Hybrid Vehicles and the Goldilocks Principle

EVs Get the Headlines While Consumers Are Getting Hybrids

For the past few years, electric vehicles (EVs) have been a huge talking point. While there has been plenty of consumer interest in EVs, there has been even more skepticism centered largely around range anxiety and upfront cost. If internal combustion engine (ICE) vehicles are porridge that is too cold, and EVs are perhaps too hot, hybrids, at least for now, appear to be “just right.”

In this week’s post, we touch on recent developments with electric vehicles and how they are leading to a surge in demand for hybrids.

Market Share

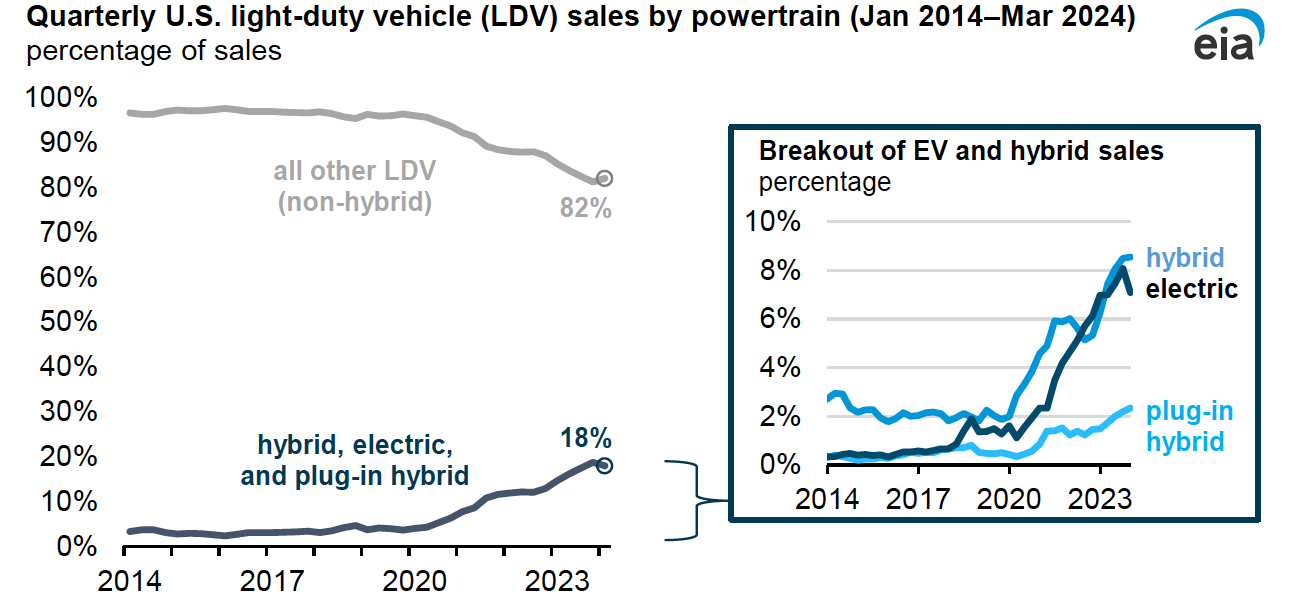

The market has changed a lot over the past ten years. Back in mid-2014, when oil prices were over $100/bbl, light-duty vehicles were 95%+ ICE. Fast forward to March 2024 and hybrid, electric, and plug-in hybrids now compose 18% of the total market, with hybrids just edging out EVs. As seen in the following graphic from the EIA, electric vehicles have particularly surged in the past few years despite a decline in 2024.

Of note, BEVs are popular in the luxury vehicle segment, accounting for approximately 33% of luxury sales over the past twelve months. Clearly, Tesla plays a role in this, but the dichotomy between luxury and mass-market consumer preferences is worth noting. Perhaps consumers with more disposable income can afford to take a chance on a new powertrain in their next vehicle purchase, while consumers with a tighter budget continue to stick to the status quo — whether it be due to upfront costs or reliability concerns.

Electric vehicles were less than 2% of the market pre-pandemic, who we’ll call the “early adopters.” Since then, the EV market has exploded as costs have declined (due to a combination of subsidies, improved technology, and competition), and EVs are gaining traction in the marketplace. While this recent growth in the market segment is promising, hurdles must be cleared before widespread adoption is possible.

Why Hybrids?

Hybrids have been around for over 25 years, so it is notable to see such a significant increase in market share over the past few years. The benefits of hybrids compared to ICE vehicles have not materially changed, nor are hybrids as subsidized as electric vehicles — though some are qualifying for EV subsidies. We believe the reason for the increase in demand for hybrids is two-fold:

- More models are being offered in hybrid form; it’s no longer just the Prius.

- The national conversation has moved in favor of more fuel-efficient options, but many consumers remain reticent to make the full switch to EVs. Hybrids may help the transition.

Since their opening act 25 years ago, hybrids have been viewed as boring with a lower performance and a higher upfront cost, while uncertainty surrounds the ultimate long-term cost of ownership. This perception may no longer hold true. For their part, the OEMs are offering models with numerous powertrain options. However, the cost difference between ICE and hybrids has narrowed, and perception has improved. The cost difference between ICE and EV is significantly higher, making the hybrid premium more palatable to consumers. In some cases, hybrids can even be cheaper than ICE vehicles.

Are Hybrids Going to Replace EVs?

While hybrids are certainly having a moment in the sun, there are reasons to believe both ICE vehicles and EVs could capture a larger market share in the future. Hybrids are more fuel efficient, but there are more opportunities for something to go wrong operating parallel drivetrains. There are reasonable arguments for and against the maintenance and repair expectations of both ICE and EV, and hybrids must grapple with both. We find it far more likely that a two-car household of the future would probably have an ICE vehicle for longer distances and an EV for shorter distances rather than two hybrids (my household being an anecdotal contrarian).

Other Developments — OEM Investment and the Election

To put it mildly, the push for EVs is not exactly bipartisan. With significant uncertainty surrounding which party will occupy the White House for the next four years, OEMs may be hedging their bets by pushing more toward hybrids. This means advancing fuel efficiency goals while recognizing demand could be significantly different if EVs are not receiving subsidies with a Republican White House. The Biden administration has talked about relaxing/extending EV market share targets, which would extend beyond 2028. Given that neither of the Democrat or Republican nominees would be eligible for a third term, future policy is even murkier.

While many OEMs announced significant investments in building out their EV production, more recent headlines include scrapping or at least delaying projects as EV inventories build up on dealer lots faster than their ICE counterparts. Large investments in EV factories can be cost-prohibitive, particularly given uncertainty about demand. This uncertainty supports hybrids in the interim, which may allow for quicker pivoting wherever the political winds blow. However, it is important to note that retrofitting for hybrid production, then later pivoting to full-bore EV production, may increase the total investment on the part of OEMs.

Conclusion

The recent speed bump in EV adoption is a reminder to OEMs that supply getting ahead of demand is a dangerous game. Despite proclamations about carbon neutrality and all-electric target dates, OEMs will continue to meet consumers where they are. Right now, that is more hybrid than it has ever been. But that does not necessarily mean that hybrids will continue to ride the coattails of EVs.

At Mercer Capital, we perform valuations of auto dealerships for owners and advisors all around the country for a variety of purposes. Additionally, we follow the auto industry closely to stay current with market trends. These give us insight into the private dealership market, informing our valuation engagements. For an indication of what your dealership might be worth, contact a professional at Mercer Capital to discuss your valuation needs in confidence.

Auto Dealer Valuation Insights

Auto Dealer Valuation Insights