Comstock’s Acquisition of Covey Park

A Valuation Analysis of the Multibillion-Dollar Haynesville Deal

On July 16, 2019, Comstock Resources, Inc (NYSE: CRK) finalized its acquisition of Haynesville operator Covey Park Energy LLC. Announced on June 10, 2019, the companies entered into an agreement under which Comstock would acquire Covey Park in a cash and stock transaction valued at approximately $2.2 billion, including assumption of Covey Park’s outstanding debt and retirement of Covey Park’s existing preferred units (totaling approximately $1.1 billion). Covey Park is a natural gas operator with core operations located in the Haynesville Shale Basin and is backed by private equity firm Denham Capital. This acquisition is the latest addition to the continuing resurgence of the Haynesville Shale Basin.

For the purposes of this post, we will be examining this deal from a few different vantage points and reviewing the fair value of the various components that make up total deal value. We’ll also look at how this transaction compares to industry valuation metrics and what kind of strategic advantages Comstock may have a result of the deal.

Deal Overview

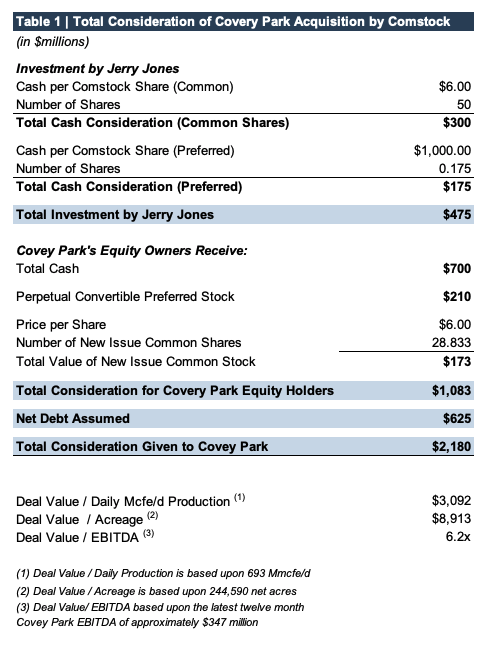

The transaction is structured in multiple layers, including a substantial investment from Dallas Cowboys owner and Comstock majority stockholder, Jerry Jones. Details behind the total deal consideration are outlined below:

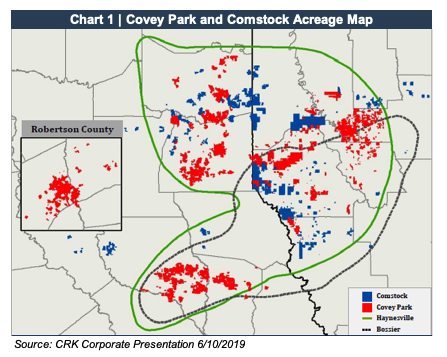

As a result of the finalized deal, Comstock’s holdings in North Louisiana and East Texas comes out to a total of 374,000 net acres with over 1.1 bcfe/d of net production. The company also holds assets in North Dakota.

The chart below maps the acreage of Comstock and Covey Park prior to the merger and where it fits into the Haynesville Shale:

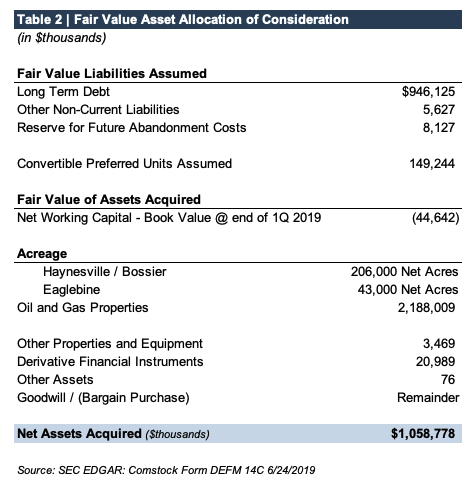

As the various components of the deal are considered, we then begin to analyze the assets actually purchased by Comstock. Analysts, accountants, and investors alike look at fair value of the parts that make up the total purchase, and allocating fair value among the components begins to paint a clearer picture of how we get to deal value.

Allocation of Assets and Liabilities to Fair Value

The table below outlines the allocation for both the assets acquired and the liabilities assumed. The calculation is management’s estimate from the Definitive Proxy Statement that Comstock had filed with the SEC on June 24, 2019.

For an E&P company, most of its asset fair value naturally derives from its property and equipment. It’s no surprise that of the assets acquired an estimate of nearly $2.2 billion is in the property and equipment camp. We can then take a step further into understanding the value of these assets by diving into the proven resource reserves that are contained within these properties.

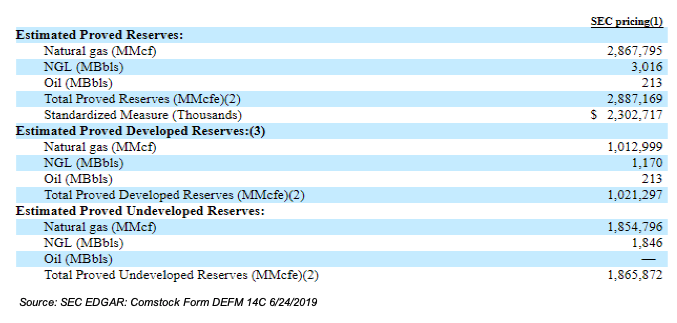

The SEC has clear rules and regulations regarding oil and gas reserve reporting (more commonly known as PV-10), and while these summaries of reserves under SEC pricing may not be accurate for determining fair market value, they do provide a general ballpark figure. Below is the summary of proved reserves for Covey Park from the Definitive Proxy Statement:

Under the standardized measure, the total value of the proved reserves (both developed and undeveloped), totals around $2.3 billion. What is interesting is this amount is north of the purchase price by Comstock and may have some investors wondering if this falls into the territory of a bargain purchase.

As we mentioned above, SEC pricing may not be the best indicator of fair value. It’s not unusual for fair value to vary 10-20% from PV-10 value, and most of that generally comes from the developed and undeveloped (PUD) reserve mix. The valuation of PUDs can be tricky at times, and they generally have a fair value that trades at a haircut. Given the mix of the total proved reserves is fairly PUD heavy, it makes sense as to why the management estimated value of properties comes in under the SEC PV-10 amount.

Other assets of note that typically are glossed over are the derivative financial instruments. E&P companies often hold futures and other derivative contracts for hedging purposes, and these contracts are marked to fair value for the purposes of the allocation. These are relatively less important given the magnitude of the other assets, but they certainly merit consideration, particularly for companies that may have significant hedging practices.

How Do Reported Valuation Multiples Compare to the Industry?

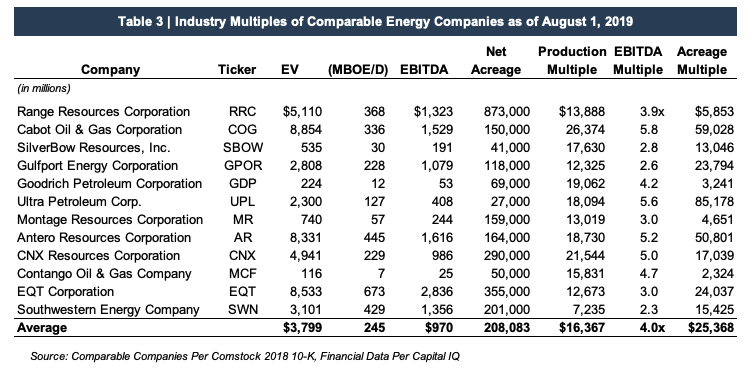

Below is a list of comparable companies that Comstock identifies in their latest 10-K as competitors, excluding non-gas players, and common valuation multiples (such as EV to Production) used for relative industry analysis.

In comparison to other operators, the acquired assets come in slightly above the median values for EBITDA multiples but are generally close to direct competitors such as Cabot and Antero. The lower acreage multiple observed in the deal compared to the industry group makes sense given our analysis above of the sizable amount of PUDs in the proved reserves.

After analyzing the structure of the deal and how it compares to other valuation metrics, we will take a look at some of the competitive advantages available to Comstock as a result of the deal.

Large Footprint, Established Infrastructure, and Low Gathering Costs

While the company already owns over 500 miles of gas gathering infrastructure, it also enjoys many locational benefits: limited basis risk due to proximity to Henry Hub, lowest in-basin gathering, treating, and transport costs (approx. 26¢ per Mcfe), and even twelve approved LNG export terminals located in the Gulf Coast.

The Houston Ship Channel and other gathering and transportation pipeline infrastructure already present in the Louisiana and East Texas regions mitigate the risks of capacity constraints and bottlenecking unlike those that historically, up until recently, plagued Northeast gas production in the Marcellus/Utica Shale.

The Competitive Edge: Capital Advantage

Being the largest operator in the Haynesville Shale provides Comstock with a strategic advantage due to sheer size of acreage owned. Just as importantly though, Comstock has another major advantage that competitors have been struggling with for some time: access to capital.

E&P companies have been facing headwinds in the public markets for some time. The major uptick in U.S. production over the past several years has triggered the need for upstream companies to increase capital expenditures to keep up with demand. However, investors have been unwilling to participate in the upstream sector because free cash flow has been directed to these capital expenditures and additional acreage as opposed to returns in the form of payouts. Consequently, investors have shifted into the realm of mineral rights aggregators because of the immediate returns in the form of dividends and returns on capital. As a result, access to capital markets (both equity and debt) has proved difficult for E&P companies in general.

Comstock, however, appears to have bypassed this hurdle before having to cross it. Jerry Jones’ large stake (75% ownership) and his deep pockets can facilitate large capital raises should the need arise. However, Mr. Jones isn’t Comstock’s sole non-public capital raising option. The aforementioned Denham Capital owns 16% ownership interest, and Comstock just renewed its bank credit facility to $2.5 billion concurrent with the transaction. This gives the company the ability to raise any needed funds before having to jump into the public markets.

Conclusion

As a result of the transaction, Comstock is now the largest operator in the Haynesville Shale. While it may seem that Comstock managed to acquire Covey Park’s large amount of acreage at a bargain, the examination of the components of the fair value allocation show that the heavy mix of PUDs in the reserves account for much of the estimated fair value by management, even though it came out lower than the calculated PV-10 valuation. This seemed to be confirmed in our comparisons to industry multiples. However, given the advantages Comstock now has as a result of the deal, the company has positioned itself to be a strong player in the Haynesville Shale Basin.

Mercer Capital has significant experience valuing assets and companies in the energy industry, primarily oil and gas, bio fuels and other minerals. Our oil and gas valuations have been reviewed and relied on by buyers and sellers and Big 4 Auditors. These oil and gas related valuations have been utilized to support valuations for IRS Estate and Gift Tax, GAAP accounting, and litigation purposes. We have performed oil and gas valuations and associated oil and gas reserves domestically throughout the United States and in foreign countries. Contact a Mercer Capital professional today to discuss your valuation needs in confidence.

Energy Valuation Insights

Energy Valuation Insights