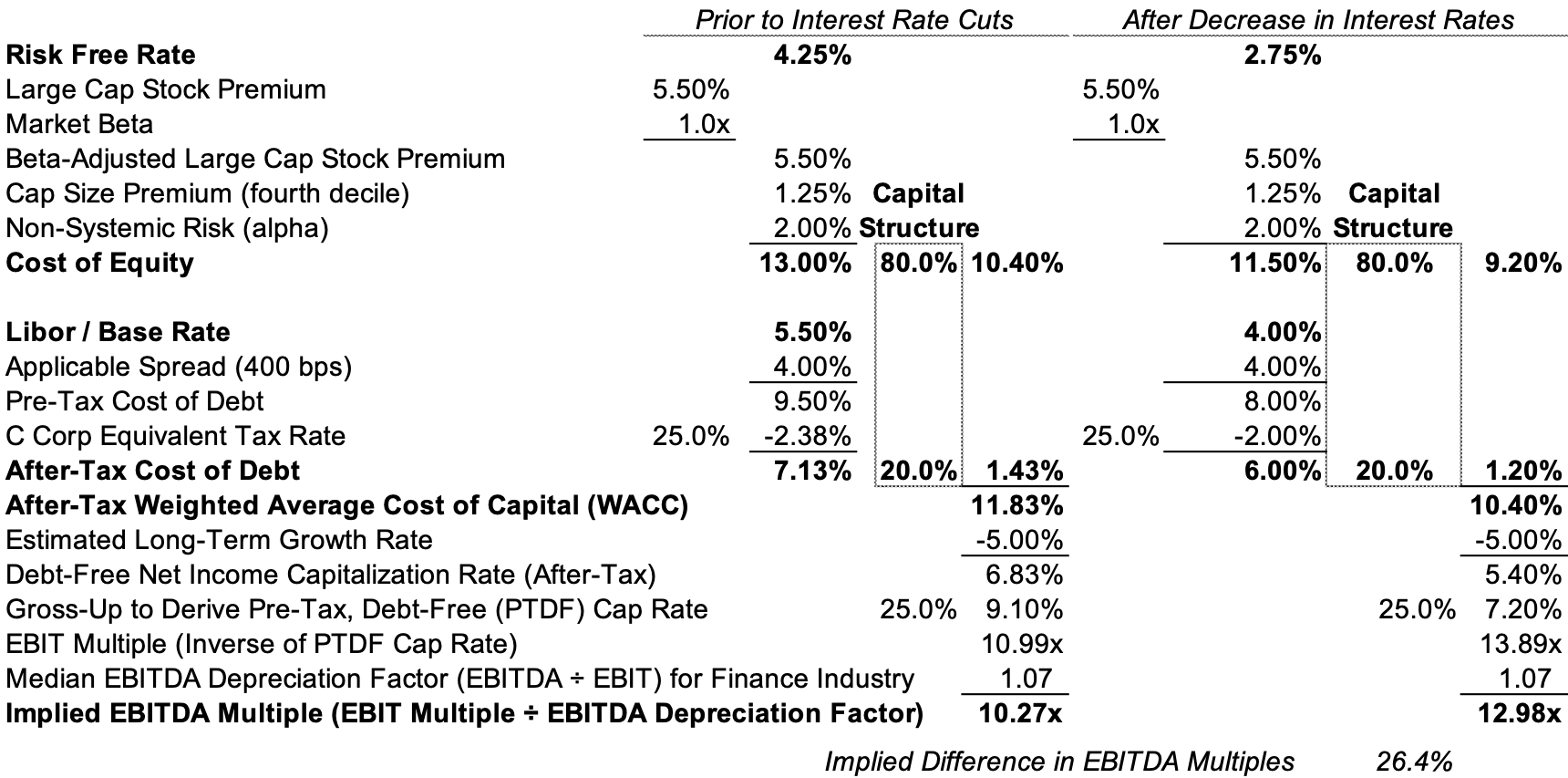

A sample build-up in the cost of capital for an RIA might look like the illustration below. The cost of equity is the sum of expected equity returns in excess of long-dated treasuries plus a non-systematic, or company-specific, risk premium. The cost of debt is typical of covenant-light loans from non-bank lenders to the space, set at a premium to some base rate, illustrated here as Libor. Most RIAs operate without debt, so the weighted average cost of capital, or WACC, is the same as the cost of equity. If you subtract expected growth in cash flow from the WACC, you’re left with a capitalization rate (the inverse of which is a multiple) applicable to debt-free net income. This can be grossed up by the firm’s effective tax rate to derive an EBIT multiple and further adjusted for depreciation to derive an EBITDA multiple. In this case, the implied EBITDA multiple is one that would be familiar to many industry participants.

This illustration derives an implied EBITDA multiple prior to expected interest rate cuts. As noted below, a 1.5% decrease in the 10-Year Treasury yield (which we’re using to approximate changes in the risk-free rate here) results in a 21% increase in the EBITDA multiple (holding everything else constant) even though we’ve assumed no interest-bearing debt in the capital structure. The reason is lower interest rates reduce an RIA’s cost of equity capital because investors in these businesses will require the same incremental return over riskless alternatives to induce investment, so a lower risk-free rate means a lower overall required return on RIA investments. Sellers can negotiate higher prices to satisfy a buyer’s lower required return, and the EBITDA multiple (assuming no changes in EBITDA) will increase with the transaction price.

Click here to expand the image above

Two weeks ago we noted that RIA acquirers and aggregators have accounted for nearly 70% of the industry’s deal volume in the first half of 2024. Since these firms are responsible for a significant portion of the sector’s acquisitions, changes in their cost of capital will affect how much they’re willing to pay for RIAs and the resulting multiple for many industry transactions. In a falling interest rate (and cost of capital) environment, they’ll have the flexibility to transact at higher prices and still satisfy the ROI that justifies the investment.

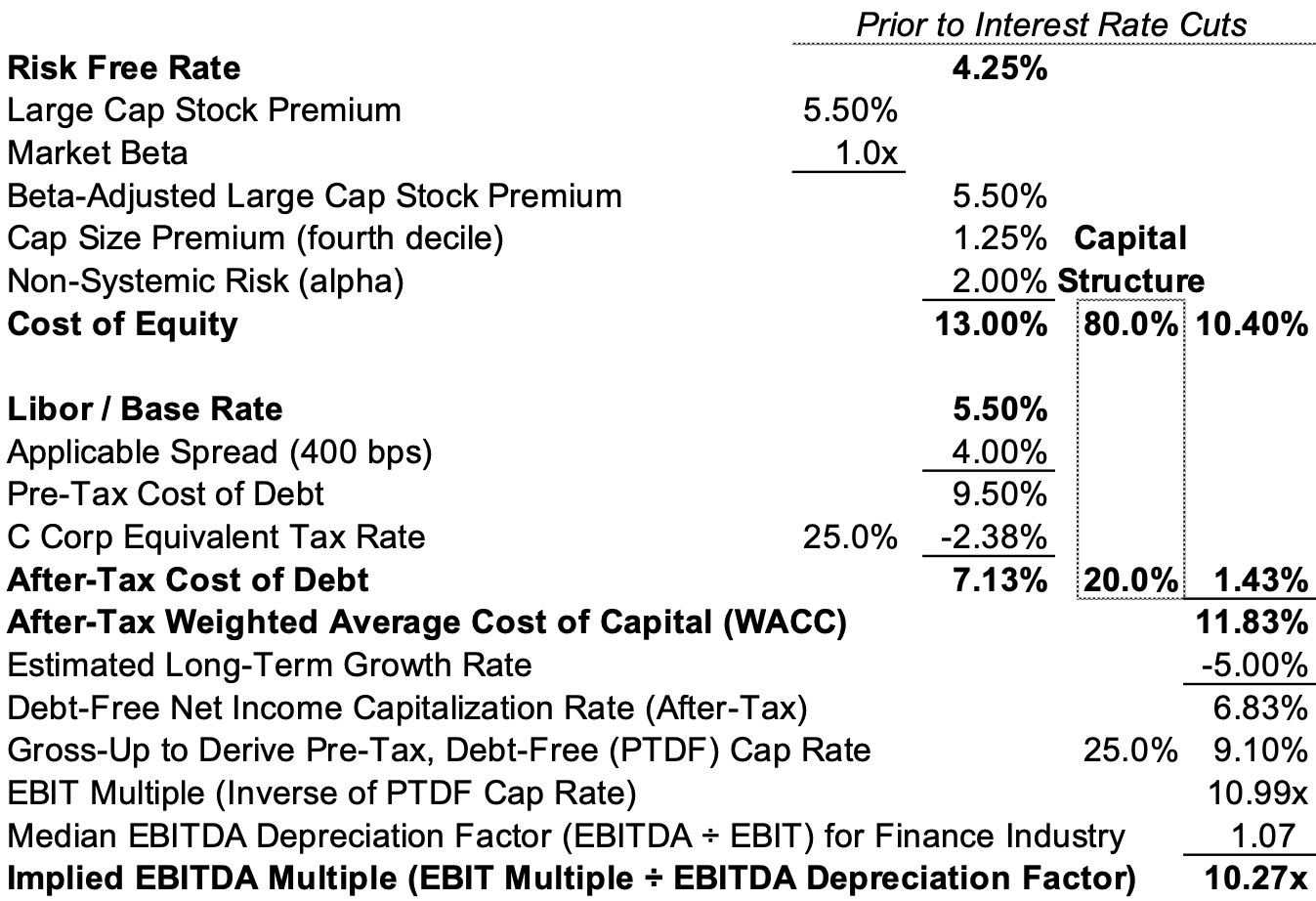

RIA consolidators typically use debt to purchase investment management firms, so their cost of capital can be viewed very differently than a pure-play RIA with little or no leverage. Aggregators employ debt financing because it’s cheaper (lower required rate of return) than equity capital, and interest rates were hovering at historic lows until the Fed began raising interest rates in March of 2022.

The illustration above shows an 80/20 equity/debt capital ratio, which is more conservative than many consolidators have employed. Push the capital structure more toward the debt side, and you’ll quickly get to the 15x or more multiples we’ve heard private consolidators use to describe their valuations.

The higher the multiple, the greater the impact from lower interest rates and vice versa. Unlike most investment management firms, lower interest rates positively affect both debt and equity financing costs for RIA consolidators, so their cost of capital has likely come down in recent months. If we illustrate that same 150 basis point decrease in rates for a consolidator, the impact on EBITDA multiples increases proportionate to their leverage. In this instance, the 1.5% decrease in rates lifts the EBITDA multiple by 26%.

Click here to expand the image above

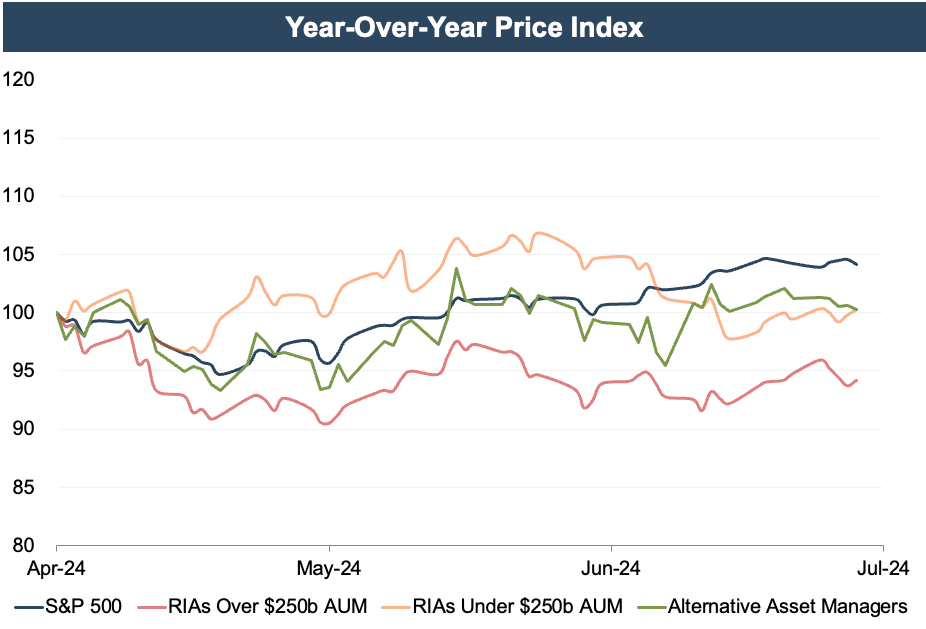

As a result, alternative asset managers, which often employ leverage in their capital structure, have seen significant gains in their stock prices over the last year on rising expectations for rate cuts in the coming months.

This momentum could certainly be derailed if inflationary expectations change and the market begins to anticipate further rate hikes, but that’s not the current consensus. RIA dealmaking has also held up reasonably well against the backdrop of higher interest rates over the last couple of years, so a significant decline in transaction multiples seems unlikely even if the Fed delays expected rate cuts. A more likely expectation is stable to modest improvements in RIA multiples if the Fed begins lowering interest rates later this year. We’ll monitor these trends and report back in next quarter’s M&A update.

RIA Valuation Insights

RIA Valuation Insights