Brigham Minerals IPO Brings Spotlight to Oil & Gas Market

Mineral Aggregators are Leading the Forefront in an Underwhelming Energy Sector

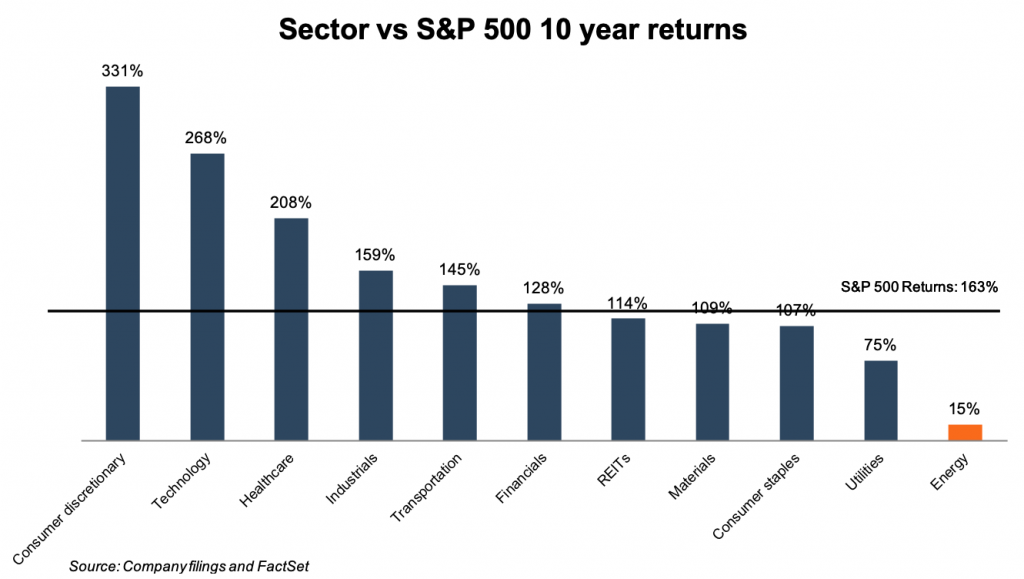

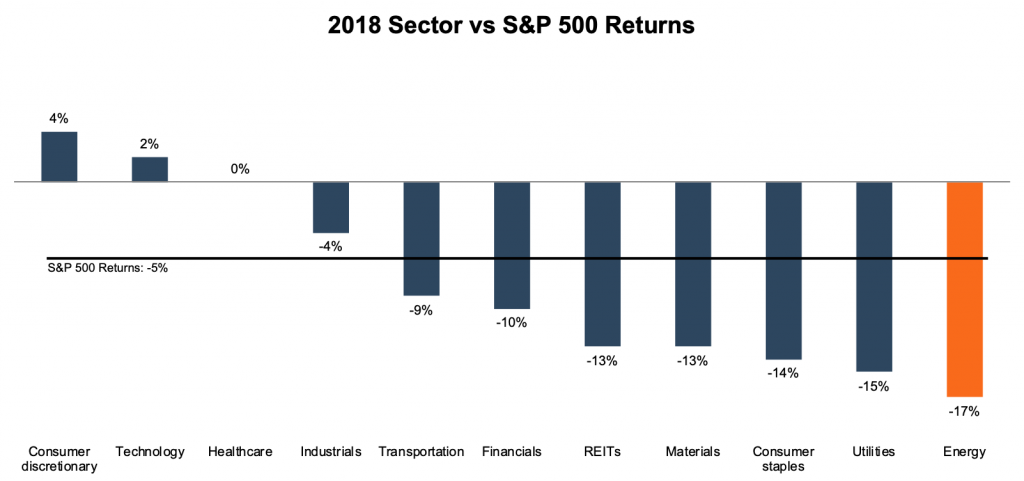

Initial public offerings in the upstream and midstream sectors of the oil and gas market have been lackluster at best for quite some time, and the trend has continued through the first quarter of 2019. Despite the rebounds in the energy sector and broader market to start the year, there has been a scarcity of energy equity capital markets activity, thus resulting in fewer IPOs in the E&P and upstream and is exacerbated by the fact that companies in this space have been underperforming relative to the broader market.

This continued lack of activity has made this market fundamentally “underweight” due to the disproportionally small size of available public equities relative to the immense use and value of oil and gas in the national economy.

However, in the midst of an underperforming energy market, there is a sector that has been an emerging bright spot: public mineral aggregators. Brigham Minerals (MNRL) is the latest mineral acquisition company to go public following a trend of other large mineral rights and royalty companies to IPO in recent years. Brigham began trading on April 18 at $18.00 per share on the New York Stock Exchange.

While we have addressed trends in the mineral aggregators and royalty MLPs, we are taking a closer look into what these companies have to offer the investing public and why they have been so popular in recent years. We continue to see an uptick in IPO activity in this sector as the value of these companies addresses the current wants and needs of energy investors, i.e. high yield cash returns with low-risk characteristics. The timeline below shows how some of the major players in this space have appeared only within the last five years.

In this post, we will review the continued IPOs and valuation implications for the mineral aggregators market as well as examine Brigham’s operations and placement in this sector.

Energy IPOs Slide While Minerals Shine

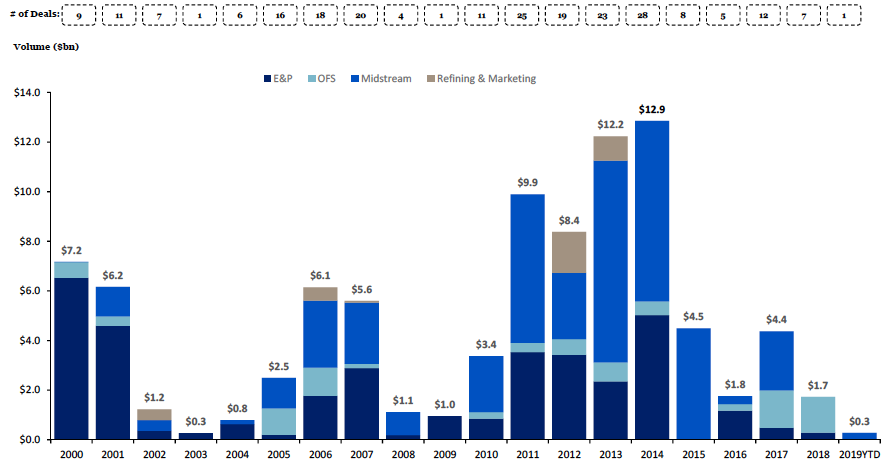

In the wake of the oil crash in 2014, there have been a total of 33 IPOs in the U.S. oil and gas market from 2015 through Q1 2019, excluding mineral aggregators. This contrasts sharply with the average of approximately 23 IPOs per year from 2011 – 2014. This decline is illustrated in the chart below, which tracks deal volume by year in various subsectors of the energy market.

The declines of IPO activity in recent years has been consistent with overall investor sentiment in the upstream and E&P space in that investors have been eager for current yield, not the future growth that these companies have been pedaling. These companies have been reinvesting into additional acreage and capital expenditures, leaving next to no free cash flow and little in the form of dividends to investors.

While E&P and upstream IPOs have been trending downwards overall in the past five years, IPOs for mineral aggregators have been increasing.

Since many of these newer companies are typically in the high growth and investment phases, they have achieved the capital necessary for growth through private funding rather than through public channels. So why have mineral aggregators been so popular in the public capital markets in a sector that has been so unimpressive from an IPO standpoint?

Mineral aggregators have the ingredients investors have been craving for some time. They are cash flow positive, high margin, and have dividend yields that provide healthy returns straight to the investor’s pocket. They also do not carry the typical risk profile of traditional E&P and upstream companies as mineral aggregators provide opportunities to be exposed to mineral plays and benefit from technological advances without taking operator risk.

While E&P and upstream IPOs have been trending downwards overall in the past five years, IPOs for mineral aggregators have been increasing, currently averaging around four per year and are continuing at an increasing rate going into 2019.

Valuation Considerations

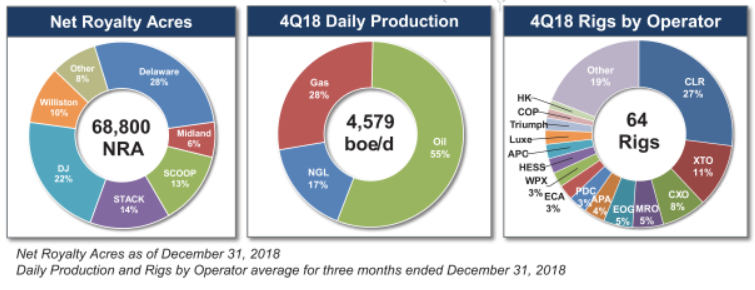

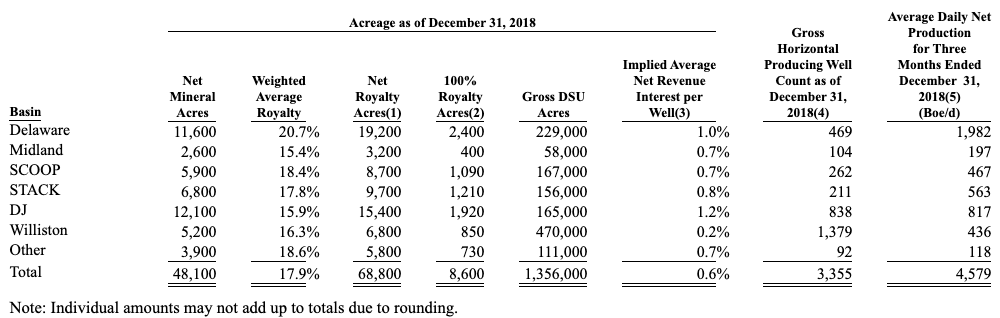

Based in Austin, Texas, Brigham Minerals had initially set out to raise $100 million in their IPO, but then increased the amount to be raised to $261 million at $18 per share in an updated S-1 filed on April 9 due to higher than expected demand. Current holdings for Brigham are shown below:

Brigham is averaging approximately 4,579 boe/d of production on approximately 68,800 net royalty acres as of 12/31/2018, pro forma, with a little more than half of the production being oil. Net income attributable to common shareholders was $0.66 per share, and adjusted EBITDA per share came out to approximately $1.11 per share attributable to common. The large gap here is due to depreciation and depletion rates nearly doubling in 2018 due to higher depletion because of the significant increase in production volumes in the current year and a revised depletion rate after evaluation of current reserve reports.

By investing directly in the cash flows, mineral aggregators are able to bypass some of the riskier and more costly upfront aspects of the process, turning their investment into a return more quickly.

After going public, Brigham will have an influx of cash which it can use to acquire more mineral interests, leading to increased production and free cash flow. At first glance, this might appear to be similar to the reinvestment cycle for E&P companies, but there are important differences. The mineral interests acquired are a revenue stream that can almost immediately be paid out as dividends to investors because the investment is in properties that are already producing and the mineral aggregators receive a portion of the proceeds. Contrast this to an E&P company that reinvests its cash flows into new projects where it must purchase property, equipment, infrastructure, etc. There are large upfront costs that eat into this capital and frequently require taking on debt as well. Before their investors start to realize a return, E&P companies aim to recoup their expenses first, not to mention servicing the debt. By investing directly in the cash flows, mineral aggregators are able to bypass some of the riskier and more costly upfront aspects of the process, turning their investment into a return more quickly.

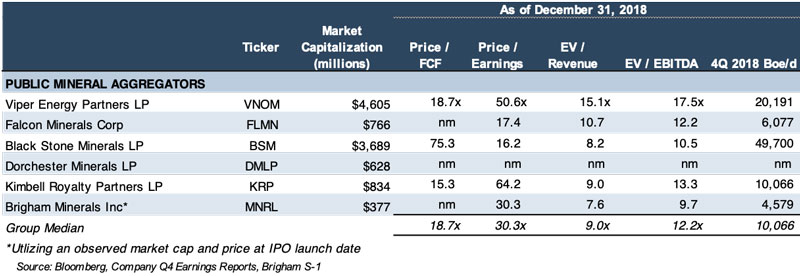

Market cap at the time of the IPO launch was approximately $377 million, and accounting for cash and debt on the books as of the 12/31/2018 financials, we arrive at an estimated enterprise value of approximately $514 million.

Below is a table of selected multiples using these calculated metrics as well as other comparable mineral aggregators:

Compared to other competitors in the mix, it would make sense for multiples for Brigham to come in under the peer group given the lower production figures. However, utilizing proceeds from the IPO to continue to acquire additional royalty acreage could push the Brigham into a position that is comparable in size and value to those like Falcon and Kimbell, so as long as it can produce free cash flow to pay out high dividends that investors have become accustomed to receiving from these other companies.

Location and Production Mix

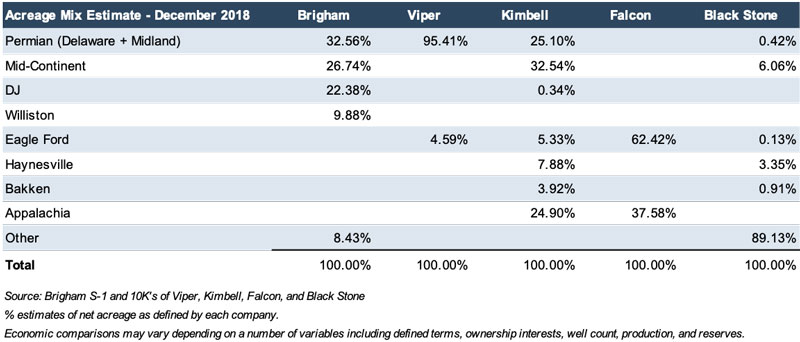

Brigham’s operations and focus are semi-diversified compared to other publicly traded mineral aggregators and has the most in common with Kimbell in this respect. What do we mean by this? While Brigham is not as concentrated in a single basin like Viper (Permian focus) and Falcon (Eagle Ford focus), it’s more focused than Black Stone which is by far the most diversified in its class with approximately 89% of holdings falling into the “other” category due to being scattered across multiple, non-traditional plays. There are benefits and drawbacks to both concentrated versus non-concentrated strategies. Consider the table below:

Brigham sets itself apart by its presence in the DJ and Williston basins. No other mineral aggregator has a concentrated or material focus there. As well activity picks up in this area, Brigham will benefit. However, it also misses out on activity in the Eagle Ford as well as gas driven plays such as the Haynesville and Appalachia.

Conclusion

As we’ve noted before, this market has been frequently discussed among industry professionals for some time and has been featured regularly at oil and gas conferences. The vast market of the public royalty aggregators has been gaining momentum as investor demand for these investment vehicles is high. Given these factors, the chances are high that we see an increase in the number of IPOs from mineral aggregators in the future compared to upstream and E&P companies.

In an industry that has seen a decline in public market activity that coincided with the steep drop in oil prices, mineral aggregators like Brigham have emerged as an attractive opportunity for investors looking to gain exposure to the industry with an opportunity to participate in the benefits sooner rather than later.

At Mercer Capital, we have valued mineral and royalty rights located across the country. We understand how the location of your assets affects value and work to monitor transactions in each region to understand the state of the current market. Contact a Mercer Capital professional today to discuss your valuation and transaction advisory needs in confidence.

Energy Valuation Insights

Energy Valuation Insights