Succession Conundrums: Why Sell to Insiders for Less?

(Because It May End Up Making You More)

Cheaper price but strategically valuable. The Porsche 912 — one of many “affordable” models the company has produced over the years in order to sustain its business model.

A frequent question among RIA owners is whether internal buyers, such as employees or partners, pay less for their equity stakes compared to external buyers, and if so, why pursue internal succession? The answer is straightforward: internal buyers typically pay less, sometimes significantly less, due to unique industry dynamics and the structure of internal deals. This post explores the valuation perspectives and practical reasons behind this pricing differential, as well as why internal succession remains a compelling strategy despite lower valuations.

The Valuation Perspective: Levels of Value

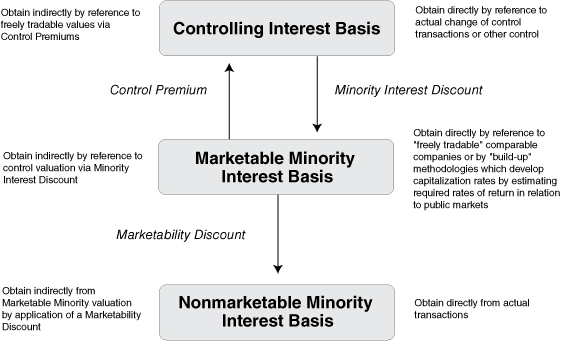

Valuation professionals often use the “levels of value” framework to assess securities. Before I discuss it, I want to mention that the framework is a construct meant to represent reality and should not be confused with reality itself.

The levels of value concept starts in the middle with the marketable minority interest level, derived from public company comparisons or market-driven rates of return. Control buyers, such as private equity firms, might pay a premium for the benefits of control or synergies, while minority interests in closely held businesses, like most RIAs, are discounted due to their lack of marketability.

RIA realities don’t always align with this framework. Most RIAs are, of course, closely held, and their valuations are driven by industry-specific economics rather than public market data. Institutional investors, for instance, may pay a premium for a minority stake in a successful RIA, valuing its steady cash flow and growth potential. These investors often prefer management to retain control to keep interests aligned and reduce monitoring costs, unlike the more traditional control premium narrative. Control buyers may pay a premium, but probably not for the usual reasons like synergies or control of the P&L.

Why Internal Buyers Pay Less

Internal buyers often benefit from discounted pricing (at least on a relative basis) not available to external buyers. These discounts stem from:

- Negotiated Valuations: Internal sales, often part of succession plans or retention strategies, use formulas like multiples of revenue or EBITDA tailored to internal agreements. These valuations are typically lower than market-driven prices paid by external buyers.

- Favorable Deal Terms: Internal deals frequently involve seller financing, deferred payments, or earn-outs, reducing the effective cost for insiders compared to cash-heavy external transactions.

- Preserving Autonomy and Culture: Founders prioritize internal succession to maintain firm autonomy and culture, often offering better economics to trusted insiders. External sales, by contrast, may compromise autonomy, as consolidators exert influence despite limited operational control in owner-operator businesses.

- Competitive Market Dynamics: The RIA market has seen a surge in institutional buyers, driving up valuations and making buy-ins unaffordable for subsequent generations. External buyers, particularly control buyers, pay premiums due to competitive bidding, but these premiums rarely reflect synergies, as RIAs offer few consolidation benefits. Branding holds little weight, and operational control remains with owner-operators, limiting the value of paying a premium.

Measuring the Discount

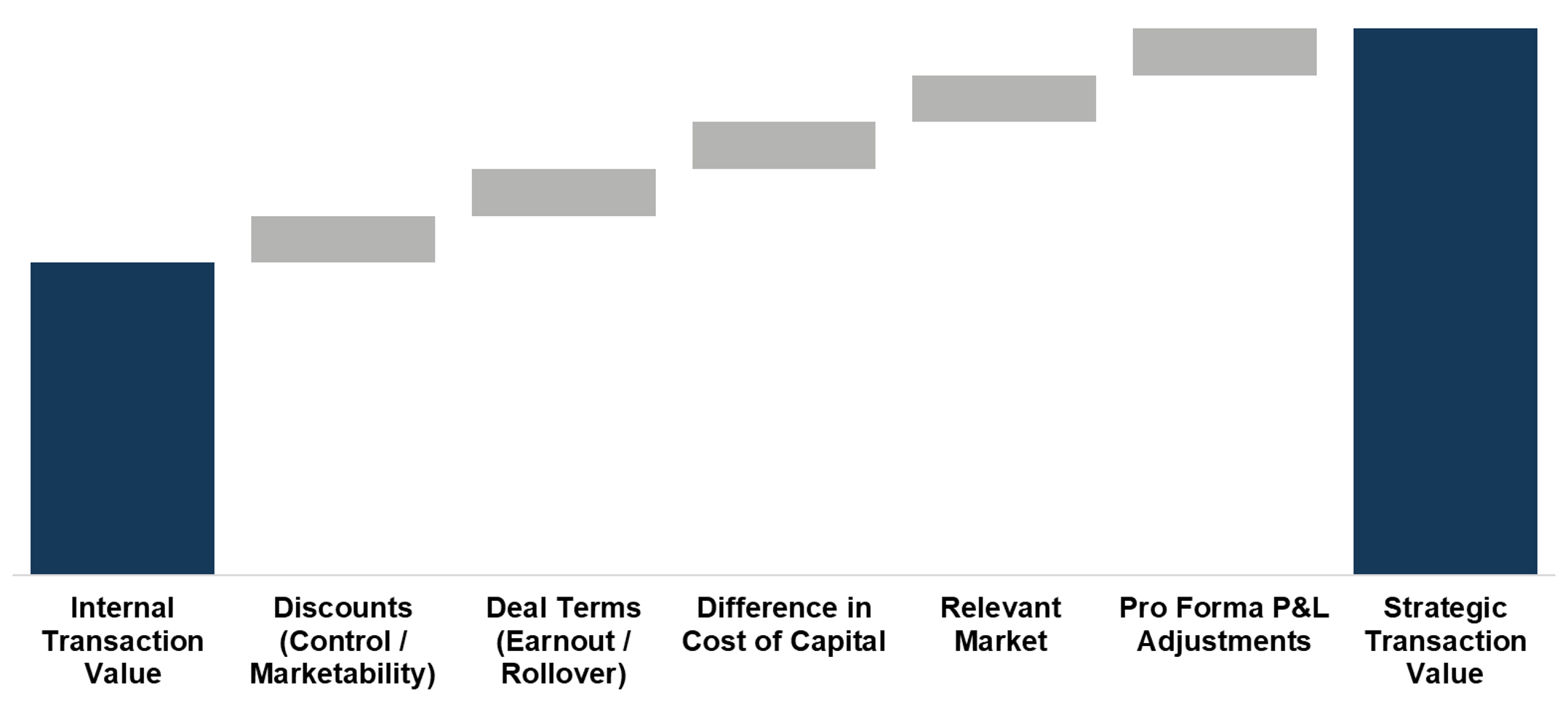

The discount for internal buyers is measured against the price paid by external buyers, but the nominal price of external deals can be misleading. For example, a $15 million RIA sale might include cash, rollover equity, and contingent consideration, with the cash-equivalent value closer to $12 million due to the uncertain value of non-cash components. If insiders buy at a $9 million valuation, the effective economic discount is 25% (not 40% against the nominal price), highlighting the importance of economic value over headline figures. My point here is that the “give-up” to pursue internal succession versus an external sale often isn’t as big as it looks.

Why Pursue Internal Succession?

Internal buyers bring more than their checkbook to the deal table. Internal succession offers compelling advantages:

- Flexibility for Sellers: Internal sales provide founders with greater flexibility in transitioning to retirement, allowing them to phase out involvement while preserving the firm’s legacy.

- Commitment to Growth: Internal buyers, often employees or partners, are motivated to build the firm’s value for themselves and senior partners, ensuring long-term stability and alignment with the RIA’s vision.

- Cost-Effective Continuity: By offering favorable terms, such as seller financing, RIAs can facilitate affordable buy-ins for the next generation, addressing the challenge of higher valuations driven by institutional buyers.

- Avoiding External Tradeoffs: Selling to external buyers often involves sacrificing autonomy, as consolidators may impose strategic or operational changes. Internal buyers, embedded in the firm’s culture, are less likely to disrupt its core values.

- Making Your Firm More Marketable: External buyers like to see an internal succession plan in practice because it gives them greater confidence in the future of what they’re buying.

The Bigger Picture

The RIA industry’s maturation has attracted institutional buyers, inflating valuations and making internal succession challenging yet essential. Internal buyers pay less due to tailored valuations, favorable terms, and the absence of competitive premiums. More importantly, they bring a commitment to the firm’s future, aligning with the founders’ goals of preserving culture and autonomy. While external sales may yield higher nominal prices, the economic value and strategic benefits of internal succession often make it the preferred path for RIA owners planning their legacy.

About Mercer Capital

Mercer Capital is a valuation firm organized according to industry specialization. Our Investment Management Team provides valuation, transaction, litigation, and consulting services to asset managers, wealth managers, independent trust companies, broker-dealers, PE firms, and alternative managers.

RIA Valuation Insights

RIA Valuation Insights