What Is a Lifestyle Analysis and Why Is it Important?

A lifestyle analysis is an analysis of each party’s sources of income and expenses. It is used in the divorce process to demonstrate the standard of living during the marriage and to determine the living expenses and spending habits of each spouse. It is typically a more in-depth analysis than the financial affidavits required in the divorce process and is prepared by a forensic accountant. The details in the analysis serve as verification of net worth and income, and expense statements submitted by both spouses can help a judge determine the equitable distribution of marital assets as well as alimony needs.

The lifestyle analysis pulls together all considerations and provides a visual of income and expenses over the remaining life expectancy. Through illustration of the aggregate sources of income(s) and expenses over time, one can discern what funds are actually required (and if these funds are available) to maintain standard of living, i.e., to fund expenses. The exercise then yields relative analyses (percentage comparisons and trend analyses), and ultimately, an illustration of net worth at a point in time, as well as net worth accumulation over time.

Factors Considered for Spousal Support

In Tennessee, the Decree for support of spouse is under § 36-5-121(i). Careful consideration must be given to the factors listed in the statute when determining historical lifestyle (standard of living) as well as reasonable need into the future. Twelve factors assist in determining whether the granting of an order for payment of support and maintenance to a party is appropriate, as well as determining the nature, amount, length of term, and manner of payment. Refer to § 36-5-121(i) for the full listing.

Although each of the factors must be considered when relevant to the parties’ circumstances, the first factor, “the relative earning capacity, obligations, needs, and financial resources of each party, including income from pension, profit sharing or retirement plans and all other sources,” has presented the two most important components: the disadvantaged spouse’s need and the obligor spouse’s ability to pay.

Hence arises the “pay & need analysis,” also known as the “lifestyle analysis.”

Sources of Financial Information Used in the Analysis

The following documentation provides financial information used in the analysis and is typically requested during the discovery process.

- Tax returns

- Brokerage accounts

- Retirement, pension accounts

- Bank, debit card, credit card statements

- Personal financial statements

- Loan applications

- Insurance policies (cash surrender value)

- Mortgage statements

- Trusts, wills

- Deeds to home, vehicles, motorboats, etc.

- Annuity, stock certificates, deposit box

- Business valuations

- Appraisals of tangible items (artwork, collectibles, etc), among others

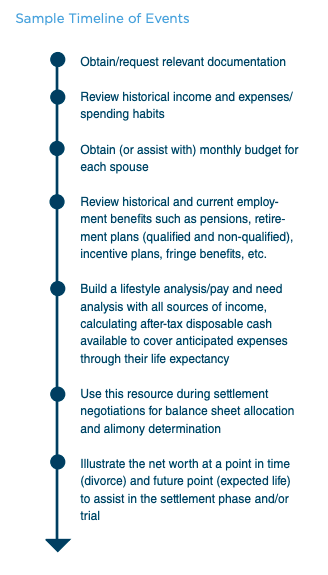

The Process: Building a Lifestyle Analysis

There are many moving pieces in constructing the lifestyle analysis, and the components can be quite different from case to case. During the preliminary stages, the financial expert/ forensic accountant will obtain pertinent documents from the aforementioned documentation in order to create the marital balance sheet (and potential separate property) and assess historical and current earnings and expenses/spending habits. Additionally, the expert may also assist in building a budget based on historical expenses. The expert will review retirement plans and annual contributions, brokerage accounts, cash & savings accounts, their respective average rates of return as well as varying tax obligations. The risk tolerance of the individuals can even be considered in relation to future rates of return. For example, a person with ample disposable cash may be willing to invest in riskier ventures where the return may be higher, than a person who chooses to invest conservatively due to limited disposable cash.

The investigative process may even lead the parties to establish the “true income” of a spouse who is suspecting of perpetrating fraud and determine any possible hidden assets or dissipation of marital assets.

Ultimately, the lifestyle analysis illustrates the sources of income, tax obligations, and disposable cash before and after expected expenses. This tool is valuable because it leads to further analyses such as relative analyses of gross earnings comparisons and after-tax disposable cash comparisons, among others. The analysis allows comparison on relative terms not just dollar amounts.

Another valuable result of the lifestyle analysis is the ability to assess the parties’ net worth at multiple points in time. The net worth accumulation analysis illustrates the differences of the division of net worth at the date of divorce, and the division of net worth at the date of death. Additionally, it illustrates the net worth accumulation between those two points in time. This process may highlight what appears to be reasonable at a point in time, may or may not be reasonable when extracted over time. When used as trial demonstratives, the illustration can assist the trier of facts in determining the disadvantaged spouse’s need and the obligor spouse’s ability to pay.

For a fact pattern and step-by-step illustration, refer to my Lifestyle / Pay & Need Analysis presentation from the 2018 AICPA Forensic & Business Valuation Conference.

Conclusion

In financial situations that may be scrutinized by regulators, courts, tax collectors, and a myriad of other lurking adversaries, the financial, economic, and accounting experience and skills of a financial expert are invaluable. The details in the lifestyle analysis can help determine the equitable distribution of marital assets as well as alimony needs.

Because no two cases are alike, all components of the analysis must be carefully assessed. Complexities that may need further consideration include, but are not limited to:

- Earnings capacity: need for a vocational expert?

- Differences in retirement plans (such as tax structure & penalties): qualified vs non-qualified, Roth vs Traditional, pensions, etc.

- Investment risk profiles: risky vs risk averse (hence, annual returns may differ)

- Alimony requested: duration, dollar amount, type

- Business ownership: valuations, personal vs. enterprise goodwill, active vs. passive appreciation (i.e., marital vs. separate)

- Deferred compensation:

- Stock options and restricted stock (both vested and unvested) • Election 83(b): timing of tax on restricted stock

- Short-term and long-term incentive plans (bonuses), among others

A competent financial expert will be able to define and quantify the financial aspects of a case and effectively communicate the conclusion. For more information or to discuss your matter, please don’t hesitate to contact us.

Originally published in Mercer Capital’s Tennessee Family Law Newsletter, First Quarter 2019.