Key Takeaways

Decompose Metrics for Real Insight: Break down AUM and revenue (e.g., market vs. organic flows) to uncover hidden churn or fee erosion—bull markets mask these risks, like fixating on speed over dashboard gauges.

Prioritize Organic Growth Post-Schwab: The $2M SAN threshold will cut referrals sharply; rely on client referrals, marketing, and retention for sustainable expansion beyond unreliable external networks.

Foster Resilience via Vigilance: Monitor fees, margins, and trends quarterly with audits and planning to avoid complacency, boosting firm value from temporary highs to lasting profitability.

Driver’s Ed

When I was sixteen, a friend of my parents came over for dinner in his new Jaguar XJ6. It was British Racing Green, with biscuit leather seats and wool carpet that smelled like Wilton sheep grazing among stone-circles built by Druids. This was the 1980s, and there weren’t many fast cars made at the time (other than Tracy Chapman’s). The Jag had four doors, but it also had a motor derived from the XK series of the 1950s and 60s, a low center of gravity, and Pirelli racing tires. At idle, it rumbled like Barry White with a sore throat.

“Wanna drive?” He didn’t have to ask twice.

Off we went into the Georgia summer evening, looking for uninhabited roads with long straights. “You can wind her out some if you want to; she’s pretty stable at speed.” She was, and before long, we were approaching triple digits. I couldn’t stop staring at the speedometer, tabulating my good fortune at knowing an enabling adult with a fast car – my dream (or at least one of them).

We topped out just shy of 120 before a reasonably sharp curve, and a bridge appeared in front of us, and I had to back off the right pedal. “We’ll do this again sometime when you can really open her up,” he assured me. I’m probably here because that never happened, and also because another friend of my parents, who had a Ferrari, never offered me his keys.

Looking back on my first experience with speed, I’m struck by two things: 1) my parents’ friend was remarkably calm given the circumstances, and 2) I was far too fixated on the dashboard instead of the road. Most XJ6 owners are well served to keep an eye on the engine temperature gauge, but anyone traveling north of 100 mph only needs to be looking at one thing: the road ahead.

Caution Signs

For Registered Investment Advisors (RIAs), the markets are that open road: exhilarating bull runs that swell AUM and revenue at high speed. But get mesmerized by the headline velocity, and you risk ignoring the dashboard—client churn, fee erosion, stagnant organic growth. Proactive monitoring isn't a distraction; it's what keeps you out of the ditch.

The recent actions at Charles Schwab drive this message home with urgency. As you know, starting January 2026, Schwab is raising the minimum investible assets threshold for client referrals through its Schwab Advisor Network (SAN) from $500,000 to $2 million. This shift is expected to halve total referrals by cutting off RIAs from leads for sub-$2M clients.

And there’s no guarantee that Schwab won’t raise that referral minimum further. It's a wake-up: external networks are as unpredictable as a blind curve. True staying power comes from organic growth—nurturing client referrals, targeted marketing, and value-driven acquisition—not market surges or custodial lifelines beyond your control.

Gauging performance for an RIA is often thought of in terms of the portfolio, particularly for product companies that specialize in particular strategies. But even though performance, in theory, should drive AUM flows, capital markets are fickle, and so is customer behavior. We prefer to start with a decomposition of AUM history and then explore the “why” from there.

Tachometer, Oil Pressure, Radiator Temp

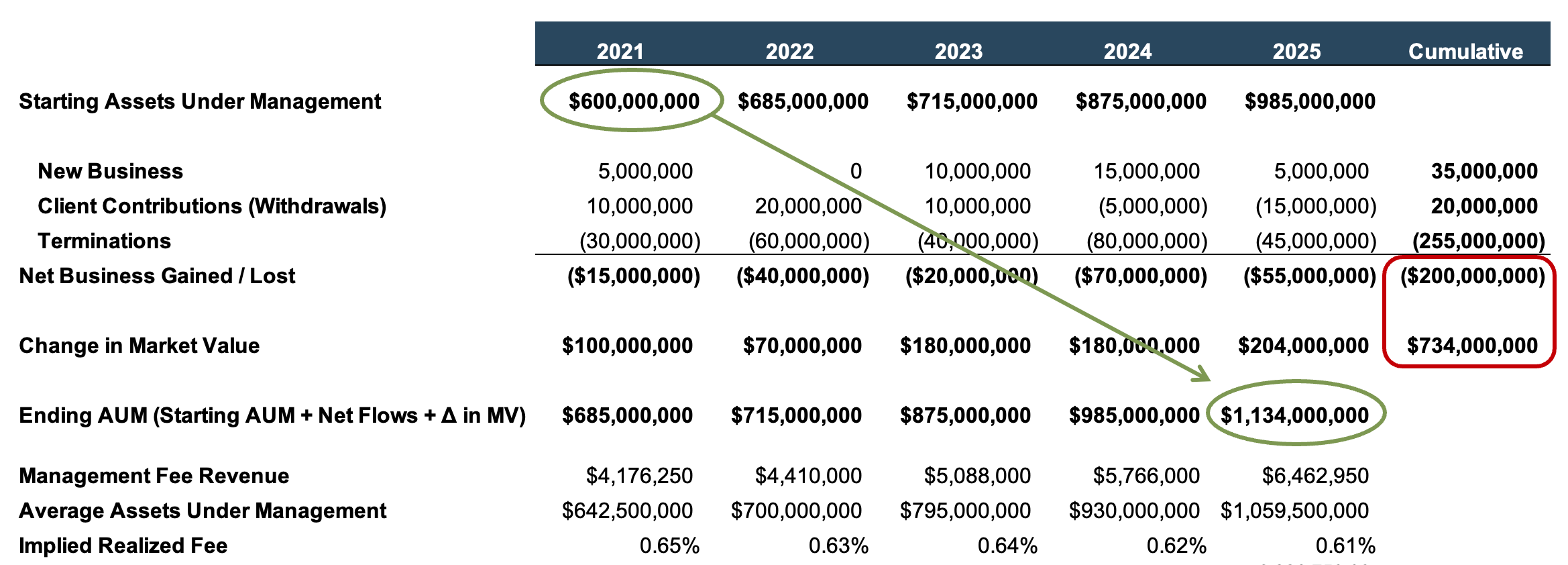

Consider the following dashboard that breaks down the revenue growth of an RIA. Over a five-year period, this RIA boasted aggregate revenue growth of more than 50%, increasing from $3.7 million to $5.7 million. AUM growth was even more substantial, nearly doubling from $600 million to over $1.1 billion.

Click here to expand the image above

Looks great, until you notice $700 million in market gains hid a $250 million organic outflow (just $35 million new vs. $285 million terminations), yet netted $500 million growth. Skip the details, and you're celebrating your wins while you’re veering off the road.

Further, there appears to be a loss in value of the firm to the marketplace. Realized fees declined four basis points over five years. Had the fee scheduled been sustained, this RIA would have booked another $372 thousand in revenue in 2025, all of which could have dropped to the bottom line. Pre-tax margins would have been almost seven percentage points higher. Small changes in model dynamics have an outsized impact on profitability in asset management firms, thanks to the inherent operating leverage of the model. But the materiality of these “nuances” can be lost in a more superficial analysis of changes in revenue.

So, we would ask, what’s going on? Did this RIA simply ride a rising market while neglecting marketing? Are clients concerned about something that is causing them to leave? Does this RIA suffer from more elderly client demographics that account for the runoff in AUM? If the RIA handles large institutional clients, did some of those clients rebalance away from this strategy after a period of outperformance? Is their realized fee schedule actually declining, or is it not? Is the firm negotiating fees with new or existing clients to get the business? Did a particularly lucrative client leave? What is happening to the fee mix going forward?

Routine Maintenance

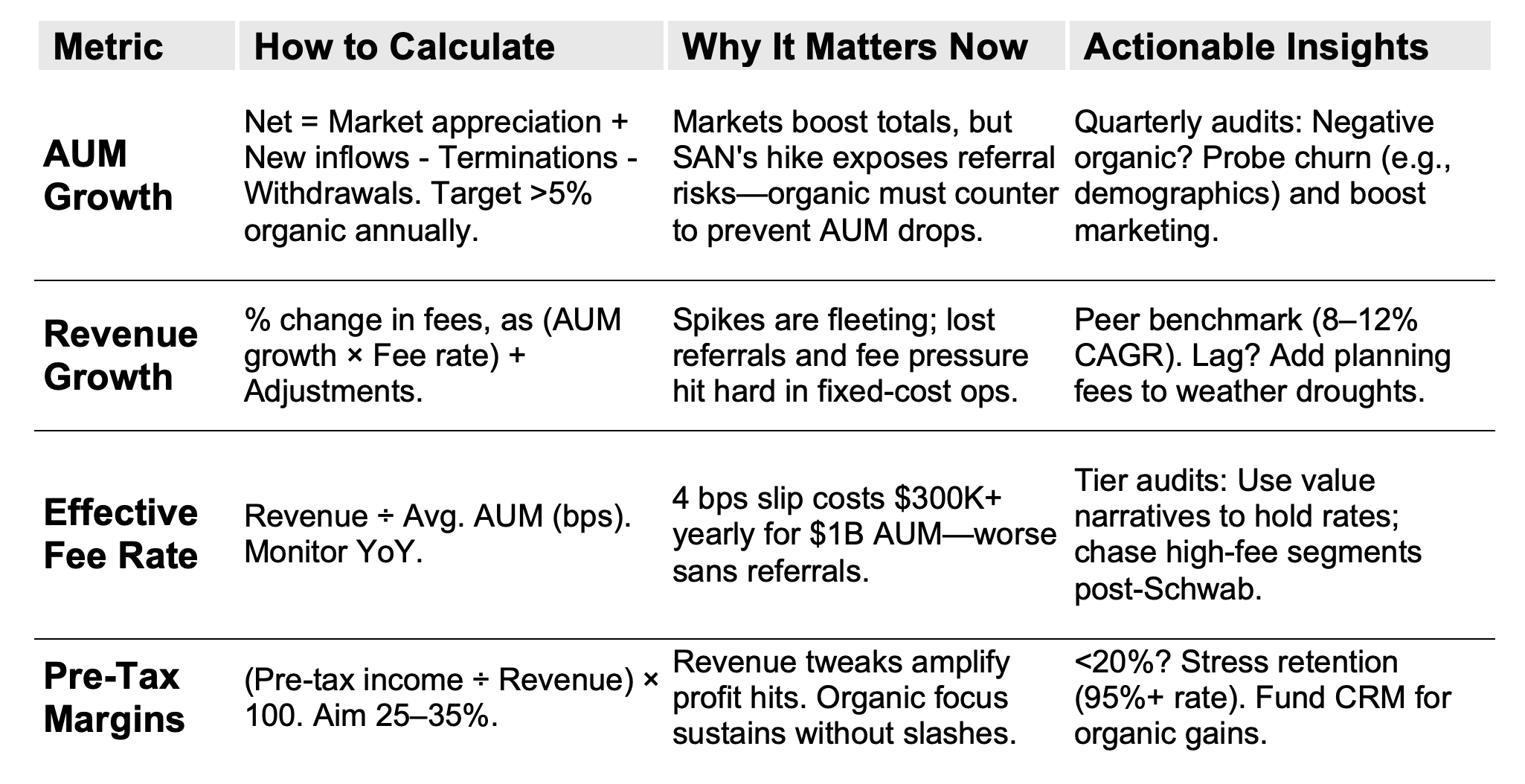

To weather referral squeezes like Schwab's, granularize your AUM and revenue. Here's a focused view of core metrics, tuned for today's realities:

These metrics interlock: Schwab's change could accelerate terminations as its retail power increases, tanking both organic growth and fees. We’ll see.

These metrics interlock: Schwab's change could accelerate terminations as its retail power increases, tanking both organic growth and fees. We’ll see.

Keeping Your Firm Well Sorted

Decomposing changes in revenue for an investment management firm can prompt a lot of questions that go beyond growth in revenue or AUM. Yet when we ask for this information from new clients, it isn’t unusual for us to hear that they don’t compile that data. All should. Some teenage drivers pay too much attention to the dashboard, while some RIA managers pay not enough. The risk to both is the same: ending up in the ditch.

About Mercer Capital

We are a valuation firm organized by industry specialization. Our Investment Management Team provides valuation, transaction, litigation, and consulting services to a client base consisting of asset managers, wealth managers, independent trust companies, broker-dealers, and alternative asset managers.