EQT’s Acquisition of RICE Energy

Our Valuation Analysis of This Marcellus and Utica Mega Deal

Deal Overview

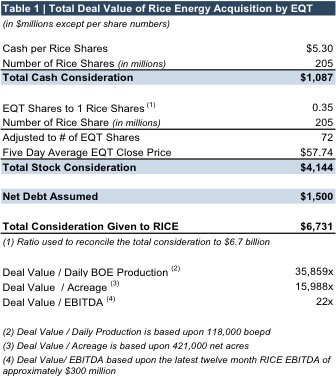

On June 19, 2017, EQT announced the acquisition of Rice Energy (RICE) for approximately $6.7 billion. RICE will receive approximately $4.1 billion in EQT common stock and $1.1 billion in cash as well as be relieved from $1.5 billion in net debt that EQT is assuming.

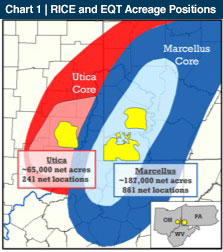

Based on EQT disclosures, the assets owned by RICE include (1) 255 wells currently producing 1,145 mmcfe per day (mmcfepd) which are expected to increase to 1,300 mmcfepd; (2) 252,000 in net Marcellus and Utica acres with more than 1,100 net locations remaining to explore; (3) 92% of RICE GP interest including the incentive distribution rights (IDR’s); and (4) 28% of Rice Midstream Partners (RMP). By all accounts, the location of the acreage is contiguous or nearby to EQT’s current acreage and the combination of the two companies will create the largest gas producer in the Marcellus and Utica.

Reported Valuation Multiples Do Not Present the Whole Picture

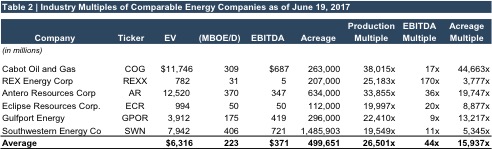

In comparison to other operators in the Marcellus and Utica, the transaction is on the higher end of the range with Antero Resources Corp (AR) and Cabot Oil and Gas (COG) when considering an EV/Daily Production multiple and on the high end with the acreage multiple (See Table 2). However, the “reported” value multiples may not be the whole picture.

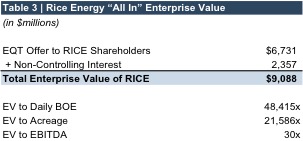

We have considered EQT’s offer to RICE shareholders, but RICE’s shareholders only own 28% of Rice Midstream and 92% of the GP interest. Due to the accounting rules for consolidation, the majority of the income statement and production figures capture activity for 100% ownership (the non-controlling interest is not taken out until the end). Therefore, by not including the non-controlling interest that is consolidated into Rice’s balance sheet, we previously compared less than 100% of the Company’s Enterprise Vale to 100% of the Company’s production, acreage, and EBITDA.

What Does the “All In” Enterprise Value Mean to Investors?

The non-controlling interest on the balance sheet of RICE amounts to $2.4 billion as of the end of Q1 2017. The offer for $6.7 billion was for the interest RICE owns in the business’ assets. Therefore, to compare production and acreage multiples to the publics, we would need to calculate an “all in” enterprise value as shown in Table 3.

Under the “all in” approach, the production multiple of 48,415x is well above the other operators in the area (see Table 2) and investors should be excited about the proposed transaction according to the surface data. The EBITDA multiple is not a great indication here as some companies in the guideline group were marginally profitable at the EBITDA level leading to abnormally high EBITDA multiples. In response to the announced transaction, the share price of RICE increased approximately 25% or $1 billion.

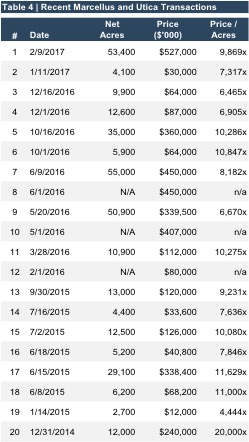

Based upon our experience in performing valuation services in the Appalachian play, the analysis above appears reasonable. Table 4 shows the previous 20 transactions in the area. Not all transactions could be broken down into producing and non-producing acres; therefore, it is shown as a total price to total net acres multiple. The EQT and Rice transaction shows as the most expensive price / acre transaction of the last 20 in the area.

In Chart 1, disclosed by RICE and EQT, shows the acreage position with the resource play for RICE. According to this map, RICE has acreage in some of the most prolific and hottest areas in the Marcellus and Utica.

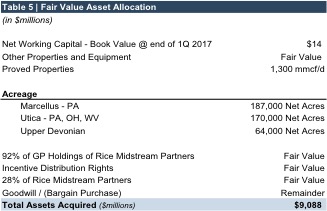

Allocating Assets in This Transaction to Fair Value

Considering the purchase price implications of the Rice Energy transaction, based upon the publicly disclosed information, the assets to allocate to fair value appear as found in Table 5.

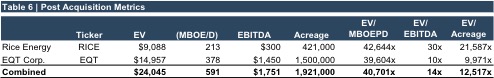

Does This Transaction Result in a Marcellus and Utica Mega-Producer?

The result of this transaction is the potential creation of a Marcellus and Utica mega-producer with over 1.9 million acres, 591 barrels of daily flowing oil equivalent and a stronghold in the gathering pipelines that can transport gas to the East, Midwest, and South in the near future. The implied enterprise value of $24 billion would approximately double the enterprise value of the company next closest in size, Antero Resources.

Further Reading on This Deal

Over the previous week there have been many articles written on this transaction. We found the following articles most helpful:

- Rice Energy News Release: EQT To Acquire Ricer Energy for $6.7 Billion

- EQT Investor Relations: EQT Corporation to Acquire Rice Energy for $6.7 Billion

- Oil & Gas Financial Journal: EQT to Acquire Rice Energy for $6.7 B

- How Four Brothers Survived the Gas Bust to Make Family a Billion

- EQT to Acquire Rice Energy for $6.7 Billion — Update

- The EQT Corporation Acquisition of Rice Energy is Smart

- With $8.2B Acquisition, Pittsburg’s EQT Becomes America’s Biggest Natural Gas Producer

Mercer Capital’s Experience

Mercer Capital has significant experience valuing assets and companies in the energy industry, primarily oil and gas, bio fuels and other minerals. Our oil and gas valuations have been reviewed and relied on by buyers and sellers and Big 4 Auditors. These oil and gas related valuations have been utilized to support valuations for IRS Estate and Gift Tax, GAAP accounting, and litigation purposes. We have performed oil and gas valuations and associated oil and gas reserves domestically throughout the United States and in foreign countries. Contact a Mercer Capital professional today to discuss your valuation needs in confidence.

Energy Valuation Insights

Energy Valuation Insights