Banks Interested in Asset Managers and Trust Companies

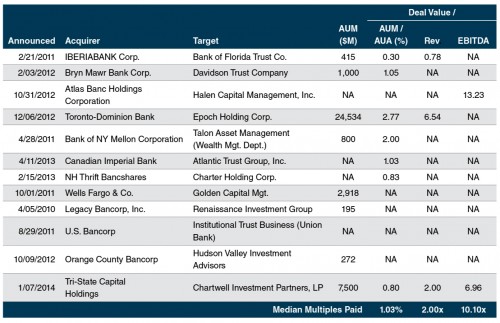

In a low interest rate environment coupled with rising capital requirements, many banks are turning their attention to asset management firms and trust companies to improve ROE and diversify revenue. Although deal terms are rarely disclosed, the table below depicts some recent examples of this trend with pricing metrics where available.

Source: SNL Financial

While multiples for activity metrics (AUM and revenue) can be erratic and tend to vary with profitability, EBITDA multiples are often observed in the 10x-15x range for public RIAs with their private counterparts typically priced at a modest discount depending on risk considerations, such as customer concentrations and personnel dependencies.

Powered by a fairly steady market tailwind over the last few years, many asset managers and trust companies have more than doubled in value since the financial crisis and may finally be posturing towards some kind of exit opportunity to take advantage of this growth. Despite the richer valuations, banks and other financial institutions are starting to take notice for a multitude of reasons:

- Exposure to fee income that is uncorrelated to interest rates

- Minimal capital requirements to grow AUM and AUA

- Higher margins and ROEs relative to traditional banking activities

- Greater degree of operating leverage – gains in profitability with management fees

- Largely recurring revenue with monthly or quarterly billing cycles

- Potential for cross-selling opportunities with bank’s existing trust customers

Still, there are often several overlooked deal considerations that banks and other interested parties should be apprised of prior to purchasing an asset manager or trust company. We’ve outlined our top three considerations when looking to purchase these kinds of businesses in today’s environment:

- Price. With most of the domestic equity markets at peak levels, asset manager valuations have never been higher, and purchasing an RIA or trust company prior to a market downturn or correction often leads to disappointing returns on investment. There may be some temptation to pay a higher earnings multiple based on rule-of-thumb activity metrics (% of AUM or revenue), but we would typically advise against paying above normal multiples of ongoing EBITDA for a closely held asset manager, absent significant synergies or growth prospects for the target company.

- Structure. Since many asset managers and trust companies are heavily dependent upon a few staff members for investing acumen or key client relationships, many deals are structured as earn-outs to ensure business continuity following the transaction. These deals tend to take place over three to seven years with a third to half of the total consideration paid out in the form of an earn-out based on future performance.

- Degree of operational autonomy. Asset managers (and their clients) value independence. Institutional investors typically have to consent to any significant change in ownership to retain their business following a transaction and may not be willing to do so if they feel that their asset manager’s independence is compromised. Senior managers at the target firm will likely need to be assured that the new owner will exert minimal interference on operations and strategic initiatives if key personnel are to be retained after the merger.

Perhaps because of these considerations, it is estimated that less than 1% of the 11,000 RIAs and independent trust companies transact in a given year. Still, with an aging ownership demographic and uniquely attractive business model to many prospective buyers, it is reasonable to assume that more asset managers and trust companies will transact in the coming years.

Mercer Capital provides asset management, trust companies, and investment consultants with corporate valuation, financial reporting valuation, transaction advisory, portfolio valuation, and related services. For more information, please contact us.