Asbury-Park Place Acquisition as Seen Through a Monday Night Football Commercial

You Make the Call!

One of my favorite memories as a kid was watching Monday Night Football. Three things, in particular, stood out: the iconic introduction theme music, the “Game of the Week” feeling, and the IBM: You Make the Call commercial segment. Invariably at some point during the hotly contested game, the IBM commercial would be inserted. The announcer would narrate a controversial play and the highlight would run to a critical juncture, only to be paused and allow for the viewer to play armchair referee and guess the outcome or “make the call.” These commercials basically pre-dated instant replay review and the official’s ability to “go under the hood” to review the play and determine the proper outcome.

With the revival and announcement of Asbury Automotive Group’s acquisition of the Park Place dealerships in Texas earlier this month, I was once again reminded of the IBM commercial.

In this week’s post, we review a timeline of the transaction, along with an analysis of Asbury’s stock price against the rest of its public competitors and also examine the operational strategy of Asbury over the years to explain aspects of the Park Place acquisition.

As with any merger or acquisition, the true success or failure of the deal may not be known for years. Investors and industry professionals can try and play armchair quarterback and try to predict the outcome. This blog post aims to provide ample information so that you can “make the call” on the transaction.

Transaction Timeline

The original transaction was announced in December 2019 and would include 19 franchise locations, one open point, two collision centers, and an auction business all located in the Dallas and Austin markets. Franchises included: Mercedes-Benz, Lexus, Jaguar, Land Rover, Porsche, Volvo, Sprinter, and five ultra-luxury (Bentley, Rolls-Royce, McLaren, Maserati, and Karma). At the date of the announced transaction, Asbury’s common stock traded at $122.67/share.

The original transaction was announced in December 2019 and would include 19 franchise locations, one open point, two collision centers, and an auction business all located in the Dallas and Austin markets. Franchises included: Mercedes-Benz, Lexus, Jaguar, Land Rover, Porsche, Volvo, Sprinter, and five ultra-luxury (Bentley, Rolls-Royce, McLaren, Maserati, and Karma). At the date of the announced transaction, Asbury’s common stock traded at $122.67/share.

On March 18, 2020, Asbury secured additional borrowings on its existing lines of credit and used vehicle floor plans. Recall that the first two weeks of March saw COVID-19 cases and the impact of shelter-in-place orders and other economic interruptions in the United States. At this point in the timeline, it still appeared that the transaction would continue, although Asbury’s stock price had already declined by a whopping 64% to $44.62/share.

On March 18, 2020, Asbury secured additional borrowings on its existing lines of credit and used vehicle floor plans. Recall that the first two weeks of March saw COVID-19 cases and the impact of shelter-in-place orders and other economic interruptions in the United States. At this point in the timeline, it still appeared that the transaction would continue, although Asbury’s stock price had already declined by a whopping 64% to $44.62/share.

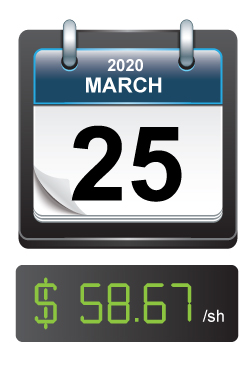

Just one short week later, Asbury terminated the Park Place transaction on March 25, 2020, citing the uncertain market conditions related to the COVID-19 pandemic. Interestingly, Asbury’s stock had rebounded slightly from the week before to trade at $58.67/share.

Just one short week later, Asbury terminated the Park Place transaction on March 25, 2020, citing the uncertain market conditions related to the COVID-19 pandemic. Interestingly, Asbury’s stock had rebounded slightly from the week before to trade at $58.67/share.

Earlier this month, news broke that the Asbury-Park Place transaction was moving forward again on July 6. The auto industry had experienced some modest gains in the monthly SAARs for May and June, and this news was a shot in the arm for the auto M&A market. As more information has been released, the revised transaction with Park Place is scaled slightly lower from the original proposed transaction in December 2019. Terms of the revised transaction include the acquisition of 12 franchises, no open point, two collision centers, and the auction business. Pricing terms include total consideration paid of $735 million, excluding vehicles, reflecting $685 million of Blue Sky value on $95 million of EBITDA with $20 million in run-rate synergies. As I reviewed Asbury’s Q1 earnings call from earlier in the Spring, there were hints that this transaction might have still been in the works. At the time of the re-announcement, Asbury’s share price had increased to $78.41/share.

Earlier this month, news broke that the Asbury-Park Place transaction was moving forward again on July 6. The auto industry had experienced some modest gains in the monthly SAARs for May and June, and this news was a shot in the arm for the auto M&A market. As more information has been released, the revised transaction with Park Place is scaled slightly lower from the original proposed transaction in December 2019. Terms of the revised transaction include the acquisition of 12 franchises, no open point, two collision centers, and the auction business. Pricing terms include total consideration paid of $735 million, excluding vehicles, reflecting $685 million of Blue Sky value on $95 million of EBITDA with $20 million in run-rate synergies. As I reviewed Asbury’s Q1 earnings call from earlier in the Spring, there were hints that this transaction might have still been in the works. At the time of the re-announcement, Asbury’s share price had increased to $78.41/share.

In the two weeks following the announcement, Asbury’s share price increased by 25%. It appears that investors are excited by the revived transaction in the short run. We analyzed the historical trading prices of the other auto public competitors to determine how Asbury’s trends compared to the overall public auto market. While other public competitors (Lithia Motors and Sonic Automotive) have experienced larger rebounds than Asbury, the boost provided by Asbury’s transaction announcement has exceeded the gains by any other public competitor in that short time. It remains to be seen if investors will continue to show this level of enthusiasm in the months to come.

In the two weeks following the announcement, Asbury’s share price increased by 25%. It appears that investors are excited by the revived transaction in the short run. We analyzed the historical trading prices of the other auto public competitors to determine how Asbury’s trends compared to the overall public auto market. While other public competitors (Lithia Motors and Sonic Automotive) have experienced larger rebounds than Asbury, the boost provided by Asbury’s transaction announcement has exceeded the gains by any other public competitor in that short time. It remains to be seen if investors will continue to show this level of enthusiasm in the months to come.

Asbury’s Operational Strategy

In its presentation to investors and explanation for the transaction, Asbury executives cited the following objectives: 1) conscious effort to acquire more luxury franchises, and 2) move out of less desirable markets and move into more favorable markets. Asbury management further postulated that luxury dealerships are more resilient than other franchises during market downturns, provide more stable margins, have less competition due to fewer dealers across the country, and maintain a higher portion of their gross profits from parts and service than other franchises such as import, domestic or mid-market.

Let’s examine these objectives and play armchair quarterback with Asbury’s executive management. Since a large focus of the proposed transaction centers around luxury dealerships and their performance during economic downturns, we analyzed Asbury’s franchise platform from 2008 to present day. As much has been written in this space and in numerous industry pieces, perhaps the closest comparison to the present unstable economic conditions is the Great Recession in 2008 and 2009.

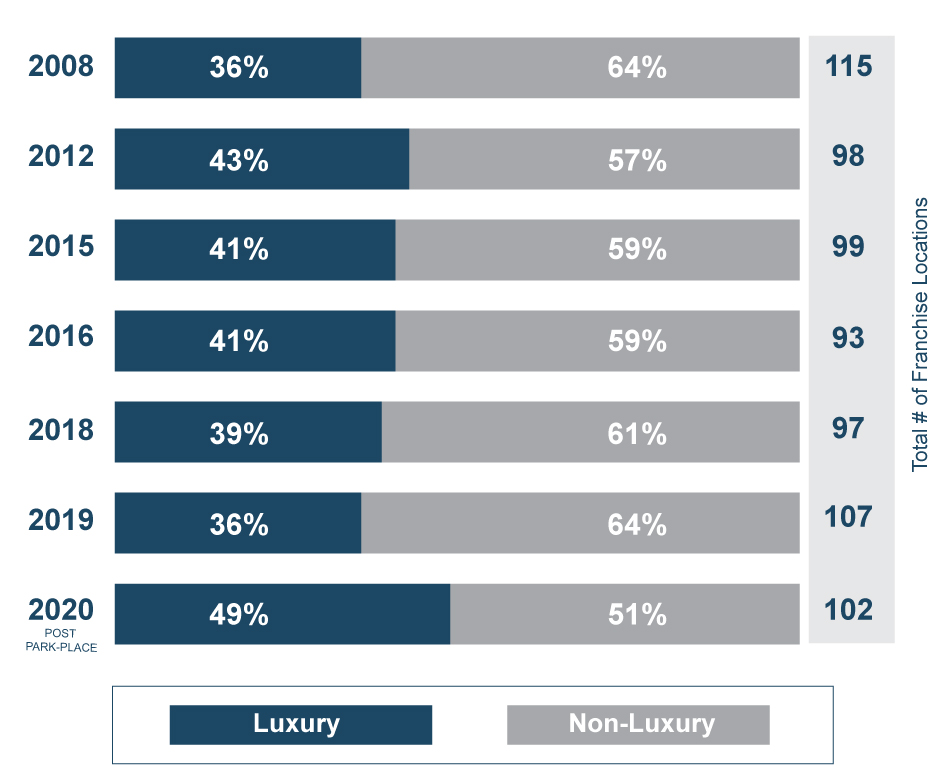

Since 2008, Asbury has operated approximately 93 to 115 franchise locations in any given year. While the overall number of franchise locations hasn’t shifted too dramatically, the shift in dealership types can definitely be viewed following the additions from the Park Place transaction. As early as 2008, Asbury operated with only one-third of its franchises as luxury brands. Post-Park Place, Asbury’s brand mix will now be almost 50/50 luxury vs non-luxury.

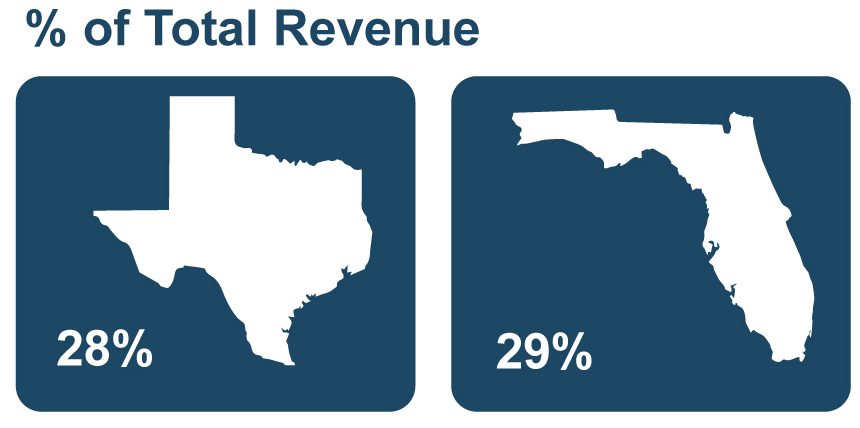

In addition to the brand shift, Asbury has also vacated several markets and entered into more favorable new markets. Specifically, Asbury has vacated Arkansas, California, and New Jersey. In recent months, Asbury has also divested of its Mississippi locations and one of its Atlanta Nissan locations, but has made an acquisition in the Denver, Colorado market. With the additional platform provided by the Park Place locations, Asbury’s focus will be on Florida and Texas as the two main sources of total revenue.

Resiliency of Luxury Brands

Resiliency of Luxury Brands

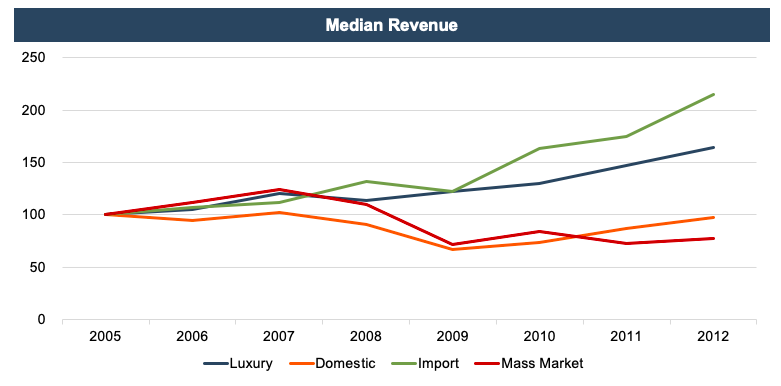

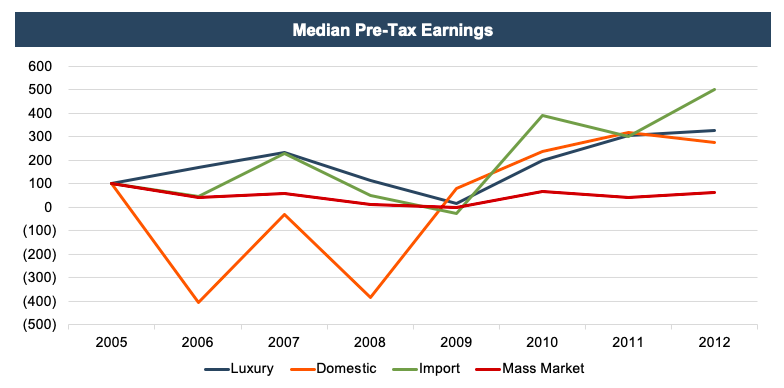

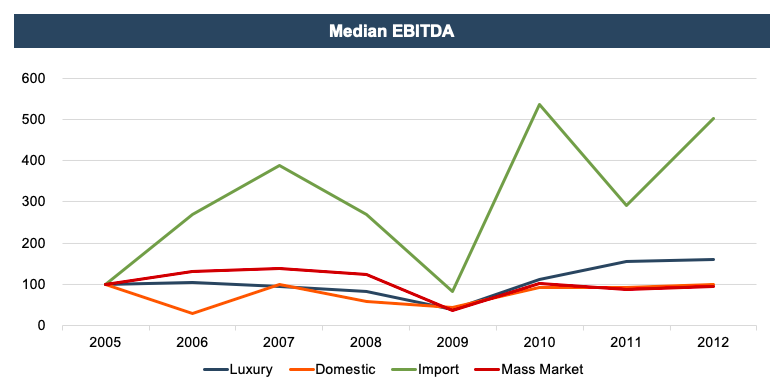

In order to test Asbury’s theories regarding the resiliency of luxury franchises against others during a downturn, we examined various financial indicators from public manufacturers’ from 2005 through 2012. For purposes of our analysis, we categorized the following as luxury brands: Audi AG, Bayerische Motoren Werke, Tata Motors Limited, Daimler AG, and Porsche Automobil Holding SE. We also compiled a sample group for other dealership classifications including import, mass market, and domestic. The results will be slightly skewed as several public companies overlap into multiple categories. Nevertheless, we indexed and measured the performance of the luxury brands to the other dealership groups by median revenue, gross profit, earnings before tax (“EBT”) and earnings before interest, taxes, depreciation and amortization (“EBITDA”).

Our study provided the following analysis of each financial metric indexed against a baseline median from 2005 data:

For these indicators, luxury brands fared better than most other dealership groups but seemed to lag slightly behind import dealerships. Asbury executives will be banking on similar success and performance of their luxury brands as the auto industry continues to try and recover from the turbulent economic conditions caused by the pandemic.

Conclusions

So how will Asbury perform and will the revived acquisition of the Park Place dealerships prove to be successful? Only time will tell in the coming months and years.

But for now, investors and industry professionals can hit the pause button and evaluate it just as viewers did with IBM’s iconic commercials from Monday Night Football in the 1980s and “YOU MAKE THE CALL!”

Auto Dealer Valuation Insights

Auto Dealer Valuation Insights