Blue Sky Multiples Rebound from Q1 Declines but Full Recoveries Reserved for Top Brands

Blue Skies Ahead?

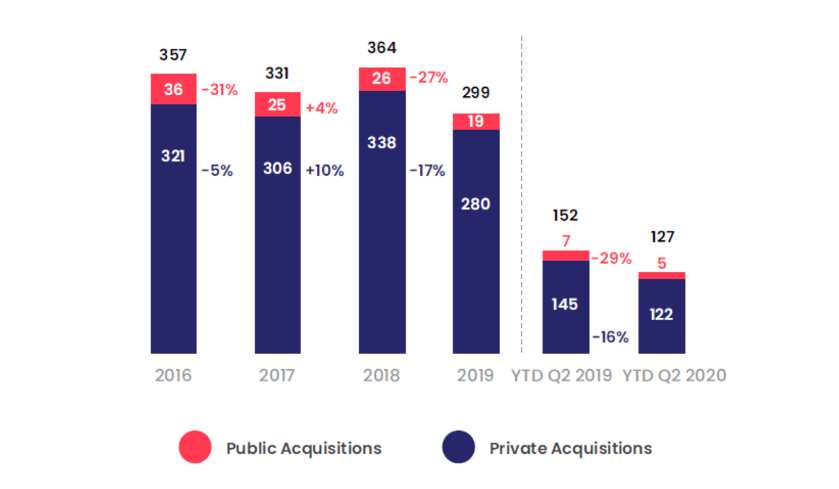

Last quarter, we sat down (virtually) with Kevin Nill of Haig Partners to discuss M&A trends in the Auto Dealer Industry. He noted amidst the uncertainty, buyers and sellers were either applying pre-COVID multiples to lower earnings or lower Blue Sky multiples to pre-COVID earnings. Sluggish deal volume continued into Q2 with transactions down 16% compared to 1H 2019, but the pace is picking up.

In this post, we review Haig Partners’ Q2 report on trends in auto retail and their impact on dealership values. We also look at how Blue Sky multiples have rebounded after declines in Q1. While most brands saw a partial recovery, a return to pre-COVID multiples was largely reserved for brands with the highest multiples in their category (luxury, mid-line import, and domestic).

The Haig report succinctly described the landscape thusly:

When customers couldn’t come into showrooms, dealers responded by selling vehicles online. When inventory levels for new vehicles fell, dealers focused on used car sales and were able to hold for more gross on both new and used vehicles. While waiting for the recovery, dealers reduced advertising, personnel and floorplan expenses significantly. The pandemic forced dealers to adopt new technologies and leaner business practices sooner than they otherwise might have. The result is that most dealers have become stronger during this time of crisis, not weaker. Investors have noticed. The publicly traded franchised groups have higher values today than before COVID, and we have seen the values of private retailers rebound as well. Dealership buyers are betting that the future of auto retail is bright, even when the lift from trillions of dollars of government stimulus spending wears off.

Activity Ground to a Halt, but It’s Picking Back Up

According to Haig, about 25-30 dealerships have been bought/sold each month on average. While the pandemic curbed activity significantly from March through May, there is evidence of pent up demand. Haig indicated that of the 42 dealerships that transacted in Q2, 33 were sold in June.

While transaction activity has largely come from private acquisitions as seen above, our review of public franchised auto dealer earnings calls indicates public acquisitions are likely to pick up. Public companies, such as Lithia and Asbury (with its Park Place acquisition) have increased their appetite for acquisition. In order to compete in a digital world, public franchised dealers are looking to scale their operations. Online-centric competitors such as Carvana and Vroom have experienced rapid growth in recent years, though they are used vehicle dealers and thus uninhibited by franchise agreements. In order to add scale, public franchised dealers will need to leverage their relationships with OEMs and be more pragmatic in their growth. Still, scale is anticipated to benefit these players by spreading digital innovation costs over higher revenues.

Advantageous Buying Opportunities Were Somewhat Short-Lived

As we mentioned above, deal activity from March through May was paused for numerous reasons. First, having to perform the due diligence process virtually reduces the likelihood of a transaction between two parties that don’t know each other well, even if both sides were eager to press forward. Widening gaps in valuations between buyers and sellers also made sellers less likely to relinquish their assets in a spiraling economic climate at the onset of the virus. After all, for many families, their auto dealership is the principal asset on the family balance sheet, and owners were wise to hold tight to their assets in a spiraling economic climate.

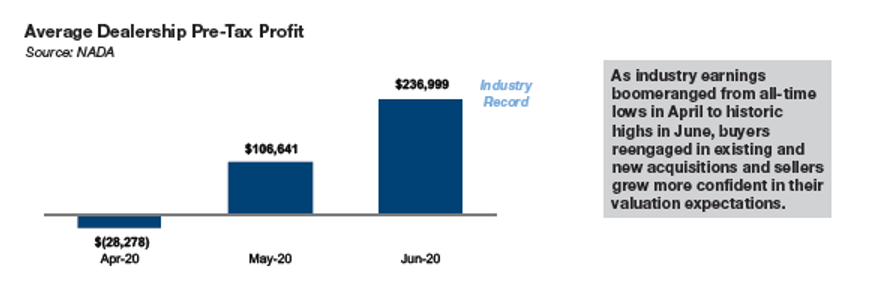

According to Haig, COVID caused buyers to pull offers or demand price concessions amid concerns of earnings stability. However, buyers have come back to the table in recent months as profits have been much stronger than initially anticipated. Haig estimated Blue Sky values declined about 10% from 2019 levels in Q1; this figure ended up being only about a 5% dip in Q2. Kerrigan Advisors, another preeminent investment bank in the auto dealer space, sees Blue Sky values actually up 3.3% in Q2 2020 compared to Q4 2019. We’ll discuss the rebound in valuations in depth below.

While SAAR has declined, gross profits (on a per vehicle basis) have improved.

We see an interesting parallel in the minds of buyers, both of vehicles and dealerships. While SAAR has declined, gross profits (on a per vehicle basis) have improved. Through July, average new vehicle gross was up 7.8% per vehicle retailed compared to 2019, while used vehicles improved 5.1%. Consumers hoped an economic disruption would create a unique buying opportunity, but a lack of new vehicle inventory and interest rate tailwinds allowed dealers to raise prices. People with the financial wherewithal to purchase a new vehicle amid skyrocketing unemployment early on in the pandemic likely got a good deal, but NADA estimates incentive spending per vehicle declined 17% from April to August.

Similarly, dealership buyers that were able to successfully negotiate price concessions on transactions already in progress likely got a good deal with the surprising earnings performance. Through July, average dealer sales were down 13.6% compared to 2019, but pre-tax earnings declined only 4.6%. As noted in The Blue Sky Report for Second Quarter 2020, published by Kerrigan Advisors, average dealership profits rebounded from lows to highs in the span of two months.

Deals that were scuttled, delayed, or that didn’t even get off the ground, ultimately, may have benefited the seller that chose not to sell at the April lows. And as one of our colleagues has told me during the sell-side transaction process, every day you don’t sell your business, you are effectively buying it back at its current value in the marketplace. Dealers who chose to “re-buy” their dealership in April will be glad they did.

Blue Sky Multiples

In Q1, virtually every brand covered in the Haig Report saw a decline in their Blue Sky multiple. The lone exception was Mazda whose multiples actually improved over Q4 2019. This likely has less to do with pandemic mitigation as it does with other recent troubles. While Mazda’s franchise sales fell the least (7% decline) of all the major franchises compared to 1H 2019, this may say more about 2019 performance than it does about pandemic mitigation. Its range of Blue Sky multiples has improved in each of the last two quarters, but Mazda still remains slightly below its range of 3.0x – 3.75x from Q3 2019.

In Q1, virtually every brand covered in the Haig Report saw a decline in their Blue Sky multiple.

Every other brand declined about a half turn of pre-tax profits in Q1 (e.g. Mercedes-Benz fell from 6.50x – 8.0x in Q4 to 6.0x – 7.50x in Q1). Fortunately, as SAAR rebounded, heightened levels of uncertainty abated, and dealers and the country at large embraced and adapted to the new normal, valuations rebounded in Q2. However, only Porsche, Toyota, Ford, and Kia rebounded fully to their Q4 multiple range. Hyundai actually saw a modest uptick on the high end to pull even with Kia at 3.0x – 3.75x compared to 3.0x – 3.50x in Q4 2019.

Notably, Porsche, Toyota, and Ford have recently been the leaders of their peer group. No luxury brands besides Porsche saw a full rebound to the top end of the pre-pandemic range. After years of tracking at the exact same range, Toyota stuck its nose in front of Honda, whose range only regained half of its pandemic losses. Similarly, Ford’s Blue Sky multiples have moved in lockstep with Chevrolet since Q2 2018. Pre-pandemic declines to Ford’s dealer valuations allowed Chevy and FCA to pull in front in Q4 2019. Now, all three of these domestic dealers sit at a 3.0x – 4.0x Blue Sky range with Buick-GMC just slightly behind.

Conclusion

Fortunately, while there is still uncertainty about when the economy will return to “normal,” the auto dealer industry appears to have adapted to the circumstances at hand. Valuations have rebounded as earnings have recovered, and the industry has largely avoided the doomsday scenarios prognosticated in March. Still, not many people would have predicted working from home would remain so prevalent heading into October. As Q3 wraps up, we hope dealers continue to navigate these waters as they continue to re-buy their dealership.

Blue Sky multiples provide a useful way to understand the intangible value of a dealership, particularly in a transaction context for someone familiar with the auto dealer space but perhaps not the specific dealership in question. Buyers don’t determine the price they are willing to pay based on Blue Sky multiples; they analyze the dealership and determine their expectation for future earnings capacity (perhaps within the context of a pre-existing dealership where synergies may be present) as well as the risk and growth potential of said earnings stream. For dealers not yet looking to sell, Mercer Capital provides valuation services (for tax, estate, gifting, and many other purposes) that analyze these key drivers of value. We also help our dealer clients understand how their dealership may, or may not, fit within the published ranges of Blue Sky multiples. Contact a Mercer Capital professional today to get the ball rolling.

Auto Dealer Valuation Insights

Auto Dealer Valuation Insights