The Impact of Market Volatility on RIA Valuations

An Illustrative Example of the Dangers of Formula Pricing in a Buy-Sell Agreement

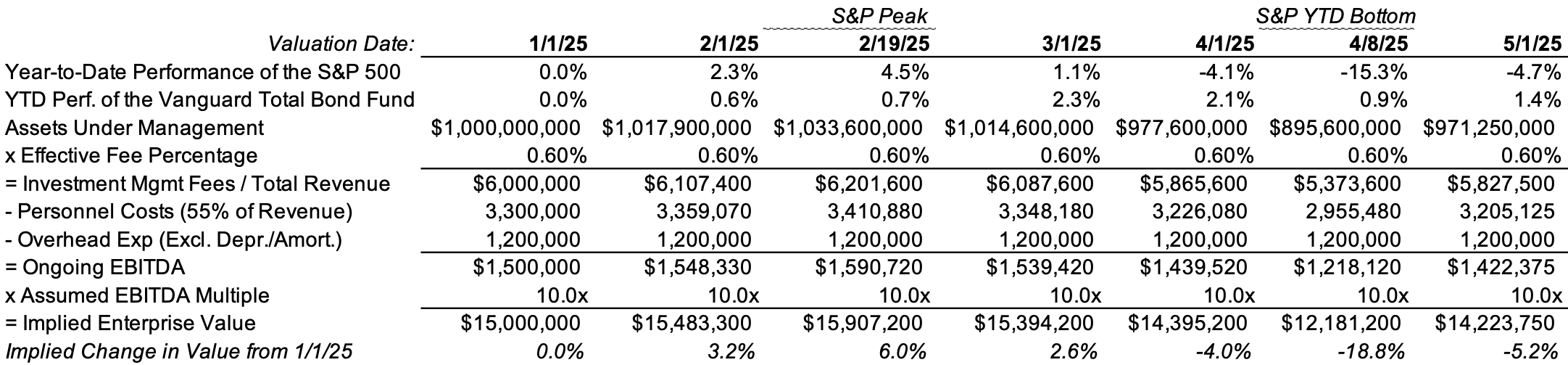

Following up on our post from last week and prior musings on formula pricing, we show an illustrative example of how the market volatility we’ve endured so far this year could impact the formula pricing valuation of a $1 billion AUM RIA that has 70% of its clients’ assets in the S&P 500 and 30% in a diversified bond fund. In this example, we assume personnel costs vary with revenue (55% of total revenue), and overhead expenses (20% of revenue at 1/1/25 or $1.2 million) are fixed. We further assume the RIA’s buy-sell agreement calls for a 10x ongoing EBITDA formula valuation based on AUM at the valuation date.

Click here to expand the image above

The table above demonstrates the profound impact that market volatility can have on an RIA formula price valuation in a short amount of time. In this example, the RIA’s formula price value increased 6.0% in the first seven weeks of the year before declining 23.4% in the next seven weeks (an 18.8% decrease from the start of the year) from the market downturn. You’ll notice the RIA’s value is actually more volatile than the stock market because some of the firm’s expenses are fixed, so its earnings (and therefore value assuming a constant multiple) vary more than the S&P 500 even with a 30% AUM allocation to (more stable) bond investments.

For this reason, most valuation practitioners employ a DCF model to avoid overstating the impact of any particular moment in the market. A DCF model considers a long-term view of the RIA’s projected cash flows based on historical and expected trends in AUM, fees, operating expenses, and profitability. A formula price valuation merely considers the RIA’s ongoing EBITDA (or other metric) based on its AUM, effective fees, and operating expenses at the valuation date.

The Importance of the Valuation Date

This example also illustrates the importance of the valuation date for an RIA during volatile market conditions. If the value of an investment management firm can change 20% or more in a matter of weeks (especially in the context of a formula price valuation), then the valuation dates for planned shareholder transactions should be determined well in advance and agreed upon by all parties. They should occur at some regular interval (usually quarterly, annually, or bi-annually) at a prespecified date, so the buyers and sellers can’t cherry-pick a date that works best for them. There’s little to no opportunity for one side of the transaction to best the other if the valuation date is known by all parties in advance and the value is determined by an independent appraisal firm.

During volatile markets, it may be necessary to update your valuation even if you’re already having your RIA appraised on a regular basis. Using the formula price example above, imagine a transaction on April 8th of this year that used the appraised value of the business as of December 31, 2024. Obviously, the seller would be thrilled with this, but the buyer would effectively be paying an effective multiple of over 12x ongoing EBITDA ($15 million value at 12/31/24 divided by $1.2 million of ongoing EBITDA at 4/8/25) for a business that has historically been valued at 10x. A good rule of thumb is if AUM is up or down 10% since the last valuation, you should consider getting another valuation, and if it is up or down 20% or more since the last appraisal, then you should definitely get another one.

Focus on What You Can Control

Our RIA clients are often frustrated that something they can’t control (the market) dramatically impacts their firm’s value. They understand the economics — markets affect AUM, which directly impacts revenue, profitability, and value. But it’s discouraging that a bear market can completely wipe out any progress they’ve made on business development and cost-cutting when it comes to their firm’s value. We get that, but it’s also true that the market (that same force they can’t control) tends to go up over time, and their AUM, profitability, and value should follow suit.

It’s also worth noting that many of the factors that influence an RIA’s EBITDA multiple (primarily risk and growth attributes) can be controlled by its key managers. RIA buyers tend to pay a higher multiple for firms with a demonstrated history of gaining new business, retaining client relationships, and reducing dependencies on key individuals. Market volatility shouldn’t affect any of that, so if you focus on what you can control, it should pay off in the long run.

About Mercer Capital

We are a valuation firm that is organized according to industry specialization. Our Investment Management Team provides valuation, transaction, litigation, and consulting services to a client base consisting of asset managers, wealth managers, independent trust companies, broker-dealers, and alternative asset managers.

RIA Valuation Insights

RIA Valuation Insights